Why industrial metals can hold the key to starting a diversified mining house

Industrial metals provide a base from which to diversify, Corella's Jess Maddren says. Pic: Getty Images

- Diversification allows companies to sustain their operations across the resources cycle

- Industrial metals could provide a stable base to build upon, kaolin developer Corella’s CEO Jess Maddren says

- ‘Specialised diversification’ involves supplying multiple commodity markets from the same asset

If there’s one thing that characterises the largest miners, it is the diversified nature of their portfolios, enabling them to weather any upturns or downturns.

As an example, the world’s largest miner BHP (ASX:BHP) has its copper, iron ore and metallurgical coal businesses, where strength in one commodity can counter-balance weakness in another.

Speaking to Stockhead, Corella Resources (ASX:CR9) chief executive officer Jess Maddren said that in investing or business, there were two key strategies.

“You can go niche, like bitcoin investing or exploring for a single mineral, but that’s like putting all your eggs in one basket, or you can diversify, which gives you the ability to have exposure to high risk and high returns, low risk and low returns, or any possible combination,” she noted.

“You don’t need to diversify to the point of neutralisation. It is all about what’s right for the person or company.”

Maddren noted that some mineral products had big swings, pointing to copper as an example due to its tendency to either go boom or bust.

“The same is true with oil and gas, you either make a discovery or hit a duster, it’s big return or zero return,” she added.

Maddren’s Corella is looking to move in that direction, in a sense. Its high quality Tampu resource is largely a kaolin deposit, giving it a base business with a large and relatively transparent industrial market, but it is looking to add resources for markets like rare earths and battery metals from the same asset in a process known as ‘specialised diversification’.

The case for base

Maddren believes that it is important for companies to have a base product or business line that may offer a smaller profit margin but will do so for longer with more predictability.

“That means your company has less swing variability. I think that variability is the killer for all businesses,” she stressed.

“If you’re up and down, you can never maintain good teams all the way through.”

Maddren said kaolin would be Corella’s base business.

“There will always be a market for kaolin if you have good pharmaceutical grade kaolin, which we do, and it delivers a compound annual growth rate of 5-6% averaged across all the industries kaolin is used in,” she noted.

“There are some very specialised uses of kaolin that you can get up to 10% CAGR, which is great, and that is going to produce our base case industrials business.

“It is a great product, it is in the ground, we don’t have a very expensive capex for our processing plant, so we should be able to get high-grade kaolin for low cost.”

HPA feedstock

This plant will allow the company to produce a saleable percursor to high purity alumina that will bring in cash flow without the higher costs associated with going all the way to producing 99.99% pure HPA, used in batteries and LED lights.

Tampu currently has a resource of 24.7Mt that at an average yield of 50% could produce a 12.2Mt grading 36.5% Al2O3 product suitable for sale as kaolin and as a feedstock for HPA.

Maddren expects this to be increasingly valuable as electrification continues. Aluminium could be substituted for copper in transmission wires as copper becomes more scarce.

While an aluminium wire is less conductive and needs to be about 25% thicker, it would still cost and weigh significantly less than an equivalent wire made from the red metal.

That means less aluminium available for HPA production.

“Despite it never really being celebrated, kaolin is the only feed for HPA that is decoupled from the aluminium supply chain,” Maddren said.

“Our high purity kaolin will go in as feed for HPA. I think that’s a good thing going forward when you combine that with the strategy we intend to take, which is going after a low capex, low opex flow sheet.

“Then you couple that with running hard at the Future Made in Australia subsidy in 2027 through to 2038, which is a 10% rebate on your (refining) opex that goes straight to your bottom line.

“All of a sudden, you are looking at these projects that will have good returns in the long term.”

Specialised diversification

From here, Maddren says CR9 will then diversify into higher value minerals. But it won’t be looking at new projects to do so.

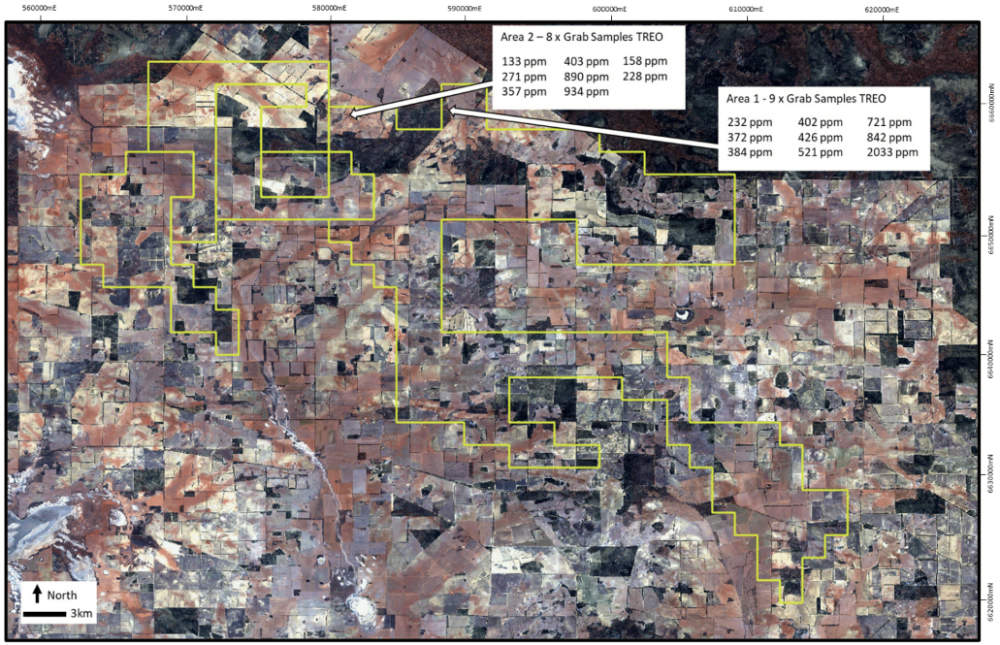

Rather, the company will lean on the geology present at its Tampu project, which already has the potential to host critical minerals and rare earths.

“We have granites, which means there’s a good chance we have pegmatites, and if you have those two, there’s a good chance that some of your pegmatite-related mineralogy and rare earths is present,” she pointed out.

Maddren noted that while Brazil had the advantage of high humidity and temperature to aid with the weathering process that led to REEs in rare earth clays, weathering can also occur without those catalysts as long as the same rock type is present and enough time has passed, which is certainly the case in the Yilgarn craton.

“You are going to get that in the Archaean in the middle of WA because it has been stable for so long,” Maddren said, adding that she was only after true ionically bonded REE clays as it was the only thing that money could be borrowed for.

“I’m already building the clay plant for kaolin, I can easily put another line on for clay beneficiation, that will give me two clay plants next to each other.”

CR9 is also looking for any pegmatite-associated economic mineralogy such as lithium, tin and tantalum.

It wants to follow in the footsteps of the majors by starting small and diversifying over time, but Maddren is keen to focus on what Corella knows and avoid “flavour of the month” fads chasing assets in temporarily hot regions or commodities.

“You don’t diversify like Harley Davidson, which got into perfume,” she quipped. “No one wants to smell like a biker.”

Operating in the same area also allows the company to know its stakeholders and build long-term relationships, trust and respect.

Industrial metal players

While CR9 is certainly making progress, it certainly isn’t the only industrial metals play operating on the ASX.

Titanium Sands (ASX:TSL)

Titanium Sands operates the Mannar heavy mineral sands project in Sri Lanka that has a hefty resource of 318Mt at 4.17% total heavy minerals.

A scoping study has been released for a Stage 1 development, which will draw on a resource of 82Mt at 6.03% within a 8km by 1km high-grade zone exposed at surface with no barren overburden.

This is expected to generate net revenue of $1.28bn at a low capex of $122m with payback in just under two years.

NPV and IRR, both measures of potential profitability, are estimated at $545m and 52% respectively.

TSL’s directors and local management recently met with the Presidential Secretariat in Colombo to discuss the co-ordination of government departments involved in the project regulatory approval processes.

Landowners covering the area of the project environmental impact assessment have also expressed their support for the project and the need for it to progress through the regulatory processes as soon as possible.

Additionally, the retention of EL370 has been granted by the Geological Survey and Mines Bureau, ensuring that all five of the company’s key exploration licences are current.

Suvo Strategic Minerals (ASX:SUV)

Suvo is an existing producer of kaolin, with the sale of 5321t of hydrous kaolin from its Pittong project in Victoria generating revenue of $3.1m during the March 2024 quarter.

In a demonstration of the continued demand for kaolin, it secured purchase orders from five new customers totalling 730t, which is expected to generate an additional $630,000 in annual turnover – a 47% premium over the March 2024 quarter weighted average selling price for existing customers.

The company is also embarking on its own kind of specialised diversification with moves to commercialise its geopolymer concrete product, Colliecrete, which replaces ordinary Portland cement with alkali activated pozzolanic materials produced from kaolin.

Not only does the resulting concrete have a much lower carbon footprint, it also has an average strength that surpasses many traditional concrete applications.

Andromeda Metals (ASX:ADN)

Andromeda Metals is focused on developing The Great White Project (TGWP) on the Eyre Peninsula in South Australia that is the subject of a definitive feasibility study outlining attractive economics for a kaolin mine with a 28-year life.

The project will have a low Capex of $194m over three stages and will generate average annual EBITDA of $140m from a simple, free-dig mining operation with low strip ratio and simple mechanical separation processing.

Post-tax NPV and IRR have been estimated at $763m and 43% respectively.

More recently, ADN has earned a 51% interest in the Eyre Kaolin joint venture that is in close proximity to TGWP and includes kaolin prospects with properties complementary to those at its flagship project after meeting the requirements of the Stage 1 earn-in.

It has the right to increase its stake in the four tenements that make up the JV project to 80%.

At Stockhead, we tell it like it is. While Corella Resources and Titanium Sands are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.