Why Andromeda is all fired up about its Great White kaolin project

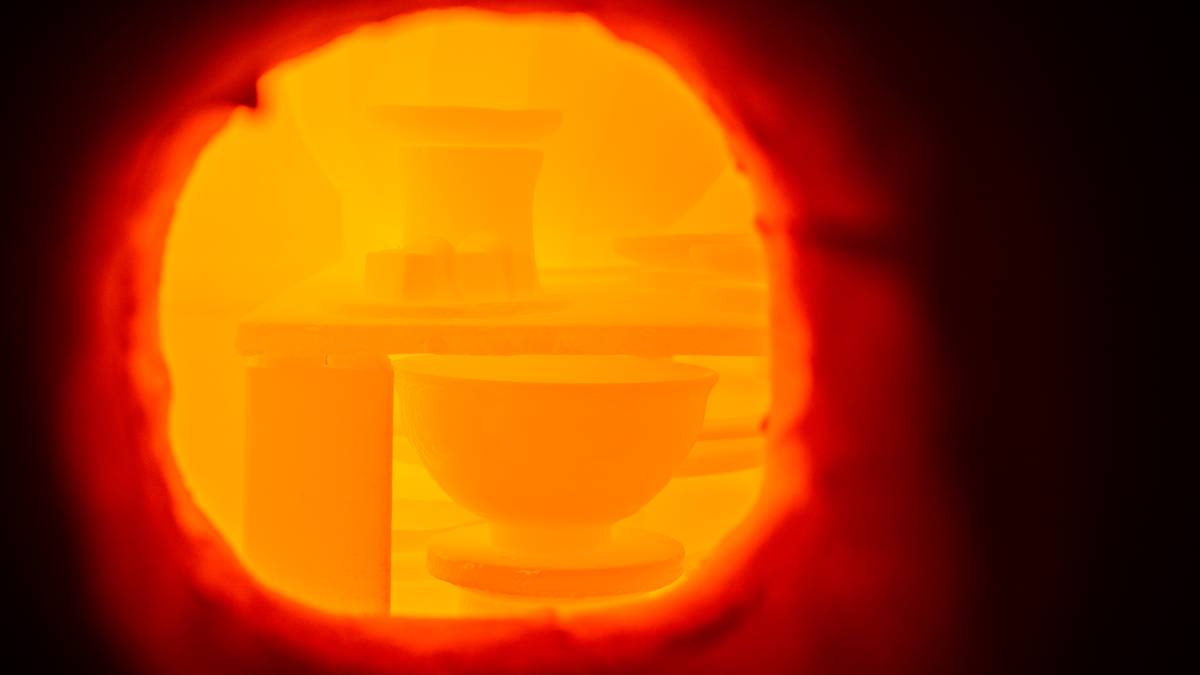

The global kaolin market is heating up. Pic via Getty Images

- Once overlooked, kaolin is now attracting serious market interest

- Andromeda’s near-production Great White project is well positioned to address anticipated supply shortfalls once operational.

- We caught up with Miguel Galindo, an independent non-executive director at Andromeda, to get his market outlook

With demand climbing across global manufacturing hubs for luxury surfaces like sintered stone, ceramics and premium tableware, kaolin – a soft, naturally occurring industrial mineral – is quietly becoming a highly sought after commodity.

Global kaolin production in 2023 was around 40–45 million tonnes, but only a small portion, under 5%, qualifies for use in high-performance ceramic applications.

While demand for lower-grade kaolin remains stable, the momentum is in high-purity, high-brightness kaolin in key markets like Asia and Europe where advanced ceramics and engineered materials are on the rise thanks to growing consumer trends towards large-format tiles and countertops.

Yet, declining reserves and rising geopolitical tensions are limiting the availability of high-quality supply, driving up prices and prompting manufacturers to become more selective in sourcing.

Australia isn’t typically considered a leading player in the kaolin market but with Andromeda Metals’ (ASX:ADN) near-production Great White deposit, that could soon change.

The company’s project is backed by 15.1Mt in high-grade ore reserves and has customers lined up with 100% of the planned capacity for Stage1A+ by four binding off-take agreements.

Lab work using kaolin from the project has also demonstrated the technical feasibility of producing HPA, validating the company’s flow sheet design.

More recently, investors demonstrated their confidence in Great White by backing a $5m share placement to help fund early works, advance plant design and engineering along with technical, financial and legal activities to support the funding process at the project.

Stockhead sat down with Andromeda’s non-executive director Miguel Galindo to get his take on the Great White project, the wider kaolin market and Andromeda’s potential to reposition Australia on the global stage.

What makes Andromeda’s Great White project unique in terms of its characteristics when compared to others around the world?

“The Great White Project is one of the few kaolin deposits globally capable of producing ultra-high purity kaolin with extremely low levels of iron and titanium – key traits for top-tier ceramic applications.

“Its outstanding whiteness and firing consistency make it ideally suited for premium porcelain tiles, ceramic wall tiles, sintered stone and fine tableware.

“Importantly, the deposit contains halloysite, a rare tubular form of kaolin, that adds distinct value in the high-end tableware segment by enhancing the manufacturing process and final finish of products.”

The company is currently working towards final approvals and FID for Stage 1A+; what is your expected construction and production timeline?

“The Great White Project is development-ready, with all key approvals received to commence construction.

“To support a Final Investment Decision being made, a project funding process is currently underway. In April, Andromeda entered exclusive negotiations with Merricks Capital for a debt-financing facility of up to $75 million.

“Subject to a positive Final Investment Decision, we expect to commence construction in the second half of this year, with a construction period of 12 months until commissioning of the first stage producing 55,000 tonnes of annual production, and a further three months for commissioning for an additional 45,000 tonnes.

“This positions us to initiate production and first deliveries by mid-to-late next year. Our development approach through Stage 1A+ is modular and market-driven, allowing flexibility in scaling production to align with market demand.”

Andromeda has offtake agreements lined up with Traxys, IberoClays, Plantan Yamada and Foashan Goaming – but what will the company’s kaolin primarily be used for?

“Our kaolin is targeted at high-performance ceramic applications, including porcelain and ceramic wall tiles, sintered stone and tableware.

“These markets require very high brightness, whiteness, and consistency, and our product delivers precisely that – the halloysite component is particularly prized in fine tableware manufacturing due to its contribution to improved forming during manufacture and the final finish of the product.

“Our goal is to serve ceramic producers who demand the highest standards – many of whom are based in or influenced by Europe.

“For example, IberoClays is based in Spain and formulates mixtures for companies that create high-end ceramics tiles and countertops. While Plantan Yamada is a Japanese manufacturer and exporter of high-quality porcelain tableware products.”

Who are the major global producers of kaolin (by country) and where does Europe factor into it?

“Leading producers include the United States, Brazil, China, the UK and Ukraine.

“Each country serves different markets and offers varying grades – the US is dominant in production of kaolin used in industrial processes and for making paper, while kaolin from Brazil and China is used to serve ceramics manufacturers. Ukraine has historically been a significant supplier of high-grade ceramic kaolin to Europe.

“Europe, particularly Spain and Italy, plays a central role not only as a consumer of high-quality kaolin, but also as a global trendsetter in the ceramics industry.

“These countries are home to some of the most advanced ceramic manufacturers and equipment producers, whose standards and innovations influence product design and production technologies worldwide.

“Securing a presence in the European tile market is therefore strategic – not just for sales, but for visibility, credibility and long-term growth in the premium ceramics sector.”

Are there supply gaps in the market given a large part of Ukraine’s resources has fallen under Russian occupation?

“Yes – Ukraine has long been a critical supplier of kaolin for European ceramics.

“The ongoing conflict has compromised both the physical supply and logistical routes, resulting in almost all of its production being removed from the market.

“This is creating supply gaps that have forced manufacturers to seek new, reliable alternatives – particularly those outside the conflict zone and with similar quality specifications.

How can Andromeda help plug those supply gaps?

“Andromeda offers a stable, transparent, and ESG-compliant alternative source of high-grade kaolin.

“Located in South Australia, the Great White Project provides a long-term, scalable supply that meets the purity and consistency standards sought by European and Asian ceramic producers.

“Our existing partnerships and distribution agreements are already aligning us with the supply needs of ceramic leaders looking to de-risk their sourcing strategies.”

In addition to being a non-executive director of Andromeda, Miguel Galindo is the founder and executive director of Galesk Consultancy SLU, an independent business consultancy specialised on industrial raw materials for the ceramics, glass, fertilizers and electric batteries’ sectors, with clients across Europe, America, Asia and Australia.

His global executive experience spans more than 30 years of experience in general management, operations, marketing, and sales in multinational companies in the natural resources sector, primarily at the Minerals Division of the Rio Tinto Group.

At Stockhead, we tell it like it is. While Andromeda Metals is a Stockhead advertiser, it did not sponsor this article.

The views, information, or opinions expressed in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.