With gold over $3050/oz, this small mine could fund Greenstone’s hunt for a company maker

Near-term gold production could allow Greenstone Resources to fund its focus on continued resource growth. Pic: via Getty Images.

- Greenstone Resources starts strategic review into the potential for small-scale near-term gold production at Burbanks and Phillips Find

- Burbanks has a sizeable resource and an existing mining permit

- Current resource at Phillips Find is either adjacent to, or below historical open pits

- Resampling campaign underway at Burbanks that replaces need for new drill program

Special Report: Greenstone Resources has kicked off a strategic review aimed at assessing the potential for near-term mining at its Burbanks and Phillips Find gold projects near Coolgardie, WA.

Burbanks is just 9km south of Coolgardie and appears to be a no brainer to meet this objective, which comes amidst strong Australian gold prices of about $3,050 per oz.

Not only does it have a historical gold production totalling 444,600oz at high-grades of 22.7 grams per tonne (g/t) gold down to about 140m from the Birthday Gift and Main Lode underground workings, it also has biggest and highest grade undeveloped resources in the region (6.1Mt at 2.4 g/t gold for 465,567oz).

Recent drilling by Greenstone Resources (ASX:GSR) has also returned bonanza grade gold of up to 1.55m @ 20.4g/t gold below the current resource, indicating that the mineralising system at Burbanks has the ability to produce continuous high-grade gold zones – a finding that bodes well for further resource upgrades.

To top it off, the project is on a granted mining lease, a must have for getting into production quickly as it cuts out a whole swathe of red tape.

Likewise, Phillips Find has seen historical production of some 33,000oz of gold between 1998 and December 2015 from three open pit operations – Bacchus Gift, Newhaven and Newminster.

Phillips Find currently hosts a resource of 732,960t at 2.3g/t for 54,567oz of gold that is either adjacent to, or below the historical open pits.

Assessing “small-scale near-term production opportunities”

GSR has appointed an independent mining consultancy to undertake preliminary open-pit optimisations for both Burbanks and Phillips Find.

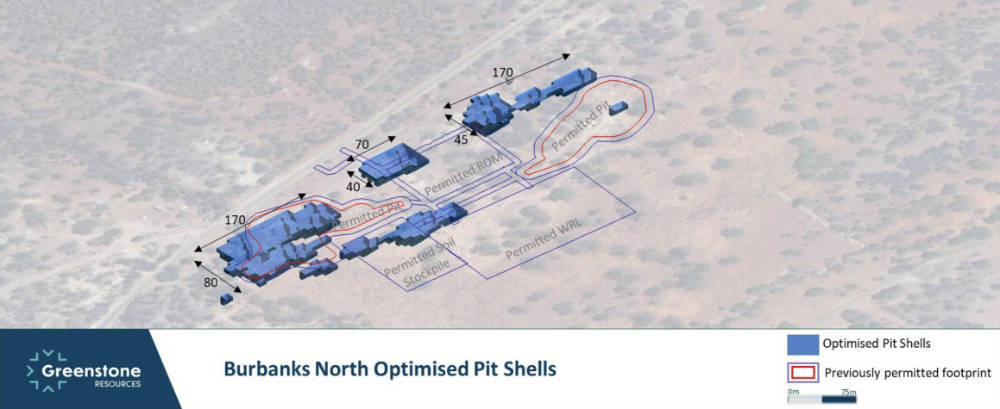

Initial pit optimisations at Burbanks North shows potential for a starter pit within the permitted area with the opportunity for a larger open pit operating scenario in the future, subject to further permitting.

Early discussions are currently underway in respect of mining and milling partnerships for Burbanks North.

A comprehensive resampling campaign is also underway at Burbanks where up to 66 holes have been identified as potentially intercepting modelled ore lodes based off recent lithographic and petrographic analysis.

Meanwhile, initial pit optimisations are currently underway for Phillips Find assessing potential open-pit cutbacks.

“While the focus for the company remains the continued growth of the resource base to support a long life and sustainable operation, the company also believes that it is prudent to assess small-scale near-term production opportunities which may provide a near-term and non-dilutive source of funding to allow the company to fund future exploration and resource growth activities,” managing director Chris Hansen said.

“The recent open-pit optimisation work at Burbanks highlights the potential for a high-grade starter pit within the existing permitted footprint, with early discussions already underway with potential mining and processing partners.

“Outside of the current mining optimisation program, the company has recently completed a detailed lithologic and petrographic review serving to identify up to 66 drill holes which may intercept previously modelled ore lodes.

“To put this resampling campaign into context, the typical ~10,000m drill campaigns previously completed by the company usually results in 30-40 holes being drilled. Importantly, the resampling does not require any further drilling, merely low-cost re-logging and sampling.”

This article was developed in collaboration with Greenstone Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.