With 30m wide pegmatite dykes, this Brazilian project could be a critical minerals smorgasbord

Early exploration has uncovered a veritable feast of critical minerals opportunities at Jaguaribe. Pic: Getty Images

- American Salars Lithium picks up Brazilian project with wide lithium-rich pegmatites

- Gives CSE-listed junior a launchpad to explore hot critical minerals jurisdiction, adding to advanced sites in Argentina, Nevada and Quebec

- Outcrop samples demonstrate lithium, niobium, rare earths, tin, rubidium and zinc potential at Jaguaribe

Special Report: Lithium, niobium, rare earths, tin, rubidium and zinc, the newest acquisition from South and North American lithium hunter American Salars Lithium will give the junior the opportunity to make a major critical minerals discovery in one of the world’s top mining jurisdictions.

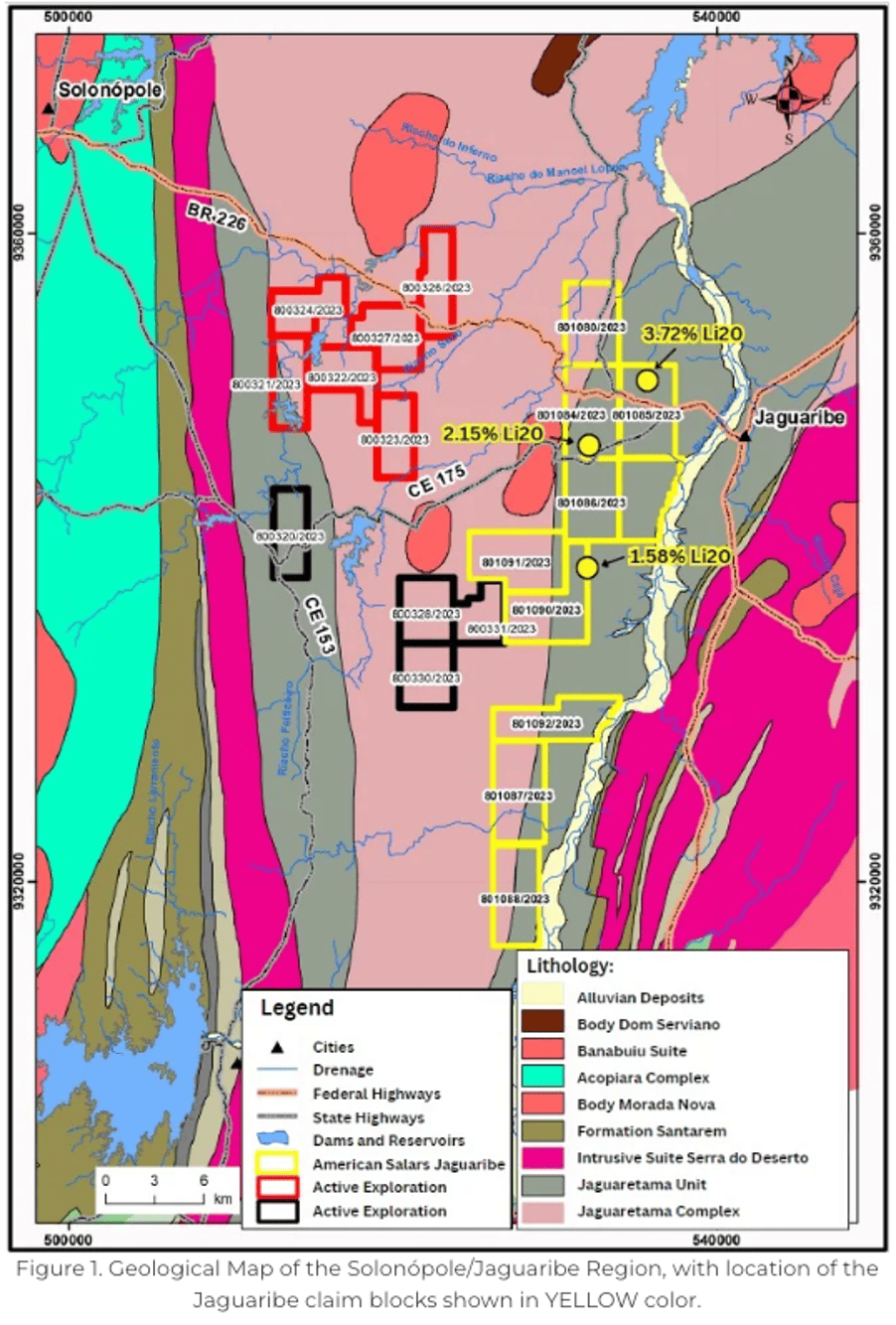

Rich in hard rock lithium-caesium-tantalum pegmatites, over 180km2 of ground in the northern Brazilian State of Ceará, the Jaguaribe acquisition contains recent high grade rock samples of up to 3.72% Li2O and represents a major spreading of the wings for Canadian Securities Exchange listed American Salars Lithium (CSE:USLI).

Already active in the battery metals hotspots of Nevada, Quebec and Argentina, where it holds a salar brine projects with NI 43-101 inferred resources1>500k tonnes of lithium carbonate equivalent resources, ASL is now leveraged to exploration success also in the fertile Jaguaribe/Solonópole of Brazil.

“We continue to add highly prospective assets to our portfolio of lithium projects in North and South America,” American Salars CEO and director R. Nick Horsley said.

“Brazil has been one of the global epicentres for lithium production and American Salars’ Jaguaribe project is located in a known pegmatite district and contains high-grade lithium samples and significant rare earth elements values.

“We will plan a much more significant exploration program to map pegmatites and further sample and define the geological values in this critical mineral rich area.”

Multi-commodity potential

Brazil has recently emerged as the next frontier in the critical minerals race, with Sigma Lithium’s low cost Grota do Cirilo among the first hard rock lithium operations globally to challenge the dominance of WA’s spodumene producers.

The development of the Serra Verde rare earths project has also put the South American nation, known for iron ore, copper and niobium riches, on the map as a potential western source of magnet metals.

Jaguaribe is no different in its mineral potential, with historic artisanal mining sites contained within its tenure that have previously been mined, albeit on a small scale, for lithium, coltan (tantalum and niobium) and tin.

Located just four hours along paved roads from the port and international airport at Fortaleza in an historical pegmatite province, initial sampling of lithium and REE bearing pegmatite dykes returned results such as 3.72% Li2O, 2.15% Li2O, 1.58% Li2O and 554.5 parts per million caesium, 135ppm tantalum, 177ppm niobium.

That’s before even considering a sample that returned over 10,000ppm rubidium, 675ppm tin and 387ppm zinc.

Phase 2 program in the works

Those results derived from a phase 1 program that identified monster pegmatite dykes up to 30m wide and 300m long that remain largely underexplored.

Field crews, a Brazil-focused senior geo and hard rock lithium specialist Mitch Lavery, the project’s qualified person, have come on board to oversee a more extensive mapping program of pegmatite outcrop in phase 2.

Work is also ongoing with Brazil based geological consultants to help plan a follow up drilling program to evaluate priority targets at Jaguaribe.

If a major discovery is made it could not be in a better place.

The site consists of 10 claim blocks over sparsely populated farmland with no rainforest in sight and stable topography to carry out exploration activities.

And its location in Brazil’s north provides ready access to the US and European battery chemicals markets, who are itching for sources of supply for electric vehicles which are not fed through the dominant Chinese supply chain.

The deal to acquire the asset will involve the exchange of 3.5 million units of American Salars’ stock for the 14473777 outstanding common shares in the vendor BC Ltd, a company of which Horsley is a director.

The American Salars units will consists of one common share and one purchase warrant at 20c for a period of three years with a hold for four months and one day from their issuance, with the acquisition subject to CSE approval.

Lavery conducted due diligence on the geological potential of the property, with the decision to acquire it made by the company’s two independent directors.

This article was developed in collaboration with American Salars Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.