Why the best place to find an iron ore mine is next to an old one

The road to riches is paved with red dirt in the Pilbara. Pic: Getty Images

- The best place to find an iron ore mine is next to another one

- Juniors CZR and Red Hawk show the value creation possible by finding a small iron ore mine that can be marketed to a neighbouring major

- Peregrine has unearthed two massive channel iron deposit targets near BHP’s Newman hub in the Pilbara

They say the best place to look for a new gold mine is under an old one.

In iron ore, the saying could be that the best place to find a new mine is next to an old one.

That’s not just for geological reasons. It’s because logistics is the real name of the game when it comes to iron ore.

A bulk commodity that sells at its peak for around US$200/t, and currently US$105/t, the most important thing when it comes to iron ore is your cost profile.

It’s why small, junior players have historically been so few and far between, largely emerging only in boom times when margins are good, unless they have a niche like a high grade product.

The secret for the Pilbara giants is that they own thousands of kilometres of rail and their own port infrastructure which, combined with a short shipping distance to their main customers in China, keep costs at the very bottom end of the cost curve – around US$20/t.

What is less important to these operators is the quality of their orebodies (though that is a factor) than their ability to plug a new deposit into their logistics network.

And it’s instructive for junior explorers.

Making a new iron ore discovery in a new district is an enticing thought. But they carry massive capital costs and long lead times to develop – think the Simandou project in Guinea which has taken 30 years to develop and carries the highest capital intensity of any project in the industry.

Deliver a bolt on deposit on a major’s doorstep, on the other hand, and you could be looking at a handy payday.

And so it’s proven this year so far.

Near enough is good enough

There have been three significant iron ore deals in Australia this year that have showcased the importance of this strategy.

One stands out from the rest for its scale – Japanese trading house Mitsui paid around US$5.3bn (over A$8bn) for 40% of Rio Tinto’s (ASX:RIO) next major development Rhodes Ridge, enriching its previous 50-50 joint venture partners, the heirs to Peter Wright’s prospecting fortune.

But the other two provide more direction for micro cap investors.

The first was Red Hawk Mining (ASX:RHK), which exited the ASX after a $254m acquisition by Fortescue (ASX:FMG).

It had previously been part of the Balla Balla joint venture, an all too ambitious project backed by a State Agreement and major investor New Zealand’s Todd Corporation to develop a multi-billion dollar low grade iron ore project from pit to port.

That only would have made sense at ultra-high iron ore prices, and the decision to shrink the broader project to focus on the higher grade Blacksmith deposits proved a good one for the former Flinders Mines.

A future development would have been hamstrung by port access and the need to run road trains from the site. But there were two logical suitors – Rio, which owns the nearby Brockman hub to the south, and FMG, which has the Solomon hub to the east.

As it proved, Andrew Forrest’s Fortescue won the day.

The other is the sale of CZR Resources’ (ASX:CZR) Robe Mesa deposit, effectively an extension of the Mesa F deposit at the Robe River JV between Rio Tinto and Mitsui.

The $75m deal completed in September after Mark Creasy-backed CZR dumped a previous bid from a Chinese-linked firm that was held up by foreign investment approvals, providing access for the RRJV to more material of the low phos product, prized by Japanese carmakers.

After years of being squeezed out of the Pilbara by the majors, the logic is clear. As long-running mines degrade and run short of ore, new deposits will be essential to maintain the product grade and quality steel mills in Asia have relied on for decades.

Find something next door to a major hub with similar metallurgical characteristics and you’re in a terrific position for a deal.

Who is in pole position to do just that?

Creasy’s iron ore empire

CZR may have been a big success story for prospector extraordinaire Mark Creasy, but another of his investments has just put its hat in the ring.

Peregrine Gold (ASX:PGD), which counts Creasy as its largest holder, has been making hay with the sun shining in gold and iron ore exploration this year.

The iron ore development is the newest for the George Merhi led explorer, and potentially the most lucrative.

Gold prices may be at all time highs, and PGD has plenty of that at its Newman and Mallina projects in the Pilbara including high grade gold hits at the Tin Can and Peninsula prospects.

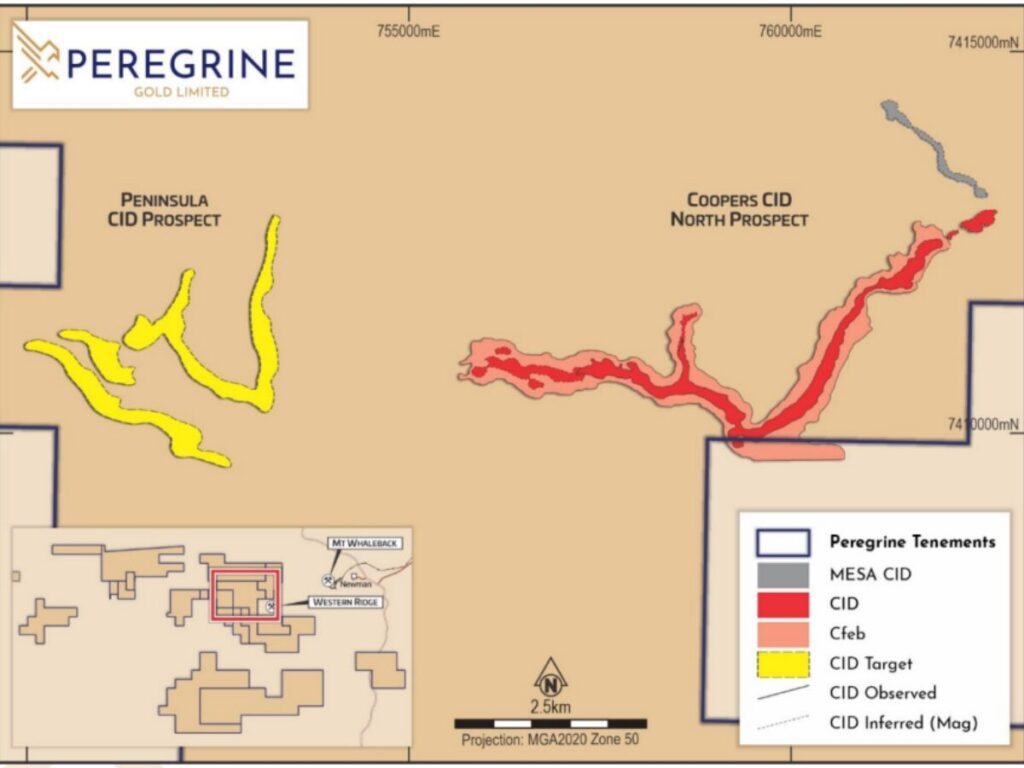

But recent investor interest has been driven by two channel iron deposit discoveries, one called Coopers CID and the other called Peninsula.

Coopers CID North contains a host of rock chip samples grading as high as 61.2% Fe over a strike length of 6.4km and width of 200m.

Peninsula sits around 2.5km to the west, and includes rock chips from 2021 which graded between 56.9% and 60.2% Fe.

The 2000km2 prospect is being mapped with results expected next month.

These prospects are both enormous in scale and, critically, close to some of the Pilbara’s biggest mines at BHP’s (ASX:BHP) Newman hub, including the historic Mt Whaleback.

The area is already seeing renewal, with the Western Ridge crusher project – just 2km from Coopers – being developed at a cost of US$943m.

From Q1 FY27, the project will deliver an average 25Mt of iron ore a year for 12 years to replace depleting orebodies around Newman.

That suggests any economic find by Peregrine could be very intriguing indeed to the Big Australian.

Peregrine has speculated that previous explorers missed the Coopers CID North find due to its low topographical position, with both those companies and the GSWA looking at mesa formations in the area to the northeast.

CIDs are typically unconsolidated and close to surface, meaning miners save costs on drilling and blasting, with the ore also typically amenable to upgrading by removing water and impurities.

The Coopers discovery ‘has apparent scale that compares very favourably with Robe River Mesa’, Peregrine said in its initial July announcement on the find.

Fundies are watching closely. Hedley Widdup’s Lion Selection Group (ASX:LSX) joined Creasy on the Peregrine register by taking $500,000 of a recent $3m placement.

“Peregrine’s channel iron prospects are exceptionally well located and offer attractive scale if the large surface footprints can be proven through drilling,” Widdup said at the time. “This offers great diversity for Lion as well as tremendous potential value growth through discovery.”

Iron ore exploration is not a failsafe pursuit.

Macro Metals (ASX:M4M) found that out when its attempts to drill an extension of BHP’s historic Mt Goldsworthy mine turned up donuts. It has since shifted to mining services and has its own CID prospect, Turners, on the books.

But there’s little doubt proximity to power is a valuable thing in the Pilbara.

At Stockhead, we tell it like it is. While Peregrine Gold is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.