Who Made the Gains? Here are January’s top 50 miners and explorers

Tennis god Andre Agassi celebrates with the trophy after the final match at the ATP Masters on November 1, 1990 in Frankfurt, Germany. (Photo by Bongarts/Getty Images)

Lithium stood tall in a choppy, volatile month for ASX stocks.

It felt a bit like 2017, when more than 100 ASX exploration stocks were chasing a lithium payday.

When prices plummeted stocks moved on, and by late 2020 the number of stocks with active lithium projects in their portfolios had dwindled to the low double digits.

But guess who’s back now prices are soaring?

We count +80 lithium explorers/miners on the ASX right now.

Are they all great stocks, with great projects? Lol, no. But once again punters and sophs can’t get enough of that white gold and, unlike the ‘false start’ in 2017-2018, most experts reckon this nascent boom is the real deal.

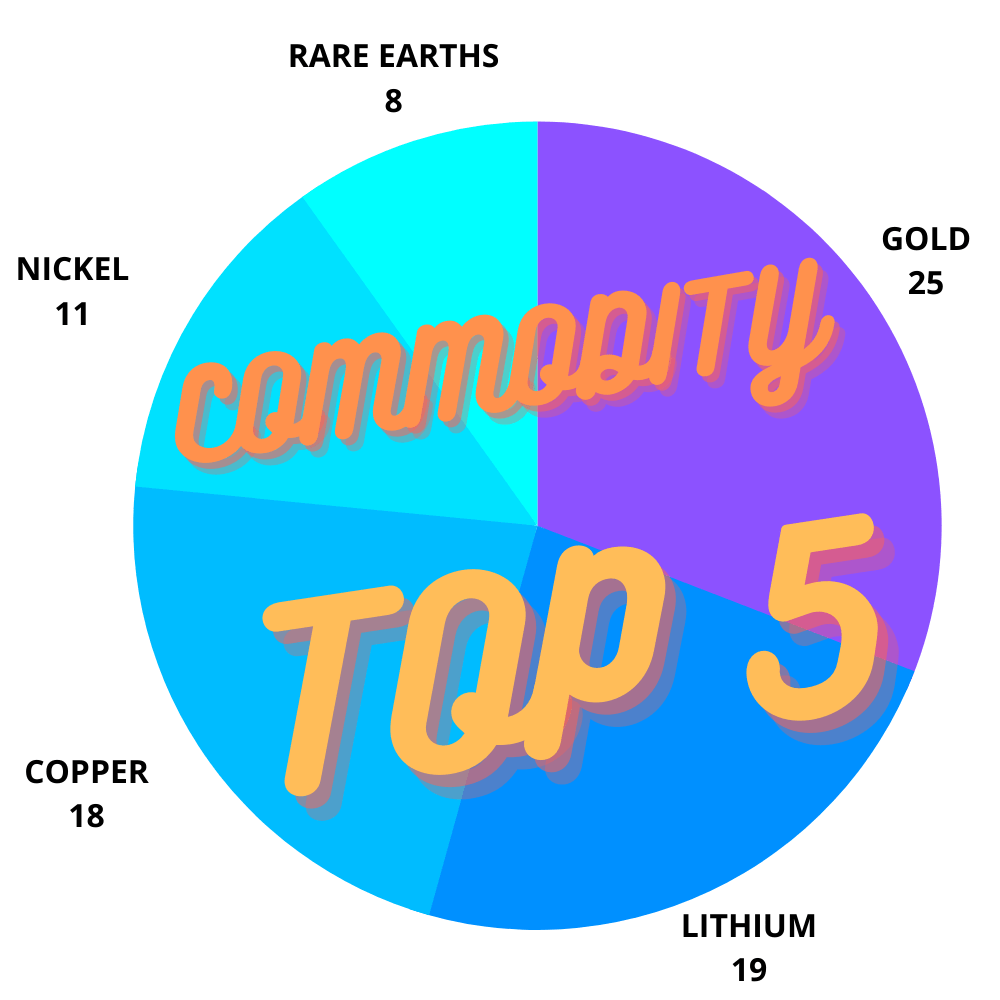

There are 19 stocks with lithium exposure in January’s Top 50 alone.

Overall, there is an incredibly strong showing from the battery metals/critical minerals suite — nickel, copper, rare earths, cobalt, graphite, and vanadium — as the ‘green metal’ thematic gathers pace.

What were the top 50 resources winners for January searching for?

Here are the top 50 ASX resources stocks for the month of January >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1 MONTH RETURN | LAST SHARE PRICE | MARKET CAP | LOOKING FOR |

|---|---|---|---|---|---|

| CRR | Critical Resources | 191.7% | 0.105 | $139,308,675 | Lithium,Copper, Zinc, Silver |

| ESS | Essential Metals | 177.8% | 0.5 | $120,330,673 | Lithium |

| 1MC | Morella Corporation | 172.7% | 0.03 | $155,286,420 | Lithium |

| ARR | American Rare Earths | 130.3% | 0.38 | $157,033,553 | Rare Earths |

| ZAG | Zuleika Gold | 117.6% | 0.037 | $14,871,361 | Gold |

| DM1 | Desert Metals | 113.7% | 0.545 | $21,895,500 | Nickel, Copper, PGEs |

| PGO | Pacgold | 111.0% | 0.96 | $34,479,300 | Gold |

| SPQ | Superior Resources | 109.1% | 0.046 | $71,217,034 | Copper, Gold, Nickel, PGEs |

| LM8 | Lunnon Metals | 107.7% | 0.81 | $61,663,126 | Nickel |

| GT1 | Green Technology | 98.9% | 0.875 | $89,570,000 | Lithium |

| GL1 | Global Lithium | 96.3% | 1.57 | $210,986,890 | Lithium |

| CHR | Charger Metals | 94.7% | 0.74 | $24,824,052 | Lithium, Nickel, Copper, Cobalt, PGEs |

| QXR | Qx Resources | 90.5% | 0.04 | $26,456,131 | Lithium, Rare Earths, Gold, Silver, Molybdenum |

| XTC | Xantippe Resources | 90.0% | 0.0095 | $47,133,799 | Lithium, Gold |

| CPM | Cooper Metals | 88.6% | 0.33 | $8,916,600 | Copper, Gold |

| CNB | Carnaby Resources | 87.1% | 1.375 | $178,339,658 | Copper, Gold, Lithium |

| IEC | Intra Energy Corp | 84.6% | 0.024 | $10,029,418 | Nickel, Copper, PGEs |

| AUQ | Alara Resources | 80.0% | 0.045 | $33,155,174 | Copper, Gold |

| AS2 | Askari Metals | 79.5% | 0.35 | $10,899,016 | Lithium, Gold, Copper |

| RNU | Renascor Resources | 79.2% | 0.215 | $397,712,907 | Graphite |

| CMD | Cassius Mining | 76.9% | 0.023 | $7,428,833 | Limestone, Gold |

| CDT | Castle Minerals | 76.0% | 0.044 | $38,974,441 | Graphite, Lithium, Zinc, Lead |

| ASO | Aston Minerals | 73.5% | 0.17 | $171,755,537 | Nickel, Cobalt, Gold |

| CAV | Carnavale Resources | 71.4% | 0.012 | $34,023,224 | Gold |

| MRR | Minrex Resources | 69.4% | 0.061 | $39,444,046 | Lithium, Gold, Tin, Tantalum, Rare Earths |

| DCX | Discovex Resources | 66.7% | 0.01 | $25,686,641 | Gold, Copper |

| ESR | Estrella Resources | 63.6% | 0.036 | $38,842,443 | Nickel, Copper |

| CLA | Celsius Resources | 63.2% | 0.031 | $31,619,342 | Copper, Gold, Cobalt |

| NIM | Nimy Resources | 62.8% | 0.35 | $16,878,004 | Nickel |

| LRV | Larvotto Resources | 62.5% | 0.195 | $6,147,750 | Copper, Gold, Cobalt, Lithium |

| LPI | Lithium Power International | 61.4% | 0.67 | $219,725,004 | Lithium |

| AZL | Arizona Lithium | 61.1% | 0.145 | $269,381,481 | Lithium |

| QGL | Quantum Graphite | 57.1% | 0.22 | $70,320,000 | Graphite |

| KFM | Kingfisher Mining | 55.3% | 0.295 | $9,074,925 | Copper, Gold, Rare Earths |

| TNR | Torian Resources | 54.5% | 0.034 | $35,493,620 | Rare Earths, Gold |

| WCN | White Cliff Minerals | 53.1% | 0.0245 | $13,050,321 | Lithium, Rare Earths, Gold |

| BNR | Bulletin Resources | 52.2% | 0.105 | $27,755,758 | Gold, Lithium |

| HIO | Hawsons Iron | 51.9% | 0.205 | $153,736,384 | Iron Ore |

| ZNC | Zenith Minerals | 48.9% | 0.335 | $123,769,496 | Lithium, Gold, Copper, Zinc, Lead |

| MRC | Mineral Commodities | 46.5% | 0.145 | $77,573,642 | Graphite, Mineral Sands |

| PVW | PVW Resources | 44.6% | 0.535 | $36,021,375 | Rare Earths, Gold |

| M3M | M3 Mining | 44.4% | 0.39 | $12,408,186 | Copper, Gold, Silver |

| GWR | GWR Group | 44.0% | 0.18 | $53,124,679 | Iron Ore |

| SFM | Santa Fe Minerals | 42.3% | 0.185 | $13,471,476 | Nickel, Copper, PGEs, Lead, Zinc, Silver, Gold, Vanadium |

| CAE | Cannindah Resources | 41.2% | 0.24 | $123,237,560 | Copper, Gold |

| ITM | Itech Minerals | 41.0% | 0.275 | $25,222,499 | Kaolin, Rare Earths, Graphite |

| AVL | Australian Vanadium | 39.3% | 0.039 | $118,588,677 | Vanadium, Nickel, PGEs |

| CXO | Core Lithium | 38.9% | 0.75 | $1,244,278,008 | Lithium |

| NIS | Nickelsearch | 38.7% | 0.215 | $13,475,961 | Nickel |

| COB | Cobalt Blue | 38.60% | 0.575 | $148,168,767 | Cobalt |

JANUARY TOP FIVE

CRITICAL RESOURCES (ASX:CRR) +197%

Market Cap: $139m

In 2018 CRR – then called Force Commodities — was hunting for lithium next to AVZ Minerals’ (ASX:AVZ) mammoth ‘Manono’ project.

As the heat came out of battery metals it moved onto other things like silver, lead, and copper, but has now come full circle with the recent acquisition of a lithium project in Canada called ‘Mavis Lake’.

It then doubled down, picking up another lithium project down the road called Graphic Lake.

Punters love The Lakes. Just look at this chart:

BOOM.

At Mavis, historical hits include 55.25m at 1.04% lithium from 80.75m – presenting what the company has described as “excellent potential”.

“Our strategy in 2022 is to begin exploration drilling as soon as possible once permitting is completed,” managing director Alex Biggs says.

“We have multiple targets to explore with a view to achieving, over time, the milestones set out by the vendors of 5 million and 10 million tonnes [at Mavis Lake].”

ESSENTIAL METALS (ASX:ESS) +177%

Market Cap: $120m

Fun fact: lithium explorer ESS sold Mavis Lakes to CRR.

ESS has the hands full with the ‘Pioneer Dome’ lithium project in WA which contains an actual resource (more than most explorers can boast) of 11.2Mt at 1.21% lithium.

As well as growing the resource with more drilling ESS are prepping for development.

A scoping study on the project – the first proper look at the economics of building a mine — is set to start mid-year.

MORELLA CORP (ASX:1MC) +172%

Market Cap: $155m

Besides the big miners, 1MC probs has the most battle-hardened lithium team in the business.

The lithium stock formerly known as Altura Mining continues to edge higher after relisting on the ASX in December.

1MC’s current management is a slimmed down version of the Altura team which built and operated its namesake lithium project, now owned by neighbour Pilbara Minerals (ASX:PLS).

Coming out of 16 months in suspension, 1MC now has a couple of new lithium exploration projects on the go, including ‘Mallina’ in WA’s Pilbara and the ‘Fish Lake Valley’ brines project in Nevada, USA.

The company raised about ~$8.5m prior to its relisting at 0.5c per share.

Those investors that got in at 0.5c would be happy, with the current share price up 500% on those levels. It goes without saying that longstanding investors remain deep in the red.

AMERICAN RARE EARTHS (ASX:ARR) +130%

Market Cap: $157m

Before it pivoted to rare earths in 2020, ARR was in an unhappy JV with fellow top 50 stock Cobalt Blue (ASX:COB).

Both stocks have done very well post-separation.

ARR is now benefitting from the United States’ distaste for all things China, a dominant producer and exporter of rare earths.

Its main game is the ‘La Paz’ rare earths project in Arizona, where drilling is about to kick off to “significantly increase” the 170 million tonne JORC Resource.

Then there’s the ‘Halleck Creek’ project, which ARR says could contain more resources than La Paz.

~ 308 to 385 million tonnes of rare earths mineralised rocks were identified as an exploration target at Halleck with an average TREO Grade of 2330 ppm to 2912 ppm, it said January 21.

Drilling is also scheduled to begin in the current quarter.

ZULEIKA GOLD (ASX:ZAG) +117%

Market Cap: $15m

Formerly Dampier Gold, ZAGs share price exploded in January thanks to a $3m private placement with Yandal Investments, a company owned and controlled by prominent WA prospector Mark Creasy.

Creasy has a knack of picking winners. He shot to fame in 2012 when microcap Sirius Resources made the Nova nickel discovery, which was eventually sold to Independence Group (ASX:IGO) for $1.8 billion.

Creasy was a joint venture partner in the project and the deal earned him $630 million.

ZAG says proceeds from the private placement will be used to underpin the company’s ongoing drilling programs across multiple exploration targets at its Kalgoorlie projects.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.