Why Red Metal is dreaming of a Meteoric rise on the back of its ‘world first’ rare earths discovery

Pic via Getty Images

- Red Metals says it has found an entirely new form of rare earths mineralisation at its Sybella project in northwest Queensland

- The company is up around 33% since announcing the find on Monday

- Granite hosted rock could be amenable to processing with fewer steps and complexities than conventional carbonatites and ionic clays

Red Metal (ASX:RDM), a small-cap minerals hunter with monster ambition, has been on the lookout for something special in the world of rare earths mineralisation. And the company believes it’s found it in North West Queensland.

The Sybella project’s latest results, borne from a “proof of concept” drilling campaign, is in fact so special, says Red Metal’s MD Rob Rutherford, that his team is describing it as a “world first” REO (rare-earth oxide) discovery.

Sybella is located about 20km southwest of Mt Isa, and Red Metal’s find, according to the company, shows scope for “vast tonnages of weak-acid soluble REO mineralisation hosted in low-acid consuming granite rock”.

The rare earths in question are neodymium and praseodymium (NdPr) as well as yttrium (Y) and dysprosium (Dy). These play into the EV narrative because they are essential to the production of high-performance magnets.

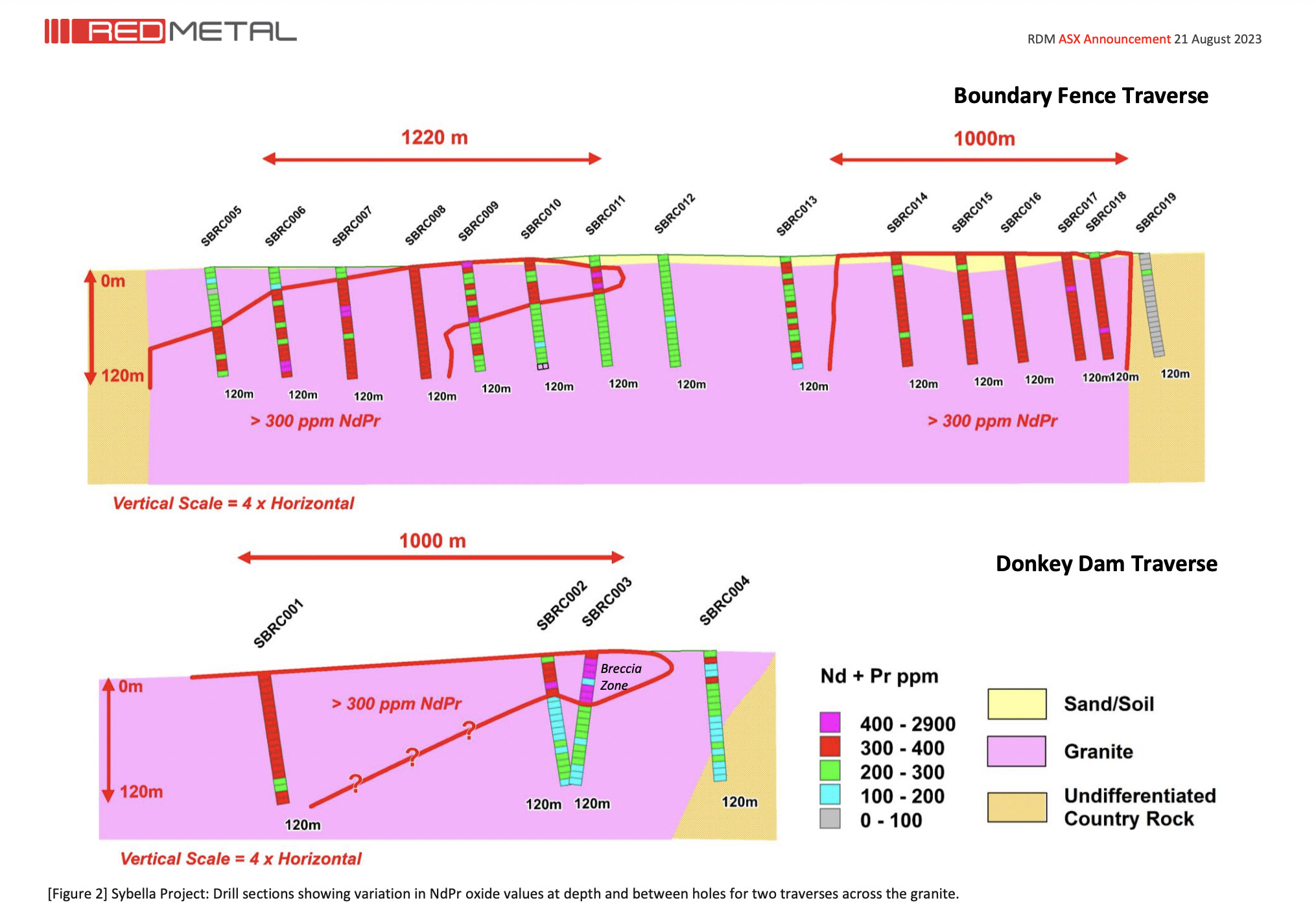

The discovery and the company’s excitement around it follows assay drilling results on 19 percussion holes which punched 2,280m into the granite, highlighting the quality of grade and substantial widths of the find.

Importantly, Red Metal is talking near-surface REO mineralisation that “should be recoverable by the application of a weak acid solution”.

It’s the acidic details that forms the crux of the matter, and are what gives this news its headline significance, which we’ll get to in a sec.

A $20.88m market-capper, RDM’s share price, meanwhile, has been chopping about all year (+25% YTD), but has just hit its highest level since April on the back of the company’s ASX announcement on Monday. Even still, RDM reckons the potential enormity of the find has likely largely yet to land with investors at this point.

We mentioned some of the key parts of the company’s ASX announcement in brief on Monday in our Resources Top 5 column, but to get a deeper sense of Red Metals’ latest activities, we chatted with Rutherford on what it all means and why he’s drawing comparisons between RDM and rare earths darling Meteoric Resources (ASX:MEI).

Hi Rob, firstly can you please give us the quick answer about why you think this discovery is such a big deal?

“Sure, the new Sybella REO discovery is special because we’ve identified easily soluble REO minerals in a low-acid consuming granite-host rock at surface, and it’s offering vast tonnage potential.”

What’s the difference or differences between these REOs and other rare earths?

“The key differences between Sybella and other REO deposits are its weak-acid soluble REO mineralogy, the unreactive host rock and its vast size potential.

“Sybella’s REOs occur within highly soluble fluoro-carbonate minerals bastnasite and synchysite.

“Although subject to more detailed studies, preliminary leach tests suggest we should be able to leach the REO from the granite by simply applying a weak acid. No mineral concentration is required and no radiogenic thorium waste will need to be managed.”

So other rare earth mining – for instance for carbonatites and ionic clays – requires more of a process than you’re looking at with this REO find?

“That’s right, we’re looking at potentially simple metallurgy, scope for vast tonnages with a very low-strip ratio and zero radiogenic thorium issues.

“By contrast, monazite-rich carbonatites have complex metallurgical paths, variable ore geometries, higher strip ratios, they require a REO mineral concentration step and need to manage radiogenic waste products once in solution.

“Ionic clay deposits meanwhile can have limited depth extent and may have highly variable metallurgical properties over the deposit.

“We’re looking at a very different process from the monazite REO carbonatite deposits mined and processed, for instance, by Lynas (ASX:LYC) , Hastings Technology Metals (ASX:HAS) and Iluka Resources (ASX:ILU).

“Essentially, sometimes with carbonatite systems, there’s a lot of carbonate within those host rocks, and when you put acid on them, the host rocks don’t actually fizz the ore mineral.

“So that’s why these carbonatite deposits have to make a mineral concentrate first, which generate thorium waste that needs to then be factored in and managed.”

At the risk of repetition here, but just to be super clear, what’s the benefit for the company in finding minerals with weak-acid solubility within low-acid-consuming granite?

“It’s a matter of cost efficiency in extraction across a site with huge scope – we’re talking REO-enriched granite here that’s about 14km long and 2-3km wide.

“So these large tonnage deposit types with the unique characterisation we’ve described (soluble ore minerals in low-acid-consuming granite) can be bulk mined and then extracted using simple coarse grind and low-acid leach processing – usually with very efficient economies of scale.

“Because granite rock does not readily react with a weak acid solution but the soluble REO mineral does, then it is hoped we should be able to wash the crushed granite in a low-cost acid solution to extract the REO.”

You’re calling the Sybella REO discovery a ‘world first’. Why has this type of mineralisation not been found before?

“Some clever lateral thinking by Red Metal’s exploration team led to the discovery of this new style of REO mineralisation, which, yes, it believes is a world first.

“Spurred on by higher NdPr prices, Red Metal targeted a REO version of the known weak-acid soluble, granite-hosted deposit styles that are seen at the giant Rossing and Husab soluble uranium deposits in Namibia and the Morenci soluble copper deposits in the USA.

“So, at Sybella, we’re talking about a rare-earth-mined equivalent of that particular weak-acid soluble style in favourable host-rock conditions.”

What are the next steps for the project, and where are you looking for potential further funding?

“The next exploration step will include bench-scale metallurgical tests and more drill profiles along the 14km strike of the REO-enriched granite intrusion.

“This work will seek an effective process for REO extraction and provide a more certain indication of the size and grade potential of this exciting new discovery.

“Re: the funding, we’re investigating a number of opportunities for funding support utilising critical metal grants from state and federal governments.

“There’s a lot of that about, and although we haven’t really been in that funding space before, we thought we could potentially get a lot of the early-stage work funded out that way – or partially funded at least through various types of grants.”

So, final thoughts? It’s all early doors for the project at this stage, right?

“Yeah, one thing to keep in mind that I’ll leave you with, though, if you want to make a comparison to another company recently, there’s Meteoric Resources (ASX:MEI), which has a granite-hosted ionic clay deposit operation going on in Brazil.

“Now that company has a market cap of $388 million. And when we look at that, and ours, we would think we have that kind of opportunity – we’re not an ionic-clay deposit but Australian based and what we do have is weathering in this granite of ours, down to about 20-30m.

“It’s weakly weathered, but it’s enough to mean the ability to grind this stuff is a lot cheaper for us down to that kind of level.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.