Would-be cobalt miner Winmar has jumped 600pc since November

Woo-hoo ... Winmar shares are up 600 per cent in two months. Pic: Getty

Winmar Resources is now a six-bagger stock after the share price soared on not much at all.

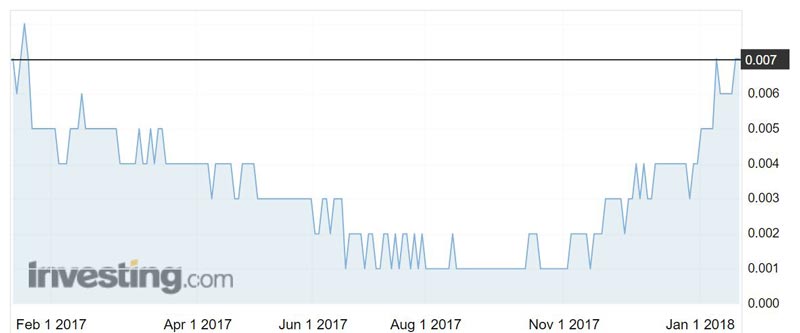

The would-be cobalt miner (ASX:WFE) shot up from 0.1c in early November to 0.8c last week, returning to the three-year high it reached around this time last year. It is now trading around 0.7c, giving it a market value of almost $14 million.

In early December, Winmar revealed it was moving into the rapidly expanding cobalt sector with an acquisition in Canada.

The company struck a deal to acquire rights to 2240 hectares of mining claims in the historic high-grade Cobalt-Gowganda silver-cobalt mining district of eastern Ontario — one of the world’s most prospective cobalt districts outside the Democratic Republic of Congo, according to Winmar.

Canada is well-known among ASX investors as the main global driver of another commodity starting with ‘C’ — cannabis. But it’s also the third biggest producer of cobalt, after China and the Congo, according to the US government’s 2017 geological survey. (Australia is fifth).

More acquisitions

And Winmar is planning more acquisitions in Canada.

Up until its foray into cobalt, the company was exploring for precious and base metals in Spain and also owned a 70 per cent stake in a currently mothballed iron ore project in Western Australia.

The news, however, appeared to keep Winmar trading in a band of 0.3c to 0.4c until Christmas.

From late December trading activity picked up and millions of shares changed hands each day, with over 113 million shares being traded on January 3 alone.

Junior players getting into cobalt have witnessed massive share price gains in the past year, thanks in large part to the anticipated growth expected from electric vehicle demand.

Cobalt is a key component of the lithium ion battery technology used in electric cars.

Bloomberg New Energy Finance estimates electric cars will account for 2 per cent of the market by 2020, rising to 8 per cent by 2025 and 20 per cent by 2030.

Winmar has been contacted for comment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.