Yandal Belt grabs attention as deals, drilling and discoveries make WA gold field hot property

The deal between Strickland and Gateway shows how valuable projects in the Yandal Belt are. Pic: Getty Images

- The Yandal belt is one of the most famous in WA, yet new discoveries show it remains underexplored

- Gateway Mining recently offered $45 million for Strickland Metals’ 400,400oz Yandal project, valuing inferred resource at $112/oz

- That shows the huge leverage to discovery success for early stage explorers like Albion Resources

Strickland Metals (ASX:STK) has pulled in over $100 million in cash and shares in the past two years for two modestly sized gold projects in WA’s Yandal gold belt.

After banking $41m in cash and $20m worth of Northern Star Resources (ASX:NST) shares for its Millrose deposit in 2023, the announcement that the rest of the now Serbian explorer’s 400,400oz Yandal gold project would be sold to Gateway Mining (ASX:GML) has cast attention on the players in and around the famous region.

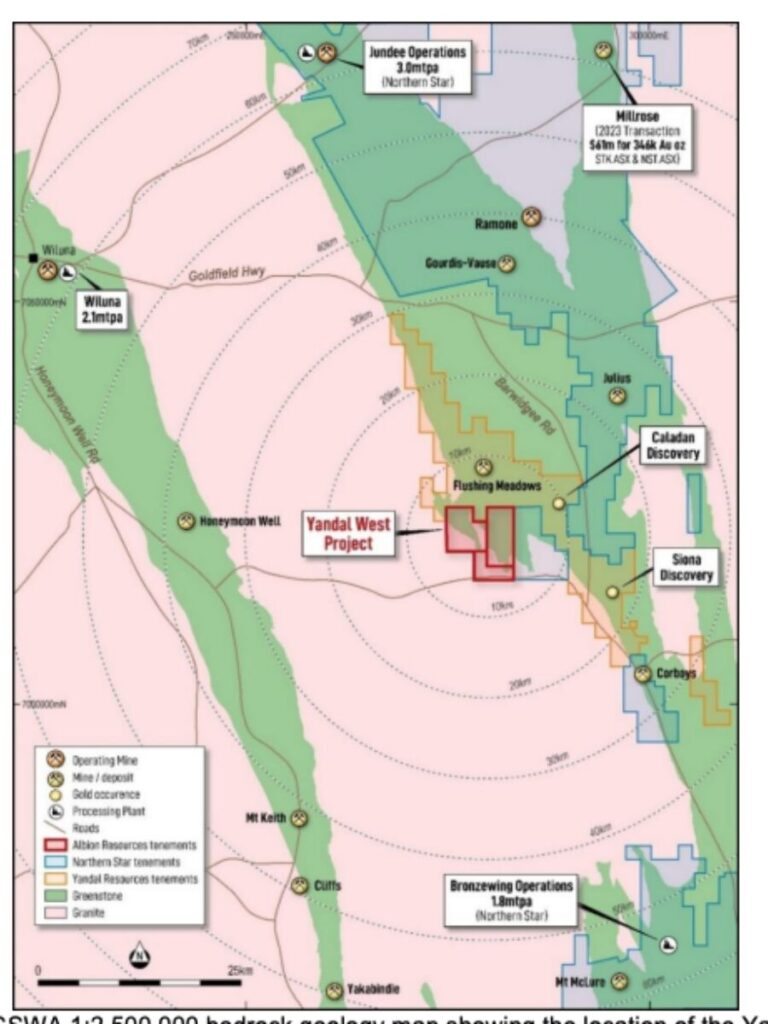

The Yandal gold belt is remote, located north-east of Leinster and Wiluna in WA’s Northern Goldfields.

But it’s a key cog in the machine that is Australia’s largest gold producer Northern Star, producing over 500,000ozpa from a string of mines cornerstoned by the legendary Jundee gold operations.

That remoteness means it is vastly underexplored compared to other famous gold belt’s like WA’s Kalgoorlie, but a high price is attributed to ounces owing to Northern Star’s magnetic influence.

The Strickland deal values its resources – and inferred resources at that – at $112 per ounce.

It’s a tantalising yardstick for Albion Resources (ASX:ALB) and its CEO Peter Goh as it kicks off reverse circulation drilling at the Yandal West gold project at a market cap of just $9 million.

“It’s very exciting and it validates our strategy, Obviously, we’re heavily invested in exploring Yandal West and that transaction shows the market recognises the value in early stage assets in the region,” Goh said.

“Our focus is on high impact areas that we’re drilling right now with the RC rig and this deal confirms this appetite for the land up there and discoveries within the region.”

Focus on Yandal grows

Famously opened up when billionaire prospector Mark Creasy sold his Jundee and Bronzewing gold discoveries to Diamond Joe Gutnick’s Great Central Mines in the 1990s in his first mega deals, the Strickland-Gateway deal isn’t the only attention the Yandal district has received lately.

Northern Star again showed its value in the company’s massive gold portfolio, making guidance and delivering 518,000oz in FY25 according to an update delivered to the ASX last Monday.

It will produce 500-550,000oz at all in sustaining costs of $2600-2900/oz in FY26 if NST’s guidance is to be believed.

At the earlier stage, buzz is growing around Yandal Resources (ASX:YRL).

It has a 268,000oz resource at Flushing Meadows and 182,200oz at Mt McClure, which sits 10km along strike from NST’s +1Moz Orelia mine.

But it was the Siona discovery last year – in an intercept of 107m at 1g/t – that really put Yandal back on the map, with another emerging find at the Caladan Gold near Flushing Meadows sending the $55m junior’s shares soaring last week.

Hammer Metals (ASX:HMX) has also piqued interest, planning drilling at the Bronzewing South project, an infamous patch of dirt central to a notorious Warden’s Court dispute between Mark Creasy and fellow prospector Leith Beal.

Right next door to Siona, Albion is at an earlier stage, but the signs are that investors believe in the story.

Wedged between the region’s key poles 55km north of Bronzewing and 60km south of Jundee, since acquiring Yandal West in November from Great Western Exploration (ASX:GTE), Albion has seen its shares rerate, up 72.5%.

That could get even more substantial if drilling turns up something like its neighbour has found.

Historic drilling included highlights at the Ives Find prospect of 4m at 8.5g/t Au from 38m (IFRC004), 3m at 52.3g/t Au from 34m (IFRC005) and 6m at 4.7g/t Au from 54m, including 2m at 13.0g/t Au (IFRC017).

The best results from the May Queen target west of the Barwidgee Fault returned 4m at 25g/t Au from 60m and 16m at 1.64g/t Au from 13m, with average drilling down to a depth of only 55m.

Maiden drilling under way

The first drill program under Albion, which started in late June, will be focused on the Colavilla workings, where between 3000-4000m of RC holes will be sunk.

“We know that this gold mineralisation there is relatively shallow – most of the old hits were within 50 metres,” Goh said.

“The opportunity for Albion is to identify more mineralisation there and see where it goes.

“Next the drill rig is going to move down to Collavilla East and Collavilla West.

“We’ve put out to the market some very strong chargeability targets going down to about 300m in depth.

“So we’re really excited to hit those – there are gold rock chips found above some of these targets, there are quartz veins and outcropping as well, above Collavilla East.

“It’s got all the smoke there for a discovery.”

Gateway’s gambit, which follows the sale of its interests in the Sandstone gold district to Brightstar Resources (ASX:BTR), shows just how prized resources Albion could find are in the belt.

“We’ve got $4 million in the bank as of last quarter so we’re trading at an EV (enterprise value) of about $4 million,” Goh said.

“If you look at that compared to the peers in the area, you look to that Gateway transaction there we’re just a smidgen of what they are.

“So we’ve got high leverage to discovery success for sure.”

At Stockhead we tell it like it is. While Albion Resources and Brightstar Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.