Who made the gains? Here are December’s top 50 small cap miners and explorers

Pic: Getty/ Wonder Woman 1984 (2020), Warner Bros

There was loads happening in December, traditionally a pretty quiet month because everyone mentally checks out ahead of the Christmas/New Year break.

Gold ended 2019 on a 14-week high to record its strongest year since 2010. Amazing stuff.

And the general feeling is that it has further to run in 2020 – hence the popularity of gold stocks right now.

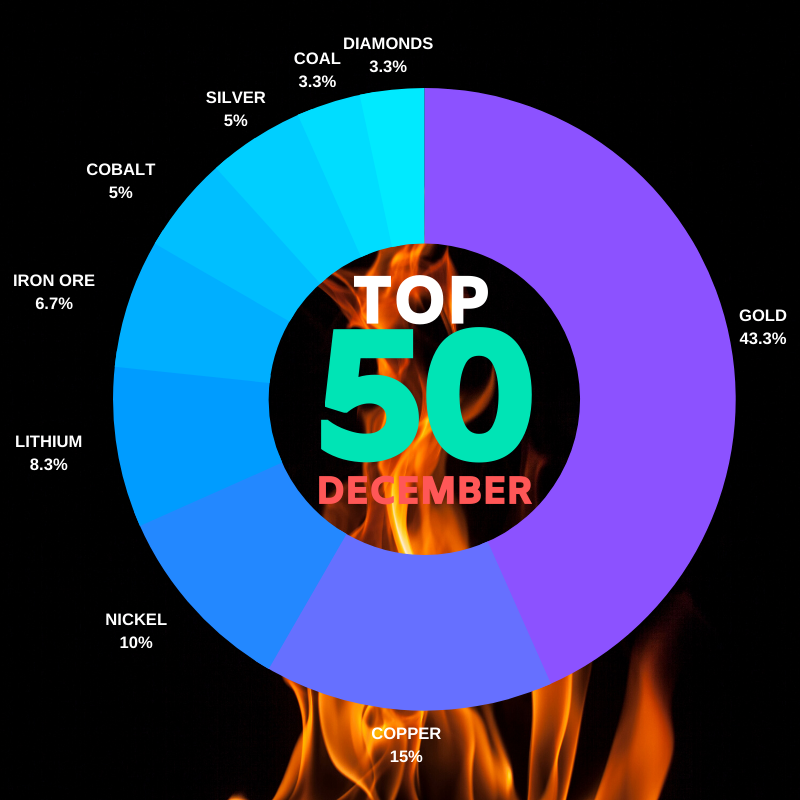

An incredible 43 per cent of our top 50 small cap miners or explorers are gold focused. Copper comes in a distant second at 15.5 per cent.

Iron ore prices have subsided since that early 2019 surge but still remain at an “usually high level” to average around $US80 ($116) a tonne for the year, according to the latest Resources & Energy Quarterly report.

Furthermore –“prices are not likely to retreat much further in the short term, as iron ore markets remain tight and iron ore stocks remain near five-year lows,” the report stated.

Nickel is out of favour (again) following that heady price surge mid to late 2019, but copper bulls reckon the red metal could be the next big thing.

Beaten down battery metals will likely experience a tough year – much like 2019 – before recovering in 2021.

But who knows what’s going to happen? No one, that’s who.

>>Scroll to the end for December’s Top 50 resources performers

TOP 5 STOCKS: DECEMBER

No goldies included in our top 5 this time (just to mix it up).

#1 Gibb River Diamonds (ASX:GIB) +158%

Market Cap: $11.64m

Christmas came early for Gibb River Diamonds when it acquired the mothballed Ellendale diamond mine in the West Kimberley region of WA. At (almost) no cost.

Ellendale has already produced 1.3 million carats, which includes over 50 per cent of global annual production of ‘fancy yellow’ diamonds.

It closed in 2015 when the previous owners went into administration — but there is still “enormous potential” for a profitable diamond mining operation, Gibb River told shareholders.

“There are numerous exciting opportunities available at Ellendale which GIB has acquired for simply the cost of pegging the leases, with no legacy liabilities,” the company says.

“The company is looking forward to an active 2020.”

#2 Legend Mining (ASX:LEG) +109%

Market Cap: $194m

Legend, which counts renowned prospector Mark Creasy as a major shareholder, was tipped to have made a Nova-style nickel-copper discovery after it went into a trading halt back on November 28, and then suspension on December 2.

On December 9 the discovery was confirmed – Legend’s third hole at ‘Mawson’ had returned a 2.1m intersection grading 2.03 per cent nickel, 1.34 percent copper and 0.11 per cent cobalt from a depth of 115.5m. The stock went on a huge run.

“This discovery hole at Mawson is an outstanding exploration success and a watershed moment for all Legend stakeholders and indeed all of the Fraser Range,” managing director Mr Mark Wilson said.

“The 2.1m high-grade intercept within a 14.9m sulphide zone is within a 70m disseminated sulphide halo and has all the hallmarks of a large mineralised system.”

READ: Barry FitzGerald — Has Legend found another Nova?

#3 MRG Metals (ASX:MRQ) +109%

Market Cap: $27.6m

The share price of this heavy mineral sands explorer is now at its highest level since 2016 on some strong December news flow.

Drilling at the mammoth Koka Massava discovery in Mozambique returned high grades up to 17.64 per cent total heavy minerals near-surface, which the company said demonstrated “the robust nature of the mineralisation”.

The stock subsequently surged a little too much, prompting a please-explain from the ASX.

The company followed up with another update, announcing plans to extend the drilling footprint at Koka Massava as it looks to prove up a resource in 2020.

READ: These gems are hunting for riches in African mineral sands, NSW porphyry copper-gold

#5 EHR Resources (ASX:EHX) +100%

Market Cap: $10m

Peru focused gold-silver explorer EHR was treading water for much of the year — frustrated by permitting delays — before a surprise pivot into diamonds revitalised the stock.

In December, EHR announced it would be acquiring Canada-based Nanuk Diamonds in a $1m deal.

The 274sqkm project area contains several occurrences of diamond-bearing kimberlitic dykes that were originally found in the early 2000s but were left unexplored for the last 15 years, the company says.

“The acquisition of Nanuk Diamonds provides an excellent, low-cost, point of entry to the diamonds sector for EHX, and we look forward to progressing work at Nanuk in the northern summer of 2020, as well as seeking other opportunities in diamond exploration,” chairman Stephen Dennis says.

#9 Lithium Australia (ASX:LIT) +76%

Market Cap: $34.5m

New York fund Lind Partners invested $6.3m into disruptive battery play Lithium Australia in early December, sending the stock on a strong run.

Lithium Australia wants to make money in three ways — by producing advanced battery cathode powders, selling storage batteries in JV with a Chinese firm, and recycling old batteries through its Envirostream subsidiary.

A week later, the Envirostream Australia plant shipped first product; a high-value mixed metal dust containing cobalt, nickel, lithium and graphite.

This represented “another important milestone in terms of revenue generation”, says managing director Adrian Griffin.

WATCH: 90 Seconds With…Adrian Griffin, Lithium Australia

Here’s the top 50 mining small caps for the month of December>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | NAME | % RETURN | PRICE 01 DEC | PRICE 01 JAN | MARKET CAP |

|---|---|---|---|---|---|

| GIB | GIBB RIVER DIAMONDS | 158 | 0.024 | 0.062 | 11.64M |

| LEG | LEGEND MINING | 109 | 0.043 | 0.090 | 194.51M |

| MRQ | MRG METALS | 109 | 0.011 | 0.023 | 27.66M |

| ACP | AUDALIA RESOURCES | 100 | 0.003 | 0.006 | 3.85M |

| ARO | ASTRO RESOURCES | 100 | 0.001 | 0.002 | 2.54M |

| EHX | EHR RESOURCES | 100 | 0.032 | 0.064 | 10.01M |

| SHK | STONE RESOURCES AUSTRALIA | 100 | 0.001 | 0.002 | 1.67M |

| WWI | WEST WITS MINING | 80 | 0.005 | 0.009 | 10.31M |

| LIT | LITHIUM AUSTRALIA | 76 | 0.034 | 0.060 | 34.52M |

| KFE | KOGI IRON | 73 | 0.041 | 0.071 | 51.09M |

| VAL | VALOR RESOURCES | 67 | 0.003 | 0.005 | 9.47M |

| ELT | ELEMENTOS | 50 | 0.002 | 0.003 | 4.63M |

| KGM | KALNORTH GOLD MINES | 50 | 0.004 | 0.006 | 4.47M |

| NTM | NTM GOLD | 45 | 0.055 | 0.080 | 46.66M |

| SVL | SILVER MINES | 45 | 0.083 | 0.120 | 104.10M |

| FEX | FENIX RESOURCES | 43 | 0.037 | 0.053 | 16.17M |

| AML | AEON METALS | 43 | 0.105 | 0.150 | 115.19M |

| SCN | SCORPION MINERALS | 40 | 0.010 | 0.014 | 2.48M |

| PSC | PROSPECT RESOURCES | 38 | 0.130 | 0.180 | 48.15M |

| AGD | AUSTRAL GOLD | 38 | 0.065 | 0.090 | 50.35M |

| IRD | IRON ROAD | 37 | 0.054 | 0.074 | 57.58M |

| ATU | ATRUM COAL | 37 | 0.285 | 0.390 | 183.79M |

| TMR | TEMPUS RESOURCES | 34 | 0.160 | 0.215 | 9.35M |

| SYR | SYRAH RESOURCES | 34 | 0.350 | 0.470 | 219.15M |

| AYR | ALLOY RESOURCES | 33 | 0.002 | 0.002 | 4.18M |

| AYM | AUSTRALIA UNITED MINING | 33 | 0.003 | 0.004 | 7.37M |

| AZI | ALTA ZINC | 33 | 0.006 | 0.008 | 19.82M |

| ADV | ARDIDEN | 33 | 0.003 | 0.004 | 7.11M |

| GES | GENESIS RESOURCES | 33 | 0.003 | 0.004 | 3.13M |

| SMI | SANTANA MINERALS | 33 | 0.003 | 0.004 | 10.74M |

| NVA | NOVA MINERALS | 33 | 0.033 | 0.044 | 44.74M |

| CY5 | CYGNUS GOLD | 33 | 0.033 | 0.044 | 2.59M |

| ABR | AMERICAN PACIFIC BORATES | 33 | 0.260 | 0.345 | 80.38M |

| CHN | CHALICE GOLD MINES | 32 | 0.170 | 0.225 | 71.26M |

| POD | PODIUM MINERALS | 32 | 0.031 | 0.041 | 6.65M |

| KGD | KULA GOLD | 32 | 0.028 | 0.037 | 2.18M |

| ARD | ARGENT MINERALS | 29 | 0.014 | 0.018 | 11.39M |

| BOC | BOUGAINVILLE COPPER | 27 | 0.255 | 0.325 | 108.29M |

| PGI | PANTERRA GOLD | 27 | 0.033 | 0.042 | 8.20M |

| AHQ | ALLEGIANCE COAL | 27 | 0.130 | 0.165 | 89.19M |

| PEC | PERPETUAL RESOURCES | 25 | 0.036 | 0.045 | 14.94M |

| BSX | BLACKSTONE MINERALS | 25 | 0.120 | 0.150 | 32.59M |

| CAV | CARNAVALE RESOURCES | 25 | 0.002 | 0.002 | 2.99M |

| CTO | CITIGOLD CORP | 25 | 0.004 | 0.005 | 12.01M |

| CZN | CORAZON MINING | 25 | 0.002 | 0.002 | 8.35M |

| GGG | GREENLAND MINERALS | 24 | 0.105 | 0.130 | 154.83M |

| JRL | JINDALEE RESOURCES | 24 | 0.255 | 0.315 | 12.13M |

| DAV | DAVENPORT RESOURCES | 23 | 0.035 | 0.043 | 7.00M |

| CMM | CAPRICORN METALS | 22 | 1.005 | 1.230 | 401.08M |

| SYA | SAYONA MINING | 22 | 0.009 | 0.011 | 33.11M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.