Why this ASX junior is buying into this Asian nickel project at just the right time

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: A renewed focus on electric vehicles that can go the distance in China spells great news for any company looking for nickel in Asia — here’s how.

Blackstone Minerals (ASX:BSX) recently set the junior sector a flutter with news that it had negotiated a 12-month option to acquire a 90 percent interest in the Ta Khoa nickel project in Vietnam.

Since the company announced its intention to buy into the project, its shares have jumped by about a third.

Not only is Ta Khoa a good asset in its own right (we’ll get into that in a bit), but the bigger picture for nickel within Asia looks downright bullish.

Here’s why:

Going the distance

In early 2018, the Chinese government made a move that made electric vehicle industry watchers sit up and take notice.

It effectively re-jigged its EV subsidy scheme to favour longer-range vehicles. You can read about the full move here, but here’s the short version:

EVs with below 150km in range would have all subsidies removed, while those with 300km of range would get even higher subsidies. Those that managed to have a range of 400km or more would get higher subsidies again.

This means battery power and weight requirements changed as well — with the Chinese government favouring heavier, more powerful batteries.

So, why is that good news for nickel?

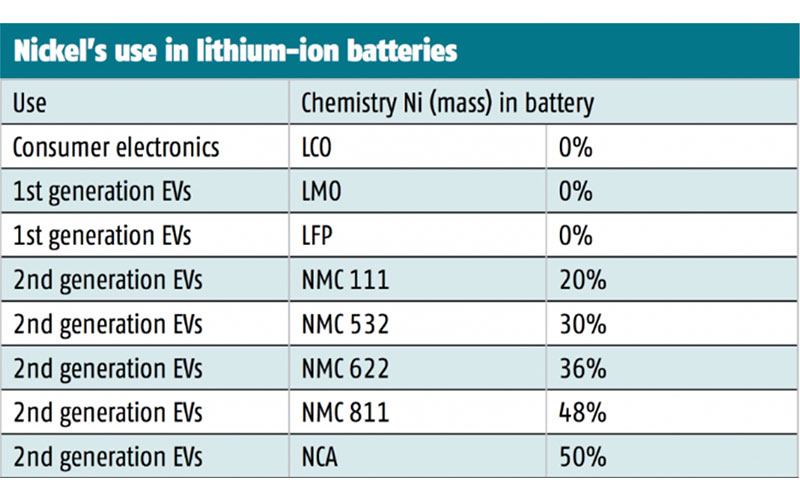

Well, generally speaking, the more nickel in lithium-ion batteries, the more powerful they are.

First generation EVs used lithium-ion batteries with no nickel content in them, but battery makers have found adding nickel to the mix leads to higher energy density.

So far, batteries with higher nickel content have been more expensive to produce, but the Chinese move to remove subsidies on lower-energy batteries changes the game for nickel.

And, that brings us back to Blackstone.

The project

With Asia, specifically China, set to be a major producer of lithium-ion batteries over the next decade – there has never been a better time to be sitting on a nickel project in that part of the world.

The Ta Khoa project sits roughly 160km west of Hanoi and comes with an already permitted and established mine.

That mine, the Ban Phuc mine, was operated from 2013-2016 and is currently in care and maintenance.

When the previous owner closed the mine, the nickel price had gone down to $US10,000 ($A14,300) per tonne, but it’s staged a recovery to $US12,000 per tonne and the outlook is increasingly positive.

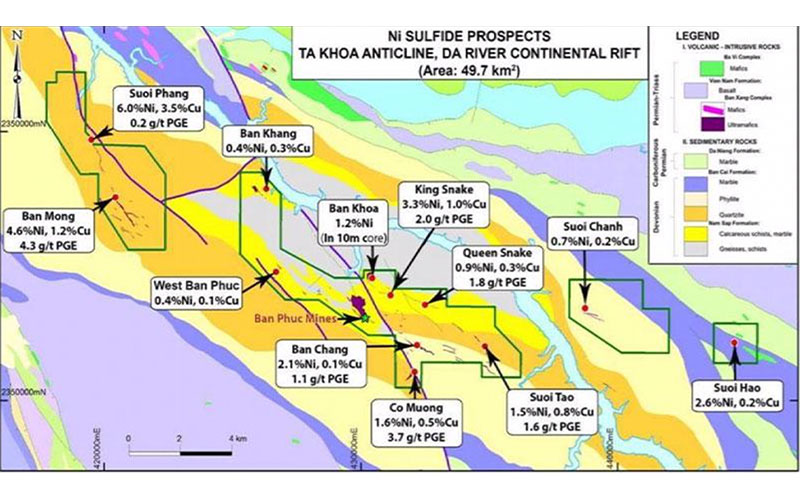

Ta Khoa also comes with 150km2of prime exploration ground, with Blackstone telling investors that the area hosts at least 25 advanced stage targets.

Crucially, the exploration targets are all nickel-sulphide rather than laterite.

Sulphides are, generally speaking, a lot easier to process into nickel sulphates, the key nickel-bearing product used by battery manufacturers.

Blackstone has previously told Stockhead that it will spend the first two years at Ta Khoa focusing on exploration, with the company then to look to re-opening the mine.

It’s also likened the opportunity to that company-making discovery for Sirius Resources, Nova-Bollinger.

When the Nova-Bollinger nickel-copper deposit was discovered in WA in 2012, it transformed Sirius into a household name and added to the reputation of Mark Creasy as Australia’s most successful prospector.

Ultimately Sirius was acquired by Independence Group (ASX:IGO) for $1.8 billion, and Blackstone sees similarities between the early stages at Nova-Bollinger and what it’s doing in Vietnam.

“We believe we’ve got what could be potentially a globally significant nickel sulphide system,” managing director Scott Williamson said.

“It’s a magmatic nickel sulphide, which is different to the stuff in Kambalda. So, it’s a bit like a Nova-Bollinger type, which can produce significant tonnages of nickel.

“We think there’s a lot of nickel here to be mined over many, many years.”

Given the previous owners spent $136 million on building the mine at Ta Khoa and associated infrastructure, Blackstone has a bit of a head-start on other juniors plugging away on the exploration side.

“We believe we will be one of the first junior companies on the ASX to deliver what will be a nickel product for the battery industry, and the reason we’re able to do that is because it’s a sulphide and we’ve got the existing infrastructure,” Williamson said.

The team

Several of the key players at Blackstone have a track record of creating value for shareholders including chairman Hamish Halliday and non-executive director Steve Parsons.

Halliday was heavily involved with Adamus Resources, which proved up a multi-million ounce discovery in Africa before selling out to Endeavour Mining in 2011 for $C313 million ($A341.5 million).

Along with serving on the Blackstone board, Parsons is managing director of Bellevue Gold (ASX:BGL), which has grown from a $5 million shell into a $300 million company in less than two years.

Scott Williamson (listen to Scott Williamson’s podcast with Barry Fitzgerald) has 10 years of experience in technical and corporate, with experienced metallurgist Stephen Ennor completing the team.

With a positive market outlook, a new flagship asset with many attributes and a high calibre team, Blackstone appears to have all the ingredients for success.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Blackstone Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.