Who Made the Gains? Here are the top ASX miners and explorers for July

Pic: PM Images, Stone/ Via Getty Images

- ASX mining/exploration stocks rebound in July, kinda

- Those explorers with exciting tales to tell last month did very well, regardless of commodity

- A closer look at July’s top 5: Cobre, Prospect, Ora Banda, MC Mining and Tyranna

July was a better month for ASX resources stocks, just, although June’s catastrophic losses – compounded by poor months in April and May – set a low bar.

Despite the wider ASX200 posting a 5.2% gain for July the S&P/ASX 200 Resources [XJR] index, which includes the biggest miners on the ASX, still finished flat.

The Betashares Australian Resources Sector ETF recovered last month from a horrid June but remains stuck at late November 2020 levels.

The ETF, which is heavily weighted towards big boys like BHP (ASX:BHP) and Rio (ASX:RIO), is down +12% year-to-date.

But what about the small caps?

The performance of the little guys is driven overwhelmingly by investor sentiment, not profit/loss statements. General market sentiment rebounded strongly in July.

In June only one exploration stock made gains above 100%, and only four made gains above 50%. From there, it tails off rapidly.

In July, there were three small cap resources stocks with gains above 100%, and 21 all up with gains above 50%. Still down from the loose 10-bagger days of yesteryear, but a promising improvement, nonetheless.

More than sentiment, though, was the attraction to individual stories.

Those explorers with exciting tales to tell last month did very well, regardless of commodity.

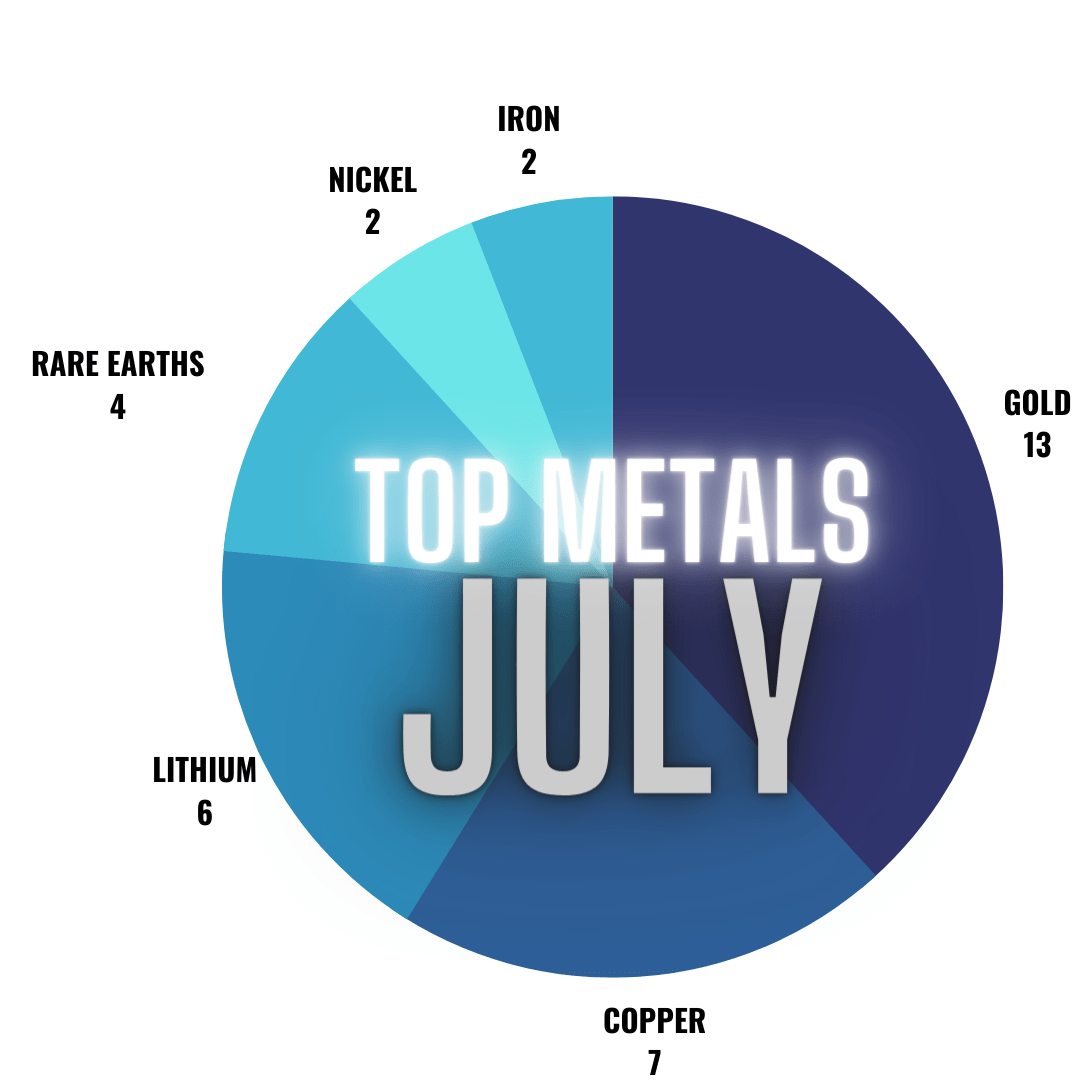

Here’s a breakdown of the six most popular commodities for July:

But as you can see below, it’s nice and diverse.

The top 25 even includes cameos from lesser known, but very cool, elements like rubidium and antimony.

READ: Antimony — One of the most important critical minerals you’ve never heard of

Here are the top 25 ASX resources stocks for the month of July >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| CODE | COMPANY | JULY RETURN % | LAST SHARE PRICE | MARKET CAP | LOOKING FOR |

|---|---|---|---|---|---|

| CBE | Cobre | 231% | 0.086 | $14,225,003 | copper |

| PSC | Prospect Resources | 150% | 0.12 | $55,471,135 | lithium |

| OBM | Ora Banda Mining | 104% | 0.055 | $75,569,302 | gold |

| MCM | MC Mining | 96% | 0.235 | $46,448,894 | coal |

| TYX | Tyranna Resources | 86% | 0.026 | $39,841,377 | lithium |

| 1VG | Victory Goldfields | 85% | 0.185 | $7,114,757 | gold, rare earths |

| GCR | Golden Cross | 80% | 0.009 | $9,875,305 | copper, gold, rare earths, uranium, phosphate |

| TNG | TNG Limited | 78% | 0.087 | $120,792,385 | vanadium, titanium, iron |

| NWM | Norwest Minerals | 64% | 0.046 | $8,307,940 | rare earths, lithium, gold, copper |

| POL | Polymetals Resources | 63% | 0.145 | $5,808,202 | gold |

| AWV | Anova Metals | 63% | 0.013 | $19,475,225 | gold |

| TGM | Theta Gold Mines | 63% | 0.091 | $50,070,688 | gold |

| ARL | Ardea Resources Ltd | 60% | 1.25 | $212,172,215 | nickel, cobalt |

| NAG | Nagambie Resources | 59% | 0.07 | $35,920,231 | antimony, gold |

| IEC | Intra Energy Corp | 57% | 0.011 | $6,663,597 | nickel, copper, PGE, gold |

| TON | Triton Minerals | 56% | 0.028 | $35,245,957 | graphite |

| LMG | Latrobe Magnesium | 55% | 0.087 | $140,122,961 | magnesium |

| GEN | Genmin | 55% | 0.255 | $72,238,402 | iron ore |

| ARN | Aldoro Resources | 54% | 0.2 | $19,917,463 | rubidium, lithium |

| RRR | Revolver Resources | 54% | 0.4 | $34,468,501 | copper |

| HMX | Hammer Metals | 52% | 0.07 | $57,077,624 | copper, gold, rare earths |

| ANL | Amani Gold | 50% | 0.0015 | $35,540,162 | gold |

| AUN | Aurumin | 50% | 0.165 | $18,021,837 | gold, lithium |

| GMN | Gold Mountain | 50% | 0.006 | $7,158,895 | copper |

| IR1 | Irismetals | 50% | 0.375 | $22,359,375 | gold, lithium |

July 2022 Top 5

#5 TYRANNA RESOURCES (ASX:TYX)

TYX is now up 400% since mid-May, when it pivoted to lithium with the acquisition of the early stage ‘Namibe’ project in Angola, West Africa.

Early signs were promising, with the company dusting off historical rock chip samples containing up to 7.49% lithium.

That’s high grade. Hard rock mines usually produce at an ore grade of between 0.8-1.5% lithium.

A fresh sampling program is now complete, the company says, with the intention now “to begin drilling as soon as possible”.

#4 MC MINING (ASX:MCM)

In late July, this tiny South African coal miner and project developer entered into a coal sales and marketing agreement with a company called Overlooked.

This will see coal exported from MCM’s small Uitkomst operation “ensuring the colliery benefits from the prevailing international coal prices”.

That means potentially bigger profits going forward.

“The colliery does not produce sufficient coal to fill a ship on a monthly basis and a partnership with Overlooked will facilitate more frequent shipments at higher international thermal coal prices,” MCM boss Godfrey Gomwe says.

“These prices have remained higher than previously forecasted and the marketing agreement ensures that Uitkomst benefits from the prevailing price, particularly our pea-sized products, as these were historically sold into domestic fixed price contracts.”

“The colliery will continue to supply coal to the local market, but at reduced volumes.”

MCM also recently completed a Bankable Feasibility Study – the most advanced of all project studies – on its flagship 296Mt ‘Makhado’ hard coking coal project in South Africa (68% interest).

The BFS envisages a production of 13.7Mt (coking) and 11.9Mt (thermal) over a 22-year mine life. Post-tax IIR and NPV were estimated at 38.2% and $268m, respectively.

The project would use existing infrastructure to minimise upfront costs, which have been estimated at $41m.

#3 ORA BANDA MINING (ASX:OBM)

Could OBM finally become the redemption story long-suffering investors crave?

Mining at its historically troubled Davyhurst gold operation near Kalgoorlie was restarted in February 2021 with plans for an initial 5.2 years of production at 81,000oz per annum.

The aspiration was $68.8m in average annual profit at a ~$2,550/oz gold price.

This was not to be, with ongoing cost and performance issues prompting the company to initiate a strategic review and ‘reset’ of its operations earlier this year.

In early July, OBM secured the services of a new chief exec to improve its fortunes.

Luke Creagh is a veteran mining engineer who most recently served as chief operating officer at Australia’s #2 gold miner Northern Star Resources (ASX:NST).

“We couldn’t be happier that Luke is joining us,” OBM chairman Peter Mansell says.

“He has had considerable experience managing mining operations and is highly qualified to guide Ora Banda through its current operational reset plan.

“We look forward to working with him for many years to come and are confident that, together, we can extract maximum value from Ora Banda’s highly prospective land package.”

#2 PROSPECT RESOURCES (ASX:PSC)

This is what a shareholder win looks like.

PSC recently sold its 72.7Mt Arcadia lithium project in Zimbabwe to a subsidiary of lithium-ion battery material producer, Zhejiang Huayou Cobalt Co, for ~$466m net.

This is an attractive outcome for shareholders, PSC says, with consideration equating to roughly $1.23 per share.

“After payment of transaction costs, Prospect is preparing to distribute almost 95% of the net proceeds from the transaction to its shareholders, with approximately $34 million to be retained for future activities,” chairman Mark Wheatley said July 22.

With the Arcadia transaction now complete, finding new projects is PSC’s top priority.

“The board believes that, with approximately $34 million of available cash and continuation of the current management team, that the company is appropriately resourced to deliver on this strategy,” Wheatley said.

#1 COBRE (ASX:CBE)

In early July, small copper explorer CBE slashed board compensation to ensure “as much capital as possible flows into the exploration programme in Botswana”.

All up, these changes would result in an annualised saving of around $300,000 plus entitlements.

Then CBE hit copper paydirt later the same month at its Ngami copper project and its money troubles magically disappeared. Probably.

The first diamond drill hole intersected a broad zone of copper over a 59m interval. Hole 2 also hit the good stuff.

“This new copper discovery represents a transformational moment for Cobre shareholders,” CBE executive chairman and MD Martin Holland said. Investors agreed.

Not that it should come as a surprise; the CBE team is stacked with talent.

It includes David Caterall, a geologist with a long history of exploration in the Kalahari Copper Belt where he has been involved in the discovery of several of the known economic deposits.

Joining him is Thomas Rogers, who was a co-recipient of the 2015 PDAC Thayer Lindsley Award for his role in the discovery of the Kamoa Copper Deposit (DRC), as was Dr Ross McGowan, who was recently appointed to the CBE as a non-executive director.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.