With a $2b NPV and over $6.5 billion in life time cash flow, Caravel is emerging as an Australian copper giant

Caravel has crushed all that stood in the way of getting its copper mine NPV up over the $2 billion mark. Pic via Getty Images.

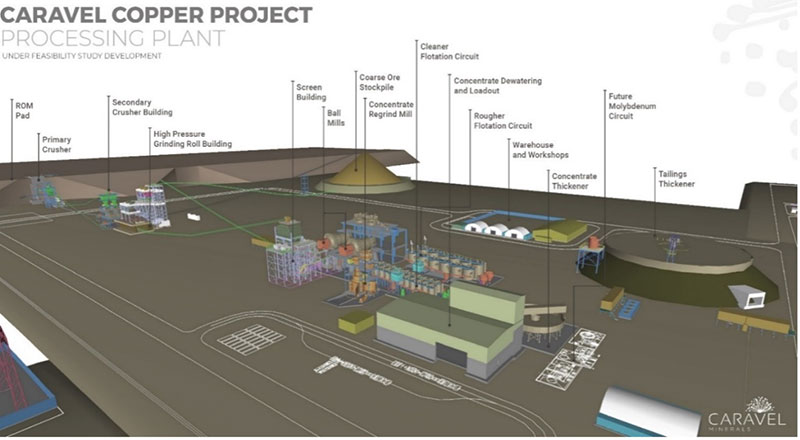

Caravel Minerals has delivered a raft of improvements to its PFS on its copper development of the same name just 150km from Perth in WA’s Wheatbelt, taking the net present value of Australia’s next major copper mine to over $2 billion.

Caravel (ASX:CVV), in concert with study experts Lycopodium and Orway Mineral Consultants, has set the stage perfectly for its H1 2024 definitive feasibility study with a string of upgrades that will boost scale and revenue, reduce payback time and cut all in sustaining costs.

It looms as one of the largest copper projects ever delivered in Australia, with a growing resource containing 2.84Mt of copper metal.

For context, the project will be comparable in annual copper output to mines like BHP takeover target OZ Minerals’ Prominent Hill and Carrapateena, and Sandfire Resources’ recently shut DeGrussa, with the update increasing steady state copper output from 60,000tpa to 65,000tpa over a 26 year project life.

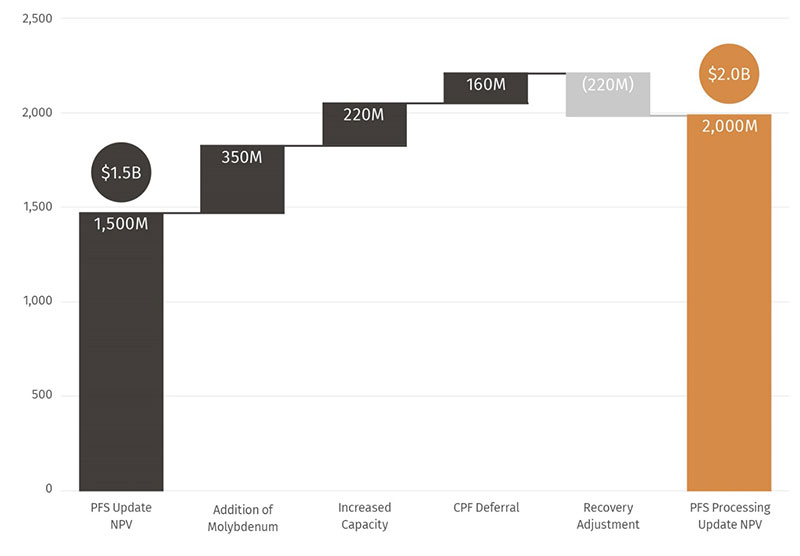

The addition of a molybdenum recovery circuit will see Caravel produce 900t of the rare steel-hardening metal a year, which hit ten-year highs in excess of US$30/lb earlier this year on the back of supply shortages in China and Chile.

Used to make things like drill rods, engine parts, armour plating, heating and saw blades along with tech applications, petroleum catalysts and fertilisers, the only production in Australia currently is as a by-product of Newcrest’s Cadia-Ridgway gold mine.

Copper production will be an even more impressive 71,000tpa over the project’s first five years, up from 65,000tpa, with a 10% increase in processing capacity from 27Mtpa to 30Mtpa.

That will come with only a slight increase in capital expenditure from $1.584b to $1.676b.

But C1 cash costs will drop from US$1.54/lb copper to US$1.23/lb and AISC is expected to fall from US$2.37/lb to US$2.07/lb, delivering a significant reduction in the project’s payback time from 5.6 to 4.9 years.

With an increase in capex of under $100m, Caravel will deliver a $1b lift in pre-tax net cash flow from $5.6b to $6.6b (from $19b in revenue), $500m rise in pre-tax NPV from $1.5 to $2b and rise in pre-tax IRR from 18% to 21%.

Upside awaits

At current copper prices in excess of US$4/lb, that would generate a strong margin.

But demand for copper is expected to boom from the back half of this decade, with market analysts expecting persistent deficits as energy transition technologies like EVs, which use four times the copper of conventional motor vehicles, explode and enter the mainstream.

The inclusion of the molybdenum circuit will provide exposure to forecast supply deficits and by-product credits to bring down operating costs, while deferring a coarse particle flotation circuit for future expansions will provide options down the line.

Caravel has used prices of US$4/lb copper and US$20/lb molybdenum for its PFS update, which could well be conservative in the context of expected shortages for both key materials.

“Our decision to commission a wide-ranging independent metallurgical review of the Caravel Project flowsheet by a leading engineering group in Lycopodium, supported by a group of highly regarded consultants, reflects our commitment to exhaustively analyse all aspects of the project and to strive to ‘build it right’ from the beginning,” CVV managing director Don Hyma said.

“The results of this review and update have exceeded our expectations. The increase in copper production stems from relatively minor changes and enhancements to the project flowsheet, in combination with the inclusion of the previously flagged Molybdenum Recovery Circuit.

“Collectively, these changes result in a significant increase in Project cash-flow, NPV and financial returns for a relatively modest increase in capital expenditure. Importantly, we have used a relatively modest assumed price of US$4/lb for copper and US$20/lb for molybdenum – with significant scope for upside on these prices.”

Lead engineers appointed

Following the success of the study update, Perth-based Lycopodium has been selected as the lead engineer for Caravel’s definitive feasibility study, the last step required before financing and a final investment decision can take place.

Along with approvals from the State and Federal Governments, CVV is targeting a potential two year construction timeframe with first production in the second half of 2026.

Caravel will waste little time getting its DFS moving.

“The outcomes of this review will now be ‘frozen’ into the detailed engineering phase, and we are delighted to announce the appointment of Lycopodium as the Lead Engineer for the Definitive Feasibility Study, which will get underway in earnest in the second half of this year,” Hyma said.

This article was developed in collaboration with Caravel Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.