‘World’s largest airborne survey’: Australia just probed an area bigger than NSW for more mineral wealth

Picture: Getty Images

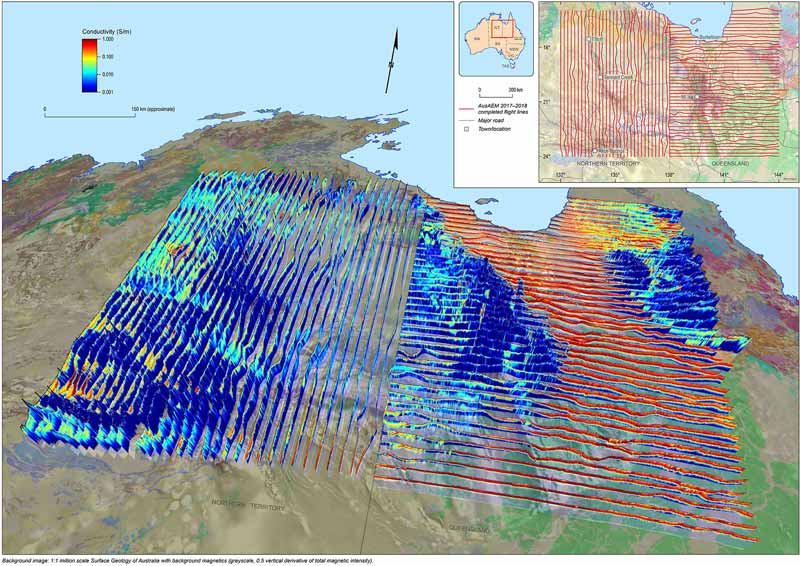

Australia is proving that it still has plenty of extremely mineral-rich terrain after flying the “world’s largest airborne electromagnetic survey” in the north of the country.

Federal government-backed Geoscience Australia has flown a 60,000-line kilometre survey over the area between Tennant Creek in the Northern Territory and Mt Isa in Queensland — two major resource hubs.

Federal minister for resources and northern Australia Matt Canavan said the survey indicated potential for new mineral deposits including gold, copper, nickel, lead, zinc and manganese, as well as critical minerals such as cobalt, platinum group elements and rare earth elements.

“The survey containing 60,000 line kilometres of data provides new insights into mineral-rich areas in Northern Australia that have not been extensively explored previously,” he said.

Airborne electromagnetic surveys use aircraft-mounted equipment to map the electrical conductivity below the Earth’s surface to a depth of several hundred metres – sometimes up to 2km below the surface in more favourable conditions.

This provides a detailed 3D picture – similar to a CT scan – that is used to map potential resources.

A spokesperson for Geoscience Australia told Stockhead this particular airborne survey is the world’s largest in terms of square kilometres covered.

“It covers an area larger than 1 million square kilometres across northern Australia, an area bigger than the state of NSW,” he said.

“The largest survey prior to this was also led by Geoscience Australia in 2013 over the Capricorn Orogen region in Western Australia in partnership with the Geological Survey of Western Australia. The total area covered by this survey was 146,300 square kilometres.”

While there is likely to be higher resolution surveys around the world, in which more line kilometres were acquired over smaller areas, this survey covers the largest area in a single survey, according to the spokesperson.

This latest data has prompted 13 explorers to now sign up for the next round of infill flying – surveys conducted over a tighter line spacing – which is being done over an “equally large” area of the west of the Northern Territory and Western Australia.

Geoscience Australia has been collecting airborne electromagnetic (AEM) data since 2006 to more fully uncover the mineral potential of the country.

AEM data is more expensive to acquire than other airborne geophysical methods like magnetic and radiometrics.

Geoscience Australia says government organisations, the minerals industry and groundwater researchers generally acquire AEM data in only relatively small and isolated locations at narrow line spacing (about 200m) for specific purposes across Australia.

Back in May last year, Mr Canavan revealed that the area on the Queensland-Northern Territory border was particularly prospective for copper.

This new data shows there are many more minerals to be found.

So which ASX-listed small caps are playing in these two exploration hotspots?

Tennant Creek

Tennant Creek is particularly prospective for gold, having historically produced over 5.5 million ounces at a high grade of 19 grams per tonne (g/t).

Anything over 5g/t is generally considered high-grade.

Truscott Mining (ASX:TRM), which has a market cap of $1.3m, has four exploration projects within 25km of Tennant Creek.

Emmerson Resources (ASX:ERM), meanwhile, is exploring and producing in Tennant Creek.

The $32m company is carrying out small-scale production from its Edna Beryl gold mine and exploring its broader Tennant Creek project, which is prospective for gold, copper, cobalt and bismuth.

Last month Emmerson reported bonanza gold grades of up to 122g/t from its Mauretania project.

There’s no actual definition of “bonanza” by the way – it’s just a way to describe speccy gold grades.

Verdant Minerals (ASX:VRM) is particularly interested in phosphate in the Tennant Creek area.

The $33m company is in the final stages of securing a native title agreement for its Ammaroo phosphate project. This will pave the way for the grant of the mineral leases by the Northern Territory government.

Verdant is in the process of being acquired by London-based private equity firm CS Capital Natural Resources, which this month tabled a $40.5m takeover offer that values Verdant at a 113 per cent premium to its closing share price of 1.5c on March 8.

Mt Isa

Strategic Energy Resources (ASX:SER) owns the Saxby gold project in Mt Isa.

Though its interest more recently has turned to making a big new discovery in the much talked about Olympic Dam copper and gold province in South Australia.

Strategic Energy picked up new ground there shortly after BHP’s (ASX:BHP) news of its significant iron oxide copper-gold find in the region.

Aeon Metals (ASX:AML), which has a market cap of about $172m, is largely focused on its Walford Creek copper and cobalt project that is located further north in Queensland near the border with the Northern Territory.

However, the company also has interests in the Constance Range and the Isa North, West and South copper projects, which are all located in the Mt Isa region.

Much larger copper producer Sandfire Resources (ASX:SFR), which is worth around $1.1 billion, has a large exploration landholding of 2400 sq km in the eastern succession of the Mt Isa region.

Sandfire’s projects in the region include the Altia Project — a joint venture with Minotaur Exploration (ASX:MEP) to earn up to 80 per cent, as well as the wholly owned Breena Plains, Cannington West, Black Rock and Kennedy Highway projects.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.