Yellow Brick Road: Arika Resources Phase 2 drilling extends Landed at Last gold strike to over 800m

- Arika Resources’ drilling has extended the mineralised zone at Landed at Last to a strike of over 800m and depth of at least 150m

- Phase 2 step-out drilling returned wide intersections with higher-grade zones at predicted target depths

- Company planning to restart drilling at Yundamindra within the coming week

Special Report: Step-out drilling has extended the mineralised zone at Arika Resources’ Landed at Last prospect to a strike length of over 800m and a depth of at least 150m downdip from surface.

The recently completed Phase 2 reverse circulation drill program at the prospect within the company’s Yundamindra project within the historical production centre of Laverton, WA, returned wide gold intercepts such as:

- 28m grading 1.4g/t gold from 70m including 12m at 3.01g/t from 79m and 1m at 24.12g/t from 87m (YMRC102)

- 17m at 1.57g/t gold from 64m including 11m at 2.32g/t from 69m and 1m at 15.59g/t from 72m (YMRC111); and

- 16m at 1.24g/t gold from 66m including 6m at 2.45g/t from 76m and 1m at 6.1g/t from 81m (YMRC114).

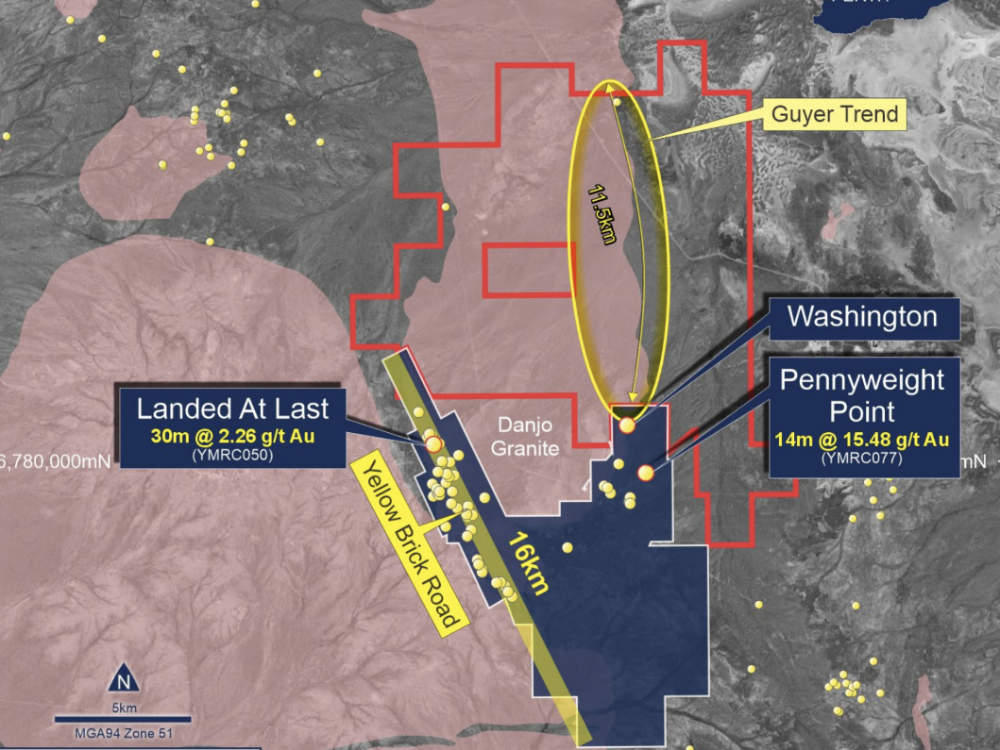

Landed at Last sits on the Western Limb of the project towards the northern end of the ‘Yellow Brick Road’ – a highly mineralised >10km long structural corridor with numerous high-grade historical workings developed on multiple parallel and cross-cutting structures.

This corridor has received only limited shallow historical drilling around the areas of historical workings and remains largely untested below 50m vertical depth while the ore hosting structures between the old workings remain unexplored.

Arika Resources (ASX:ARI) added its recent assessment of surface geochemistry identified numerous peak gold-in-soil anomalies well away from historical workings and previous drilling – all of which are considered priority targets.

The Yundamindra project itself is located immediately along strike to the south of the recent $44m Guyer joint venture between Iceni Gold (ASX:ICL) and Gold Road Resources (ASX:GOR).

Advanced target

Arika managing director Justin Barton said the latest results confirmed Landed at Last alongside its high-grade Pennyweight Point prospect as an advanced target for follow up drilling.

“The recent drilling has confirmed extensions of the mineralised zone to over 800m along strike and to a depth of 150m, with indications it is thickening at depth,” Barton said.

“Considering the shallow nature of most of the historic drilling across Yundamindra – where very few holes were drilled below 50m – this is an encouraging sign.”

Barton added that ARI is still at the early stages of exploration of Yundamindra and has already seen a significant gold footprint emerge at two prospects despite having only completed two phases of drilling.

Many additional targets have also been defined along the Western and Eastern corridors.

Watch: Gold growth on the cards at Pennyweight Point

Landed at Last

Drilling was carried out along 14 separate sections spaced 40m to 80m apart to test the interpreted position of the lode structure beyond known workings and/or previous drilling north and south of the crosscutting F1 and F2 Faults.

Most of the holes intersected thick zones of low-medium grade gold mineralisation with internal higher-grade zones at predicted target depths within fresh rock and well below previous drilling.

Several holes returned strong results within areas previously untested by drilling.

ARI noted that while several of the most recent holes failed to reach the targeted main lode south of the F1 Fault, which will necessitate deeper drilling to reach, they did identify a previously unknown flat lying hanging wall lode which could potentially be incorporated in future resource drilling in the area.

Landed at Last mineralisation remains open along strike and at depth.

Next steps

“We are looking forward to re-commencing drilling shortly, with a dual focus on further expanding the known mineralisation at Pennyweight Point and Landed at Last, while also systematically testing the 50+ targets now defined over the broader project area,” Barton said.

The company is currently awaiting assays from two diamond holes completed at Pennyweight Point and a single hole drilled at the F1 Fault within Landed at Last.

It is also incorporating results from its recent review of the historical geochemistry at Yundamindra with its existing geophysical/structural targets.

Results from this work will be used to further refine target selection prior to restarting drilling operations in the coming weeks.

At the Kookynie project, ARI is carrying out a detailed review with a pipeline of multiple new, high-priority gold targets emerging.

It plans to start surface geochemical soil surveys at a number of key prospects in the coming weeks to prioritise targets for drill testing during Q2 and Q3 2025.

This article was developed in collaboration with Arika Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.