‘Wow, this thing is open to the west’: Is Gonneville trending into Western Yilgarn’s virgin ground?

Pic: Getty Images

Chalice’s monster Gonneville nickel deposit is trending into the ground next door. After years of planning delays, Western Yilgarn (ASX:WYX) is prepping to explore its West Julimar project for the very first time.

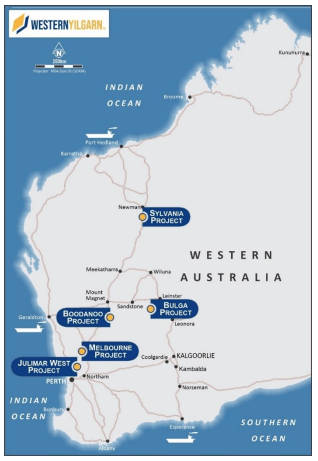

Emerging from the shell of Pacific Bauxite (ASX:PBX), Western Yilgarn listed on the ASX in 2022 with portfolio of critical minerals assets in WA.

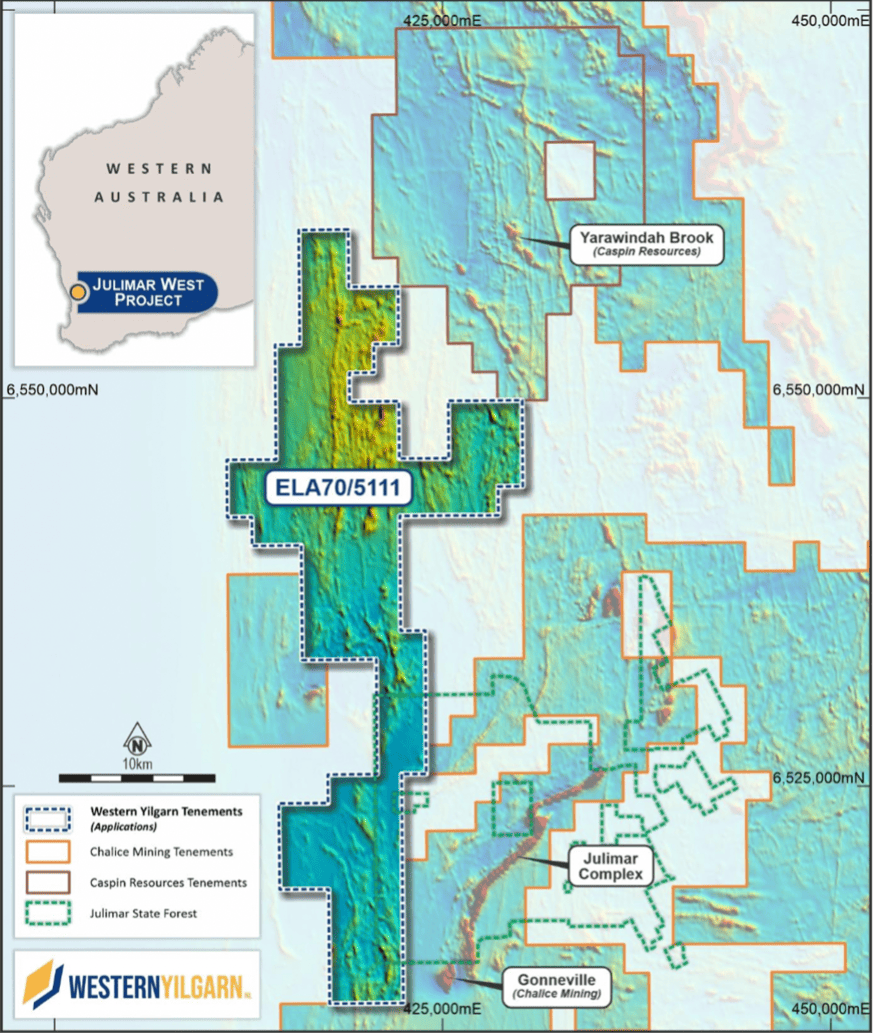

Most of PBX’s old bauxite projects were flicked off but one stood out; E705111, or Julimar West, just east of Perth in WA.

As the name suggests, this project sits right next door to Chalice Mining’s (ASX:CHN) world class 3Mt nickel equivalent Gonneville resource.

Gonneville was discovered in 2020, when the region was known for its bauxite and mineral sands, not nickel sulphides.

That has well and truly changed. Chalice has gained ~3,500% since its discovery hole and is now working hard to prove up a Tier-1 scale mine development.

Because its tenure was pegged in 2018, Western Yilgarn is a true first mover in a region now jammed to the gills with companies looking for a Gonneville lookalike.

But what most importantly sets Western Yilgarn apart from every other explorer in the area is this: Chalice announcements to date strongly indicate the mineralisation at Gonneville, 2500m away, trends into Julimar West.

There’s also a chance Gonneville could ‘repeat’ on Western Yilgarn’s ground.

“Just about every piece of evidence they have produced about the prospectivity of Gonneville have also pointed to that prospectivity running at depth into our lease,” Western Yilgarn general manager Gavin Rutherford says.

“I don’t think there has been one Chalice release that hasn’t given us cause to think ‘wow, this thing is open to the west’.

“We couldn’t be better positioned.”

Virgin ground a stone’s throw from Gonneville

And yet Julimar West remains untouched, thanks to a quirk of government policy called a File Notation Area (FNA).

“The state of play at the moment is this: we haven’t been able to explore the lease yet because it is still under application and it has been affected by this file notation area, an FNA,” Rutherford says.

“This piece of planning housework is attached to another acronym, the SAPPR – the Strategic Assessment Perth and Peel Region – which was a WA Government plan for developers in the city, where they could ‘offset’ bushland into other areas of the state.”

In December last year, SAPPR was cancelled by the State Government, which means Western Yilgarn’s FNA “is just a piece of paper that is sitting in the system without a parent”.

“The frustrating thing about this FNA is that Chalice managed to get permission to get their lease granted with exactly the same FNA, and Western Yilgarn couldn’t,” Rutherford says.

“Chalice are off and running with the same FNA applied to their exploration leases.”

Western Yilgarn is about to explore this ground for the very first time

There’s every indication from government the FNA over Julimar West will be lifted very soon.

Once this happens, Western Yilgarn will get its exploration lease, and the real work of re-rating the company via discovery can begin.

“The FNA was supposed to have been dropped in June 30. The Government has self-extended to the end of August, which is the latest advice we have,” Rutherford says.

“The exploration lease will follow, probably within a few months. We have been advised by DMIRS [Department of Mines, Industry Regulation and Safety] that our application is in good standing.

“We are absolutely confident the lease will be granted.

“We’ve done desktop surveys, I’ve had a consultant geophysicist complete an excellent report highlighting what we should be looking at on the lease.

“And we have an airborne EM campaign planned to the extent I am in dialogue with the RAAF over when we can do it.”

But there’s more to Julimar West than nickel

The project also hosts some compelling lithium targets in the southern part.

A review of public data by Western Yilgarn has uncovered 2 historic grab samples in Julimar West which returned significant tin, niobium and tantalum results along with anomalous lithium.

Field reconnaissance by the company has also identified outcropping pegmatites – rocks that can host lithium – which are potentially located within the South West Terrane greenstone unit which strikes over 9km in the southern part of the project.

Greenstone belts like this one are primarily formed from ancient, mineral-rich volcanic rocks.

“It is making us wonder if we are looking at a Greenbushes lookalike episode in the southern part of the Julimar West lease,” Rutherford says.

“I don’t think there is a geologist who would argue with us on that.”

Meanwhile, at the northern edge of Julimar West is Tambourah Resources (ASX:TMB), which has just gone into a JV with Chilean lithium major SQM.

TMB has rerated since announcing the tie-up with SQM (NYSE:SQM) in early July.

SQM will spend up to $3m on exploration to earn up to 70% of TMB’s early stage Julimar North project in WA — a strong endorsement of Julimar North and its lithium potential, TMB says.

US$18bn capped SQM – which made US$1.65bn gross profit in the March quarter – has inked deals with other Aussie juniors, most notably Azure Minerals (ASX:AZS).

In January, SQM paid $20m for a 19.99% stake in the company, which then went on to uncover a potentially monstrous deposit at Andover.

“We are very interested in what they [TMB and SQM] come up with as far as LCT pegmatites,” Rutherford says. “We are keeping a watch on that.”

“Given that Julimar West hasn’t even been granted yet, we are very keen on the prospectivity of it, and eager to get exploring.”

Boodanoo: another exciting nearology play

The company’s three other exploration projects include Sylvania in the Pilbara, Melbourne in the lower mid-west, and Boodanoo – 90km south of Mount Magnet.

The prospectivity of Boodanoo went up another level last week after neighbour Aldoro Resources (ASX:ARN) announced a nickel discovery at Area 32, part of the Narndee project.

ARN surged on outsized volumes on the news.

The explorer says the third diamond hole of the program hit a 40-metre-thick nickel zone from 1m with values up to 1.07% using pXRF readings.

“It appears from the 5 holes drilled to date that the zone is open to the north, south and west,” says the company, which is drilling another 8 RC holes to try and get a handle on this thing.

Final assays are pending, but this is promising news for Western Yilgarn, which recently completed a 519-hole auger geochemistry program to dial in on several drilling targets right next door.

This campaign unearthed a ~2km hard rock lithium prospect in the project’s south, called Boodanoo Southwest.

The company has applied for 12sqkm of extra ground which, once granted, will increase the size of Boodanoo to ~51sqkm.

This article was developed in collaboration with Western Yilgarn, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.