Why a coming collapse of rutile supply will make the titanium feedstock a market to watch

Picture: Getty Images

- Iluka Resources shareholders will vote on the demerger of the Sierra Rutile business into its own ASX-listed company on Friday

- Sierra Rutile’s head honchos say the demerger will pave the way for the development of the brownfields Sembehun mine

- Natural rutile supply is expected to fall off a virtual cliff in the coming years without new developments

Commodities have done it tough as of late, and miners are feeling the heat.

Could there be some markets built to escape the volatility befalling the mining sector right now?

The newest and largest natural rutile producer coming to the ASX, Iluka Resources (ASX::ILU) spin-off Sierra Rutile (ASX:SRX) says it could be the commodity to best ride out the storm of a potential recession.

While prices for LME-traded base metals like copper, zinc and aluminium have fallen precipitously of late, mineral sands pricing has continued to increase.

Natural rutile is a high quality titanium feedstock, used in markets like pigment, aerospace and welding.

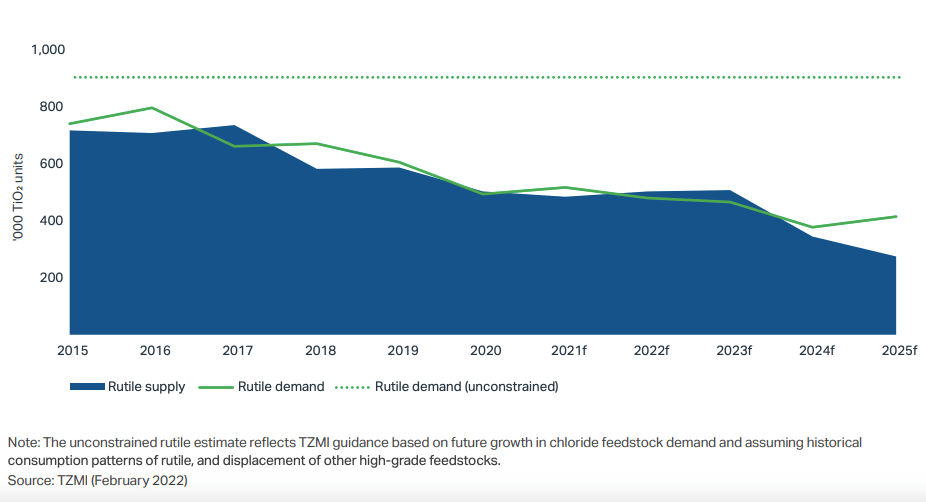

It is also an extremely tight market, with a dearth of discoveries in recent years likely to see global supply fall off a virtual cliff from ~800,000tpa in 2017 to 450,000tpa in 2025 despite continued demand for the product.

“The natural rutile supply graph is about as bad as any supply graph I’ve seen,” Sierra Rutile’s finance director Martin Alciaturi says.

“You can see it going from 800,000t down to about 450,000t in not that many years, that’s about as bad as I’ve seen for just about any commodity.

“We currently represent in round numbers around 150,000 tonnes just to make the math simpler.

“If you look at where we are now it’s around 600,000t, so 150,000t is the best part of a quarter of that natural rutile supply globally.

“It’s expected to tail away, so it’s a high value product that’s becoming more and more scarce.”

Throw your diamonds in the sky if you feel the vibe, as Kanye says.

Rutile prices rising

Iluka paid US$330m for Sierra Rutile in 2015, but slashed its value by US$290m just four years later as tough market conditions bit.

When Covid hit in 2020 the Sierra Leone government shut its borders for six months to protect one of the world’s most fragile medical systems.

Unable to find a suitable buyer or investment partner for its unloved asset, Iluka issued a notice of suspension to the Sierra Leone government, threatening the closure of the tiny West African nation’s largest private sector employer, responsible for up to 5% of GDP.

When former BHP executive Theuns de Bruyn became CEO in early 2021, they instead engineered a major turnaround operation.

Costs have fallen from US$1134/t on production of 26,000t in the March quarter of 2021 to US$893/t in the March quarter this year on production of 35,000t.

Natural rutile pricing has exploded, with Sierra Rutile collecting US$1195/t in Q1 2021 and US$1459/t in March this year, with margins going from a razor thin US$61/t to very healthy US$562/t.

For the last year the business hasn’t needed to borrow any money from its parent Iluka, which is demerging Sierra Rutile into its own company with the same initial shareholder base as it focuses its attention on building a rare earths refinery in Western Australia.

Prices have gone up again in the most recent quarter, De Bruyn says, with the absence of Ukrainian supply from the market exacerbating shortages.

“With the current supply there’s some difficult jurisdictions, the Ukraine and Russia War (for example),” De Bruyn said.

“The mineral sands business in Ukraine, they’re struggling. And then the issues in South Africa with RBM (Rio Tinto’s Richards Bay Minerals) and the harbour does have impact on the rutile and the slag.

“(Ukraine) doesn’t affect the investment case, but it does affect the market and I think it will affect the long term pricing of rutile.”

Sierra Rutile is one of the few companies that is positioned to step into that gap.

“I think we’ve had in the last … two or three months, two or three spot sales to their customers (for) rutile and I think Ukraine produces about 40-50,000 tonnes of rutile, under correction.

“And that’s where we’ve seen a spot sale of the ilmenite and two spot sales of SGR (standard grade rutile) as well going to some of their customers now.

“We see the market fundamentals for the pricing being strong in the short term. It’s continuing, we had an increase now from the last quarter to this quarter, I don’t think there’s a reason not to see it.”

Building Sembehun

The demerger will be voted on by Iluka shareholders on Friday, but Alciaturi and De Bruyn believe they will be onside with the deal, which has been supported by independent expert Deloitte.

On the start of trade in early August, SRX would have US$20.7m in net cash and a solid base to sustain the Sierra Rutile business, which was formed in the 1970s and has its roots in the discovery of titanium bearing mineral sands in southwestern Sierra Leone a century ago.

It produces around 144,000tpa at the Area One mine right now, which will run out to 2025 on current reserves.

De Bruyn thinks the conversion of indicated resources to reserves at the Pejebu and Ndendmoia deposits should extend its life to 2027.

That would provide a runway for the phased development of Sierra Rutile’s main game, the 13-year Sembehun development.

Located 30km from Area One, Sembehun is one of the few new rutile deposits that could be developed globally in the coming years.

A PFS by Hatch this year placed a US$337 million capex estimate on the project, including US$284m for its first phase and US$52m for second phase expansion.

Inclusive of zircon co-product credits, cash costs could be as low as US$535 per tonne of rutile.

A DFS is expected to begin later this year, with a final investment decision in 2023 and phase 1 commissioning in 2025.

From 2028 Sembehun would be in steady state production and provide all of the feed for SRX’s 175,000tpa plant.

Carbon footprint

Natural rutile is not the only way to produce titanium.

It can also be extracted from a lower quality mineral sand ilmenite through the Becher process developed in Western Australia to produce synthetic rutile.

But that uses large kilns, which add significant environmental and cost pressures compared to natural rutile.

De Bruyn says the world needs new pure play natural rutile mines and companies at the moment, with attitudes towards CO2 emissions in mining and manufacturing rapidly changing.

“I think where the world is currently going with COP26, the carbon footprint natural rutile has just got a significantly lower carbon footprint than synthetic rutile,” De Bruyn said.

“And I think where the world’s going to go into the future, everybody would prefer natural rutile than synthetic rutile.”

Where to find rutile on the ASX

Given much of the world’s natural rutile supply is produced by vertically integrated industrial giants like Tronox, Sierra Rutile will live largely alone as a listed producer of the titanium feedstock.

It boasts 8.1Mt in natural rutile resources, including 6Mt at Sembehun.

In fact there are very few publicly published natural rutile resources across the industry.

The most notable emerging name in the sector is Sovereign Metals (ASX:SVM), which boasts what is now the largest natural rutile deposit ever discovered at Kasiya in Malawi.

Kasiya boasts 1.8Bt of natural rutile resources at a grade of 1.01% rutile for 18Mt of contained rutile, along with 23Mt of flake graphite.

After releasing an expanded scoping study on Kasiya last month, Sovereign is moving to a PFS on a mine it says could deliver steady state production of 265,000t rutile and 170,000t graphite over a 25-year mine life.

Over in Kenya Base Resources (ASX:BSE) owns the Kwale mineral sands operation where it is developing the Bumamani deposit to extend its limited mine life into 2024.

Base produces rutile and zircon as by-products of a larger ilmenite resource.

Iluka itself owns the Balranald mineral sands deposit in New South Wales, which contains around 2Mt of rutile, but will require a novel underground mining technique developed in-house at Iluka to be viable.

A number of other companies including Image Resources (ASX:IMA), Strandline (ASX:STA) and Sheffield (ASX:SFX) boast substantial mineral sands resources where natural rutile is a small component of a larger deposit.

Mineral Sands share prices today:

At Stockhead, we tell it like it is. While Sovereign Metals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.