Who made the gains in September? Here are the top ASX resources winners

A host of resources stocks chasing gold and critical minerals led the pack in September. Pic: Getty Images

- Precious metals boom powers top resources stocks in September

- Antimony hunter Red Mountain Mining takes top spot for the biggest monthly stock gain

- Dreadnought Resources and Felix Gold also make the podium

With bullion climbing to a new end of month high, gold stocks unsurprisingly dominated in September. The precious metal surged more than 11% as the US Government shutdown sent prices soaring to record highs of close to US$3850/oz.

But it was an emerging antimony (and gold) player which was the biggest individual gainer, with Red Mountain Mining (ASX:RMX) up 338%.

The big move came after RMX secured 87 claims in Utah’s Antimony Canyon district and the Yellow Pine project in Idaho’s historic Stibnite Mining District, placing it next door to two of the most exciting developments in the US’ battle to restart production of the military metal – Trigg Minerals’ (ASX:TMG) Antimony Canyon and Perpetua Resources’ Stibnite mine.

RMX also released some interesting gold grades from channel sampling at its Fry Lake project in Canada – up to 25.1g/t, confirming high-grade mineralisation across three main vein prospects.

Gold comes second and third too

Precious metals explorer Dreadnought Resources (ASX:DRE) was in second place, up a respectable 242% for the month, with its Mangaroon project returning up to 20.5g/t at the Star of Mangaroon prospect.

A 36% increased in measured and indicated resources at the deposit caught the eye, with Star of Mangaroon now containing 75,600t at a very high grade 11.1g/t for 27,000oz.

The company is confident that there remain areas at the historical mine that are highly underexplored and could present a substantial opportunity to host more gold mineralisation. Then there’s the rare earths opportunity, with DRE company hitting 140m at 0.9% TREO from 307m at the Gifford Creek project’s Stinger niobium deposit.

That was a surprise given it came in holes drilled for metallurgical testing of known oxide mineralisation in twinned holes and intercepted a type of mineralisation not previously seen at the project – a big deal given how hot the West is right now for new sources of future-facing rare earths.

Felix Gold (ASX:FXG) rounds out the top three, up 222%, after a wave of momentum around its Treasure Creek project in Alaska. The company thinks ultra-high grade surface results for antimony, supported by assays from drilling into fresh rock and the uncovering of massive stibnite vains at surface, could help it head into production by Q4 2025 or Q1 2026 should Felix secure approvals.

Those exploration results from the NW Array prospect came after a visit to the Treasure Creek site by officials from key US departments.

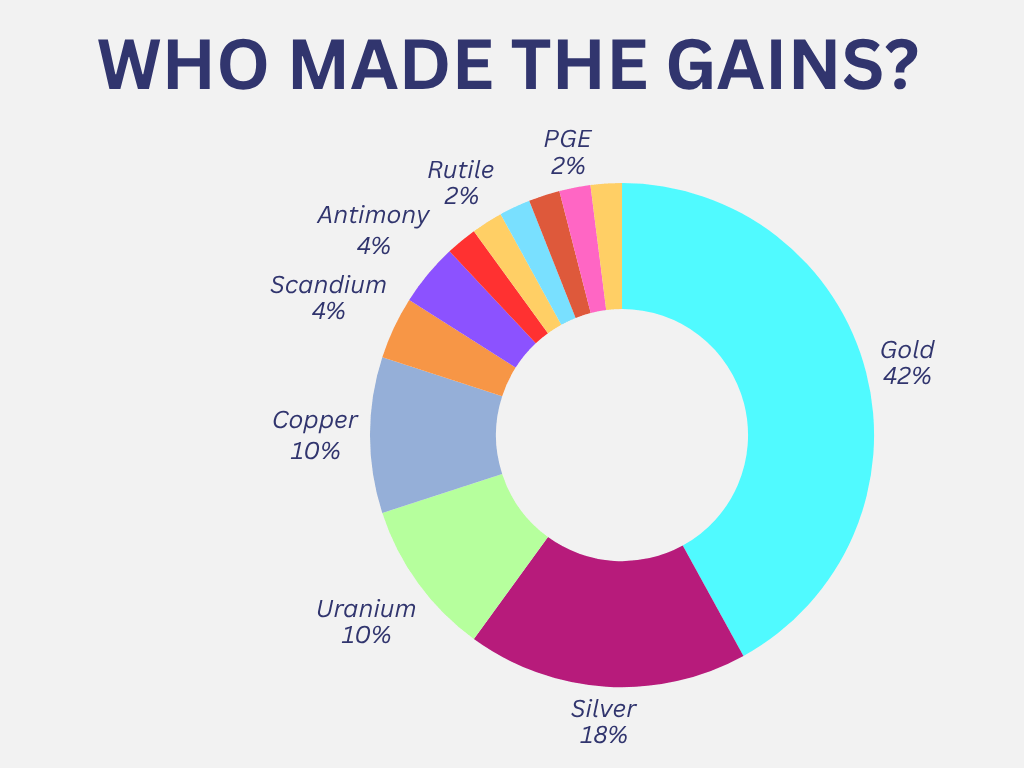

What our top gainers were exploring for in September

Here are the top 50 ASX resources stocks for the month of September>>>

| Security | Description | Last | %Mth | MktCap |

|---|---|---|---|---|

| RMX | Red Mount Min Ltd | 0.035 | 338% | $22,438,067 |

| DRE | Dreadnought Resources Ltd | 0.041 | 242% | $208,259,500 |

| FXG | Felix Gold Limited | 0.58 | 222% | $254,993,604 |

| RNX | Renegade Exploration | 0.0095 | 217% | $19,494,286 |

| CXU | Cauldron Energy Ltd | 0.023 | 207% | $41,150,703 |

| SRL | Sunrise | 5.35 | 207% | $658,290,766 |

| KGD | Kula Gold Limited | 0.027 | 200% | $31,092,312 |

| WIN | WIN Metals | 0.056 | 195% | $38,504,146 |

| SGQ | St George Min Ltd | 0.125 | 178% | $365,506,702 |

| AUZ | Australian Mines Ltd | 0.022 | 175% | $39,852,202 |

| FLG | Flagship Min Ltd | 0.145 | 174% | $36,359,804 |

| BML | Boab Metals Ltd | 0.46 | 163% | $128,445,082 |

| RCM | Rapid Critical | 0.08 | 158% | $63,881,503 |

| ZNC | Zenith Minerals Ltd | 0.145 | 142% | $76,771,047 |

| AVM | Advance Metals Ltd | 0.105 | 139% | $31,242,856 |

| ILT | Iltani Resources Lim | 0.5 | 133% | $32,970,401 |

| KRR | King River Resources | 0.016 | 129% | $23,417,393 |

| TOE | Toro Energy Limited | 0.395 | 119% | $47,511,330 |

| POD | Podium Minerals | 0.082 | 116% | $65,543,791 |

| AIS | Aeris Resources Ltd | 0.485 | 116% | $471,139,752 |

| MDI | Middle Island Res | 0.043 | 115% | $12,609,061 |

| TM1 | Terra Metals Limited | 0.17 | 110% | $106,321,532 |

| IR1 | Irismetals | 0.205 | 107% | $47,416,938 |

| FME | Future Metals NL | 0.037 | 106% | $35,460,830 |

| MC2 | Marimaca Copper Corp | 12.31 | 105% | $260,582,549 |

| PVW | PVW Res Ltd | 0.041 | 105% | $10,202,070 |

| FML | Focus Minerals Ltd | 1.065 | 101% | $305,184,957 |

| GES | Genesis Resources | 0.012 | 100% | $9,394,096 |

| LRD | Lordresourceslimited | 0.05 | 100% | $7,750,101 |

| MOM | Moab Minerals Ltd | 0.002 | 100% | $3,749,332 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | $14,466,230 |

| NES | Nelson Resources. | 0.006 | 100% | $13,031,566 |

| ORN | Orion Minerals Ltd | 0.02 | 100% | $150,048,037 |

| MI6 | Minerals260Limited | 0.25 | 100% | $516,833,333 |

| FUN | Fortuna Metals Ltd | 0.12 | 97% | $22,481,290 |

| MMA | Maronanmetalslimited | 0.46 | 96% | $92,576,300 |

| SNX | Sierra Nevada Gold | 0.062 | 94% | $10,208,865 |

| KOB | Kobaresourceslimited | 0.057 | 90% | $11,324,280 |

| PLG | Pearlgullironlimited | 0.019 | 90% | $3,886,294 |

| T92 | Terra Critical | 0.089 | 89% | $13,045,224 |

| IVR | Investigator Res Ltd | 0.049 | 88% | $84,902,933 |

| GBZ | GBM Rsources Ltd | 0.058 | 87% | $225,111,453 |

| TMG | Trigg Minerals Ltd | 0.175 | 84% | $199,807,214 |

| NNL | Nordicresourcesltd | 0.165 | 83% | $53,814,087 |

| USL | Unico Silver Limited | 0.715 | 83% | $364,874,155 |

| EG1 | Evergreenlithium | 0.042 | 83% | $11,043,220 |

| LKY | Locksleyresources | 0.47 | 81% | $129,437,512 |

| TEM | Tempest Minerals | 0.009 | 80% | $9,916,155 |

| SVL | Silver Mines Limited | 0.215 | 79% | $457,658,260 |

| AMU | American Uranium | 0.24 | 78% | $25,708,143 |

Small Cap Standouts

Renegade Exploration (ASX:RNX)

The company is in a trading halt to provide clarification on the status of mining claims staked in California in proximity to the Mountain Pass gold and rare earths project of MP Materials and the Colosseum gold-REE project of Dateline Resources (ASX:DTR).

The 39 claims in the Mustang Project are around 3km east of Colosseum and about 10km northeast of Mountain Pass, and are in the southern end of the Walker Lane Trend.

“The potential upside is these new Mountain Pass permits have fault structures and outcrop, which should enable relatively easy assessment of gold, rare earths and other minerals,” RNX chairman Robert Kirtlan said after announcing the pick-up.

“Field work will commence almost immediately to verify and confirm the geology of the project area and a ground magnetic program is also in train.”

Cauldron Energy (ASX:CXU)

CXU is inking a deal with the world’s fifth largest uranium producer and second largest in-situ recovery uranium producer, Uzbekistan’s national uranium company Navoiyuran, to advance CXU’s Yanrey uranium project in WA with in-situ recovery methods, leveraging Navoiyuran’s expertise accumulated over more than 30 years of developing and operating ISR uranium mines.

Areas of collaboration may include technical assistance in design and operations, future funding, assistance with government advocacy, specialist ISR know-how and technical input into studies.

Yanrey is about 70km south of Onslow and is in a highly prospective, mineral-rich region containing multiple uranium deposits including Manyingee deposit of Paladin Energy.

CXU says Navoiyuran, which has 42 different uranium deposits in its portfolio, isn’t the only major uranium player interested in WA, suggesting the pressure is building for the WA Government to review its mining ban.

Sunrise Energy Metals (ASX:SRL)

The company’s the Syerston project in central NSW is turning plenty of heads in the Western world and particularly in the US.

Syerston is the world’s largest and highest-grade scandium deposit with 19,000t, a fact recognised by the US Export-Import Bank (EXIM) which has provided SRL with a Letter of Interest for potential financing of up to US$67 million ($103m).

This represents around 50% of the estimated development cost and comes with attractive repayment terms of up to 15 years with SRL climbing 38.81% to $4.65, a new high of seven years. The company’s market cap has grown to approximately $520m.

“This Letter of Interest underscores the importance of scandium to the United States, both as a critical component in wireless communications technologies, and advanced alloys supporting the civilian and defence sectors,” co-chariman Robert Friedland said.

“As a key ally of the United States, Australia’s significant endowment of strategic metals positions it to be an important supplier in the future.”

SRL has slightly delayed its feasibility study completion to mid-to-late October 2025 to incorporate substantial new metal inventory data and optimise the mine plan, which should enhance project economics rather than indicate challenges.

Kula Gold (ASX:KGD)

KGD has flagged a high grade – and extensive – niobium soil anomaly at its Wozi project in Malawi.

Soil sampling has returned results over 1% Nb2O5 with the anomaly more than 1.5km in strike length and up to 400m wide at +0.4% Nb2O5.

The company says the low tantalum and uranium ratios suggest there’s good potential for direct reduction to ferro-niobium (FeNb).

“The Wozi Niobium Project offers a strategic, low-cost entry into the critical minerals space, complementing our core focus at Mt Palmer,” MD Ric Dawson said.

“We’ve initiated a targeted RC drill program to quickly assess Wozi’s potential and define its value uplift.

“Subject to results, we’ll consider engaging a specialist rare earths partner to support technical development and subsequently seek the best corporate options to add value to Kula’s shareholders.”

Mt Palmer remains the priority, while Wozi adds a quick high impact value add potential to Kula’s portfolio of projects without diverting significant resources, Dawson said.

St George Mining (ASX:SGQ)

St George Mining has made a new high-grade heavy rare earth and niobium discovery in the previously unexplored eastern portion of its Araxá project in Brazil.

The first batch of assays from reverse circulation drilling in this area outside the existing resource of 40.6Mt at 4.13% TREO returned results such as:

- 48m grading 5.71% total rare earth oxides from a down-hole depth of 2m including 15m at 12.61% TREO from 4m

- 32m at 1.04% niobium pentoxide from 11m including 6m at 2.41% TREO from 11m; and

- 40m at 2.62% TREO and 1.05% Nb2O5 from surface including 8m at 4.38% TREO from 35m.

What makes the new East Araxá discovery particularly exciting for SGQ is that its grades of higher value magnet and heavy rare earths are greater than those in the existing resource.

Zenith Minerals (ASX:ZNC)

The company has entered an agreement with Ida Metal Investments for a $7.65 million strategic placement at 12.75c per share to accelerate drilling on two of its gold projects.

A Perth-based investment company specialising in strategic investments across Australia’s gold sector, Ida Metal has bought in at a 15.9% premium to ZNC’s last closing price on September 23, securing a 10.18% stake in the company.

Managing director Andrew Smith said the landmark $7.65m placement was a significant milestone in advancing its ‘Going for Gold’ strategy at the Dulcie gold project in WA and the Red Mountain project in Queensland.

“It renders the company exceptionally well-funded to continue resource growth at Dulcie beyond the current 300,000-ounce mineral resource and to really get after Red Mountain, which has huge optionality for Zenith shareholders,” he said.

“The strategic placement comes at a pivotal time for the company, enabling us to accelerate exploration efforts at Dulcie ahead of the already-planned 9,000-12,000m resource growth drilling campaign.

“In parallel, we will implement an expedited drilling campaign at Red Mountain, with the aim of completing the expanded program before year-end.”

At Stockhead we tell it like it is. While Red Mountain Mining, Felix Gold, St George Mining and Zenith Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.