Who’s hunting for the next supersized SEDEX zinc-lead discovery?

Pic: John W Banagan / Stone via Getty Images

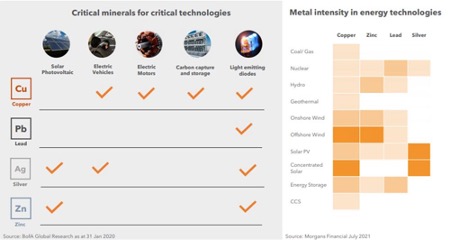

Sedimentary exhalative deposits (SEDEX) are monstrous accumulations of zinc and lead, originally formed by the discharge of metal-bearing fluids onto ancient seafloors.

These super giant Tier 1 deposits account for 25% of global zinc and lead production, and six of the 10 largest active zinc mines globally.

They are also an important source of silver and copper.

Famous SEDEX deposits include Red Dog (Alaska), McArthur River (Northern Territory), and Mount Isa (Queensland).

These things can be very lucrative.

Teck Resources’ (NYSE:TECK) ‘Red Dog’ operation — about 170km north of the Arctic Circle in northwest Alaska — is one of the world’s largest zinc mines.

In 2020, it made a $US513m gross profit on the sale of 551,000t of concentrates.

Most recently, Rumble Resources (ASX:RTR) announced that the large scale zinc-lead-silver system emerging at ‘Earaheedy’ could be SEDEX.

The discovery at the ‘Chinook’ prospect sparked a 320% increase in the company’s share price, but Rumble believes it is “just at the start of uncovering [its] scale”.

“These results to date, only partially testing 2km of the 45km of prospective mineralised strike, have highlighted the potential to delineate multiple very large-scale Zinc-Lead SEDEX style (Tier 1) deposits throughout the entire Earaheedy Project,” the company said in June.

In late August, a massive drilling program was expanded to 40,000m to find the edges of the 3km by 1.8km ‘Chinook’ deposit, as well as push down towards the ‘Magazine’ and ‘Navajoh’ prospects ~10 – 12km to the southeast.

Critical Resources: hunting for the next SEDEX deposit

Located in the prolific NSW base-metals region, Critical Resources’ (ASX:CRR) Halls Peak has potential to host a large scale SEDEX style deposit of its own.

Halls Peak sits in the same geological setting as the McArthur River.

Historical mining was shallow, and exploration rarely went beyond 200m. Critical believes the big prize is at depth, Chief Executive Officer Alex Biggs says.

“There’s been talk about it being a large scale SEDEX deposit before, but I guess what stopped the work happening is that people didn’t think deep enough,” he says.

“They only went to 100m, 200m. We are looking at 400m, 500m – and even deeper than that.”

“You look at deposits like MacArthur River, Cannington, Mount Isa – certainly structurally Halls Peak has all those indications, and of course, near- surface high grade mineralisation.”

This near-surface stuff is impressive on its own. A recent drill program in 2016 hit a highlight:

- 37.2m @ 8.7% zinc, 3.0% lead, 85g/t silver, 1.4% copper

- 11.3m @ 15.18% zinc, 8.02% lead, 597g/t silver, 1.61% copper, and

- 11.2m @ 19.71% zinc, 10.77 % lead, 134.96 g/t silver, 0.8% copper.

An upcoming 17-hole ~4,000m drilling program will target base-metal hosted massive sulphide mineralisation at the ‘Gibson’ and ‘Sunnyside’ prospects.

A bullish outlook for lead and zinc

Glencore says the electrification, industrialisation and urbanisation of developing economies supports demand growth for zinc, due to its anti-corrosive properties and use as an alloy in materials used in cars, electrical components, and household fixtures.

“The major transformation of the global energy system necessary to achieve the goals of the Paris Agreement is zinc’s use in offshore wind-energy generating facilities,” it says.

“These scenarios show zinc demand growing to 150% of 2019 levels by 2035 and to 200% by 2050 on 2019 levels.”

Lead – 80% of which is used in lead-acid batteries – will benefit as demand rebounds quickly post-pandemic.

Meanwhile, world lead mine supply is forecast to stay at pre-pandemic levels for a couple of years.

Fitch Solutions says the global market is likely to slip into a marginal production deficit of 8,000t in 2027, widening to 439,000 t by 2030.

The use of refined lead in the global automotive industry will continue to grow, despite tightening environmental regulations and increasing use of lithium batteries in electric vehicles, it says.

Critical Resources are bullish on where zinc and lead are going, Biggs says.

“There is a lot of expectation on post-COVID global recovery, which will need a lot of metal,” he says.

“We are at the start of a new commodity super cycle – probably only the third one [since in the 1970s].”

This article was developed in collaboration with Critical Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.