Why African gold still glitters for this Bridge Street guru

Pic: John W Banagan / Stone via Getty Images

Gold’s recent subdued run with investors may well present a big buying opportunity, according to Bridge Street Capital analyst Chris Baker.

The yellow metal was all the rage in the small cap space earlier in the year but has since seen its fortunes dip as attentions have seemingly turned elsewhere.

It’s a trend that comes despite sustained price strength – after hitting peaks above US$2000 per ounce late last year the commodity has hovered in the US$1700-$1800/oz range for the majority of 2021.

Baker said he felt the shift of investor focus was largely on the back of inflation concerns, with producers locally coming up against higher costs thanks to increased wages and prices, narrowed margins and profit disappointment.

“Despite this, when you look at it the A$ gold price is still strong, which is great for producers, and they are still enjoying strong cashflows,” he told Stockhead.

“When I look at the big picture, one of the things that strikes me is we’re in a relatively high inflation environment with very low interest rates, and the thing that always seems to correlate with gold is negative real interest rates.

“How else do you retain asset value? A lot of people use gold in that sort of environment to do exactly that.

“You have to wonder with what’s happening with COVID, how the second time around with the Delta variant is going to start to impact economies.

“We may see lower real interest rates for longer than we thought, which could be at the very least supportive for gold, and quite possibly encouraging for another gold rally.

“In the meantime, everyone seems to have gone ‘gold stocks? Don’t care. Gold explorers? Super don’t care’.

“A lot of these stocks have lagged broader equity markets, so I think it’s time to have a look at some of these little guys.”

Baker said there were three African gold explorers on Bridge Street’s radar screens that he felt had compelling value packed in.

Oklo Resources (ASX:OKU)

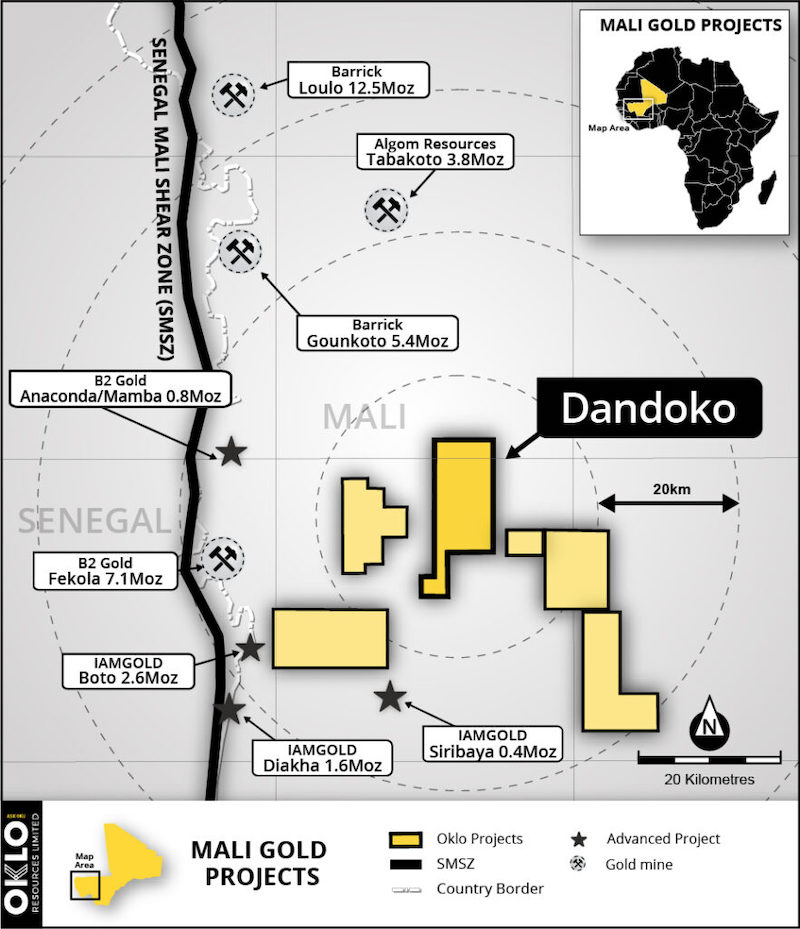

Oklo’s recent work at its flagship Dandoko project in West Mali has focused on growing the scale and grade of its holdings, and recent results have proven extremely positive.

The project sits about 30km from B2 Gold’s behemoth 7.1Moz Fekola deposit and 50km south of Barrick gold’s 18Moz Loulo/Gounkoto complex. The Senegal-Mali Shear Zone is a world class gold province with an endowment of over 60 million ounces of gold.

Handy neighbours to have.

Baker said the combination of region, quality of team and cash in the bank meant Oklo was a company worth a look.

“I think these guys are more than likely close to starting to have a look at a scoping study and doing environmental work,” he said.

“They’re not a point where they’d be pushing the button on a development yet, but they’ll be starting to look at what they need to do to get a project going while also delivering some good drill results.”

Recent drilling at the nearby Disse prospect hit gold at almost 40 grams per tonne suggesting they may be on to a new high grade ore zone.

Gold was also discovered at Sari prospect, where the company had success with follow-up drilling announced this week.

Meanwhile, step-out drilling from the existing 668,500oz Seko deposit – much of which sits in measured and indicated categories – has highlighted potential for additional resource here.

Importantly the grade of the Seko deposits is quite high. Baker said there was potential to start a mine on the back of grades of over 2 grams per tonne.

“I think it’s just a matter of time here. It’s a question of whether it’s a modest operation that they can bring into production – say at 120 to 150,000 ounces per year – or whether they can identify a multiple million ounce deposit.

“That’s obviously the success case, and they haven’t done it. Yet.”

Marvel Gold (ASX:MVL)

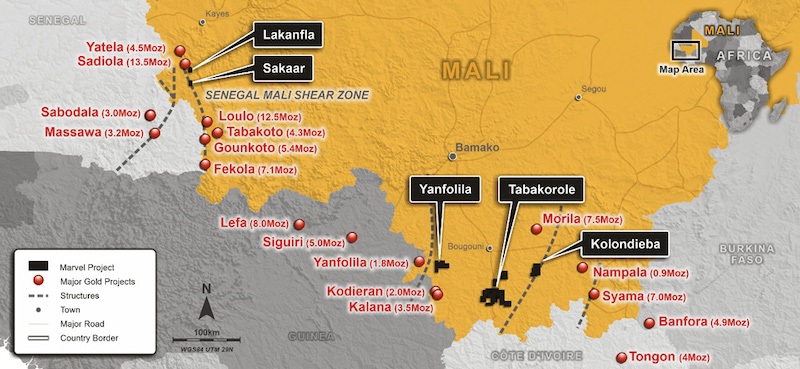

Marvel is sitting on 910,000oz of gold at its Tabakorole project in southern Mali, in the region of giants including Firefinch’s 7.5Moz Morila gold mine and Resolute Mining’s 7Moz Syama gold mine.

The deposit is currently grading 1.2 grams per tonne gold.

“It’s a low grade, but it’s also a relatively low strip ratio, and recent drilling has indicated some really good potential upside to that resource,” Baker said.

“You would think the next resource, whenever that is, would come in above a million ounces, and in conjunction they’re consolidating an enormous land package in the area.

“A lot of the basic groundwork is being done – things like geochem, a lot of geophysics, really for the first time in the area.

“I like it because it hasn’t had the eyes picked out of it by other gold producers, and it’s in a region where there’s satellite orebodies potentially waiting to be found.”

The other consideration in Marvel’s favour, according to Baker, is its Chilalo graphite project in Tanzania.

Chilalo is currently being spun out into a new company called Evolution Energy, in which Marvel will hold a 31% stake.

“This is a high-quality project, with a granted mining lease and a compete feasibility study and I believe it’s currently in there for very little,” Baker said.

“Several of the Tanzanian graphite companies are valued at multiples of Marvel, so you are either getting the gold for free, or the graphite for free.”

Turaco Gold (ASX:TCG, formerly Manas Resources ASX:MSR)

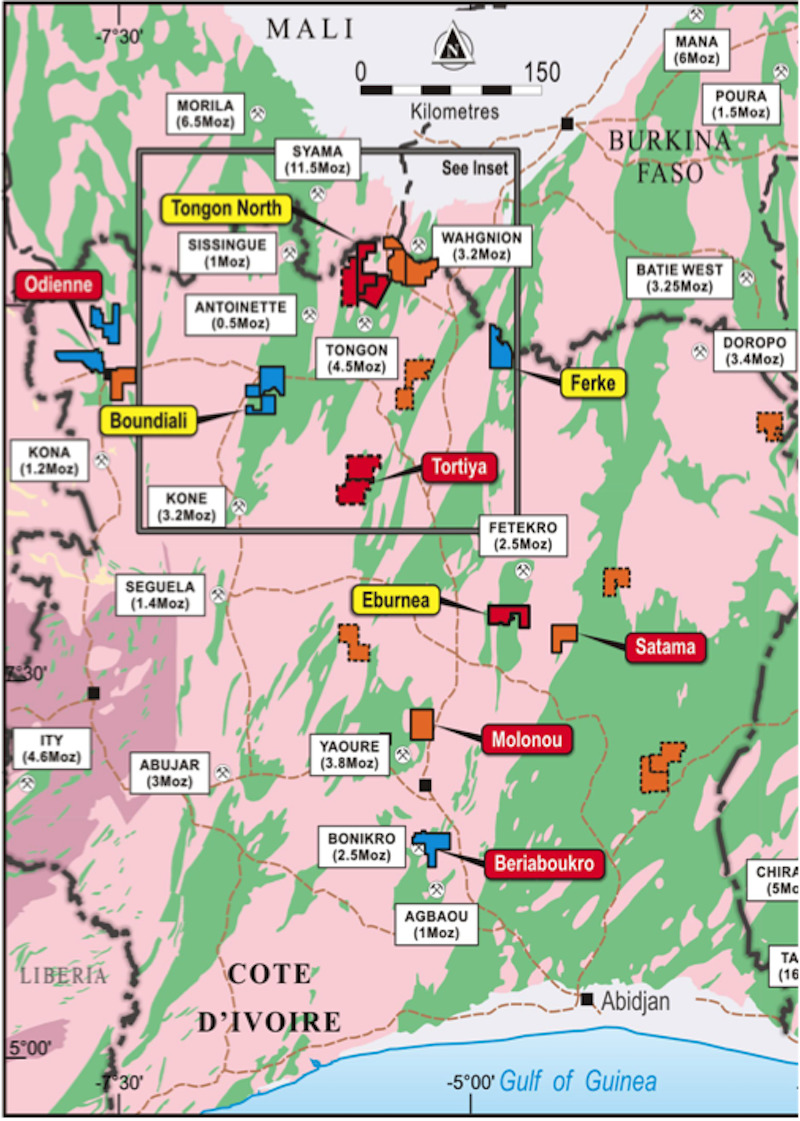

The owner of the Boundiali, Ferke and Tongon North gold projects in Cote d’ivoire, Turaco is operating in a region Baker believes has been largely ignored by the majors.

In fact, Turaco is now the largest exploration tenement holder in the country, with more than 8400km2 to work with and a management team helmed by former Exore Resources managing director Justin Tremain.

The exploration package was this year acquired from Resolute Mining (ASX:RSG) and Predictive Discovery (ASX:PDI) – PDI maintains an 11% stake in Boundiali and Ferke, while Resolute remains a significant shareholder in the junior with its general manager exploration Bruce Mowat a representative on the Turaco board.

Mowat oversaw the Resolute projects over several years previously.

The company’s three projects are located on the Birimian greenstone belt near a number of major mines and discoveries.

Check out the map.

Of these, the current exploration focus is Boundiali, where a gold-in-soil anomaly of more than 6km has been detected and is currently an exploration focus.

“This is in a highly exciting part of West Africa, it’s got management with runs on the board and it’s in an area which is highly prospective but is very underexplored,” Baker said.

“I think it’s a good story to follow.”

Drilling is about to start.

“There’s usually a bit of a wet season in West Africa, so many places tend to quieten down over August and September,” he said.

“When there’s no information, everyone gets bored – it’s a great time to be buying with plenty of activity ahead.”

At Stockhead, we tell it like it is. While Oklo is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.