Lefroy Exploration thinks this salt lake could be hiding a fortune

Pic: John W Banagan / Stone via Getty Images

At first sight the least likely place in the world to find gold is under the “moonscape” of a dry salt-lake.

But in outback Western Australia some salt flats are hiding a fortune — which is why Lefroy Exploration (ASX:LEX) could be an interesting stock for speculators to track.

Drilling at the company’s flagship Lucky Strike prospect in the middle of Lake Lefroy has so far yielded only modest hints of something interesting — with a best hit of 10.3 grams of gold a tonne over a 3-metre section from a depth of 80m.

More results like that are required to light a fire under Lucky Strike.

But the fact that a relatively high-grade intersection has been encountered early in an exploration program has helped build confidence in the theory behind Lefroy’s search — which is all about choosing the right location.

In a way, Lefroy is applying the classic three-stage formula for successful property investment – location, location, location.

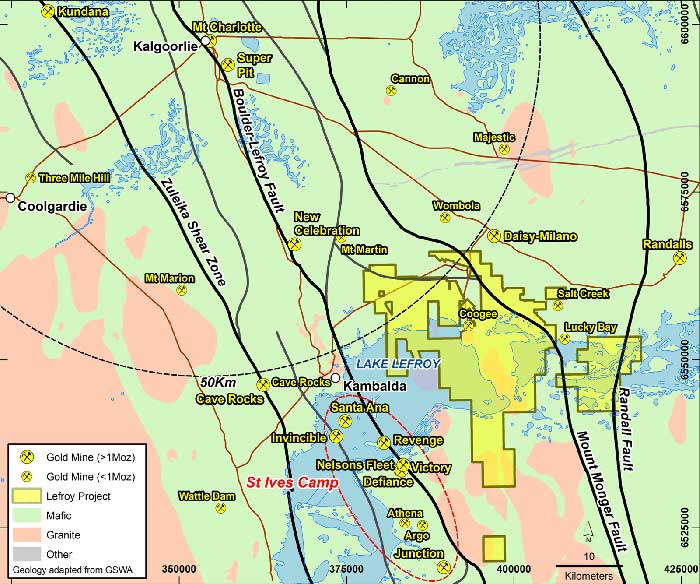

The salt lake itself lies (see picture below) adjacent to the nickel processing centre of Kambalda which Western Mining Corporation developed in the 1960s, with Australia’s gold capital, Kalgoorlie, 50km to the north.

The mix of gold and nickel has long been known in WA’s Eastern Goldfields region, including some remarkable discoveries by WMC when it was the dominant nickel miner in the region.

On one famous occasion after a blast at the face of an underground nickel mine, workers entered the freshly created stope (or tunnel) to be greeted by what became known as a “jewellery shop”.

This was a wall of gold-rich rock of such a high grade that it was hauled out and stored overnight in a cell at the Kambalda police station — because WMC did not, at the time, have conventional goldmine security systems at its nickel mines. Why would they be needed?

The jewellery shop experience added to a geological theory that the mineralisation around Kambalda extended well under the crusty white surface of Lake Lefroy which was at the time home to an unusual yacht club that raced three-wheeled yachts across the dry lake.

In time, the lake revealed a number of well disguised nickel deposits before also revealing a number of high-grade gold deposits that led to WMC developing its world class St Ives gold division that was later sold to the South African mine Gold Fields.

Most of the mines worked by St Ives lie along a major crack in the earth’s surface known as the Boulder-Lefroy fault.

Lefroy Exploration’s primary asset is a large tenement position with a western border about 10km from the fault, and a number of mines worked over the past 20 years by St Ives, including Revenge, Victory and Defiance – all named after Nelsons fleet at the battle of Trafalgar.

Of equal interest is a second gold region which abuts the eastern border of Lefroy’s land holding with a series of mines on the Mount Monger fault being worked by Silver Lake Resources which also has a processing plant at Salt Creek.

It isn’t hard for an amateur investor with an interest in exploration history to look at the region and see why the old-timers who discovered the Kalgoorlie goldfield 126 years ago failed to find anything at Lake Lefroy. There are few rock outcrops – the land is far too inhospitable.

WMC’s nickel and gold discoveries under the lake changed that. While the surface of the lake remains a barrier it is possible with modern tools to assemble a picture of the deeper rock units, which is what Lefroy has been doing and why it started drilling at Lucky Strike.

The latest campaign of 15 reverse circulation holes was completed last month at Lucky Strike with assays (lab tests) scheduled to be reported soon.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Apart from being in the right location at a good time to be looking for gold, there is another aspect to Lefroy which makes it an interesting company — the high-profile board.

Lefroy is chaired by Gordon Galt, a former chief executive of Newcrest and a founder of the resource-fund management specialist Taurus.

Lefroy chief executive, Wade Johnson, is a former WA exploration manager for the big US goldminer Newmont.

Finding people with the background of Galt and Johnson is unusual for a company with a 15c share price and a market capitalisation of just $7 million — barely enough to buy a house in Woollahra or Toorak.

Very thinly-traded Lefroy peaked at 21c last September before sliding down to 12c earlier this month.

But a 3c increase to 15c — shortly after that low point was reached — possibly points to growing interest in the Lake Lefroy drilling results.

It’s the history, location and people which makes Lefroy an explorer with potential – that might become a bit clearer when the latest assays are reported.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.