Who made the gains? Here are August’s Top 50 small cap miners and explorers

Pic: Schroptschop / E+ via Getty Images

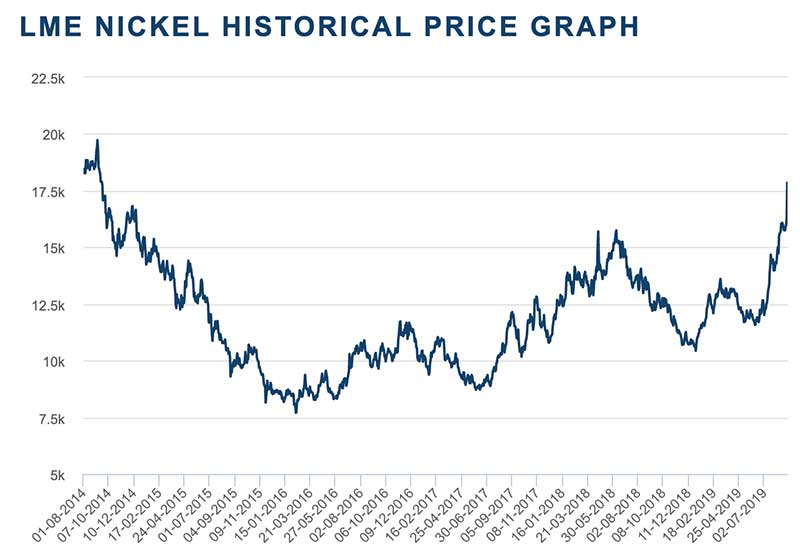

In August, nickel stole the spotlight when major producer Indonesia decided to fast track a nickel ore export ban.

And a late month toxic spill at the Ramu nickel-cobalt plant in PNG — which could have big ‘ramu’fications for battery sector supply — certainly didn’t help.

This confluence of factors caused the price to jump above $US17,000/t ($25,309/t) to its highest point for about five years:

WA lithium producer Alita Resources (ASX:A40) went into administration, slapping an exclamation mark (but not a full-stop) on spodumene’s slow price decline.

Cobalt prices got a nice +30 per cent bump when Glencore announced it was closing a major DRC mine at the end of the year.

And gold continues its steady march toward $3000/oz (probably), while silver – gold’s trailer park-livin’ cousin — is finally, finally waking up.

Scroll down for the August Top 5 >>>

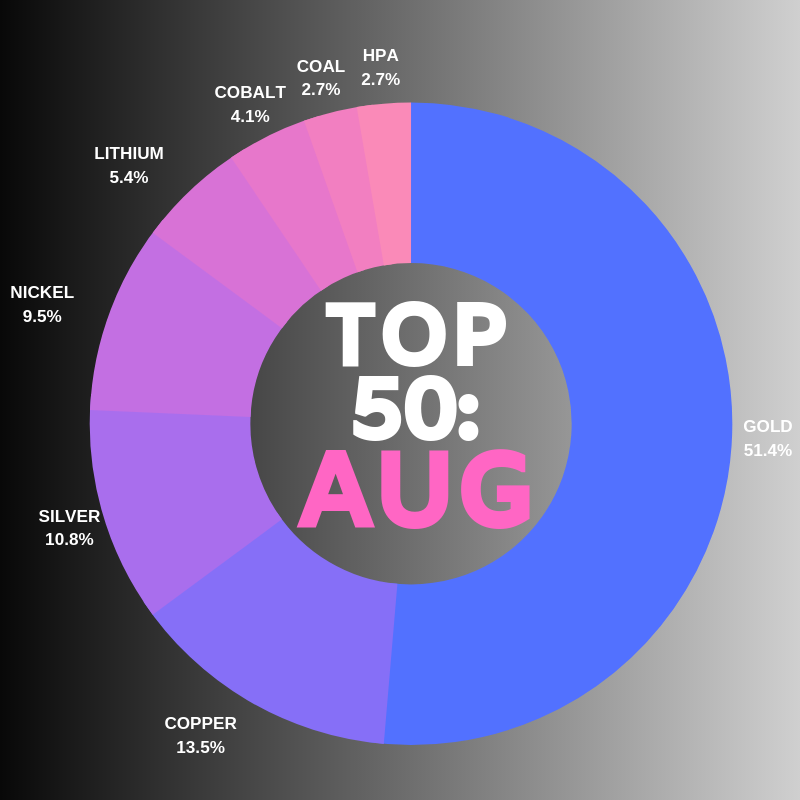

All the macro madness is (mostly) reflected in the top 50 for August. Compared to July, gold scored a bigger slice of the pie (from 42.2 per cent to 51.4 per cent), copper and nickel retained their spots, and silver is starting to move up the ranks.

We even had two high purity alumina plays in the top 50, which is pretty impressive considering there’s less than 10 HPA-focused small caps on the ASX right now.

AUGUST TOP 5

#1 MetalSearch (ASX:MSE) +129%

Junior explorer MetalSearch announced a deal to acquire Abercorn Kaolin, which owns the Abercorn high purity alumina (HPA) project in Queensland.

HPA’s fastest growing market is as a coating on the separators in lithium-ion batteries. It’s used for a bunch of other things, too.

But we should mention that HPA’s recent surge in popularity is undoubtedly due to fellow Top 50 HPA play Andromeda Metals (ASX:ADN +57%) which is ticking some serious boxes at the Poochera project in South Australia.

#2 Cazaly Resources (ASX:CAZ) +127%

Cazaly caught an unexpected rocket when its ‘for sale’ iron ore project received a surprise counter bid from $2.51 billion market cap Mineral Resources (ASX:MIN).

Mineral Resources’ $20m in loose change (plus royalties) was a damn sight better than an existing $13m offer from Gold Valley Group, so Cazaly took it. Obviously.

#3 Horizon Gold (ASX:HRN) +122% and

#4 Kula Gold (ASX:KGD) +111%

Horizon is a WA gold play with an advanced 1.4moz project called Gum Creek, but other than the fact that everyone loves an Australian goldie right now, there’s no news to explain that crazy August ride.

And ditto for Kula Gold, which recently offloaded its share of the Woodlark Island gold project to Geopacific Resources (ASX:GPR).

All we know is that Kula has since reviewed “11 projects at varying stages of exploration, from grass roots to advanced”.

#5 Investigator Resources (ASX:IVR) +106%

Investigator has benefited from a surging silver price, which finally decided to join its cooler friend gold on the dance floor.

Historically, silver tends to track the gold price up and down, eventually. It’s moving now, reaching +$US18/oz in late August.

And this improved outlook could see Investigator dust off an advanced South Australian silver project called Paris — the highest grade non-by-product silver project in Australia at 9.3 million tonnes grading 139 grams per tonne (g/t).

The explorer says Paris is “well placed” in the current market.

Here are the top 50 mining small caps for the month of August:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Name | Price 31 July | Price 31 August | Return % | Market Cap |

|---|---|---|---|---|---|

| MSE | METALSEARCH | 0.007 | 0.016 | 129 | $7,694,562.50 |

| CAZ | CAZALY RESOURCES | 0.022 | 0.050 | 127 | $15,809,663.00 |

| HRN | HORIZON GOLD | 0.185 | 0.410 | 122 | $31,377,552.00 |

| KGD | KULA GOLD | 0.009 | 0.019 | 111 | $1,117,097.00 |

| IVR | INVESTIGATOR RESOURCES | 0.016 | 0.033 | 106 | $24,419,078.00 |

| NVA | NOVA MINERALS | 0.027 | 0.054 | 100 | $50,329,844.00 |

| DDD | 3D RESOURCES | 0.002 | 0.003 | 100 | $3,471,663.25 |

| GPP | GREENPOWER ENERGY | 0.001 | 0.002 | 100 | $4,004,490.50 |

| GTE | GREAT WESTERN EXPLORATION | 0.004 | 0.007 | 100 | $9,348,016.00 |

| CHZ | CHESSER RESOURCES | 0.037 | 0.068 | 84 | $16,917,052.00 |

| SRN | SUREFIRE RESOURCES | 0.005 | 0.009 | 80 | $4,528,383.00 |

| AX8 | ACCELERATE RESOURCES | 0.030 | 0.050 | 67 | $2,381,000.00 |

| EAR | ECHO RESOURCES | 0.195 | 0.325 | 67 | $226,474,416.00 |

| MZN | MARINDI METALS | 0.060 | 0.100 | 67 | $5,585,335.00 |

| SMD | SYNDICATED METALS | 0.006 | 0.010 | 67 | $6,654,924.00 |

| GBZ | GBM RESOURCES | 0.003 | 0.005 | 67 | $5,452,985.00 |

| CMM | CAPRICORN METALS | 0.150 | 0.250 | 67 | $292,666,656.00 |

| HMX | HAMMER METALS | 0.023 | 0.038 | 65 | $16,682,653.00 |

| MEI | METEORIC RESOURCES | 0.032 | 0.052 | 62 | $51,201,272.00 |

| S2R | S2 RESOURCES | 0.130 | 0.210 | 62 | $52,062,188.00 |

| GPR | GEOPACIFIC RESOURCES | 0.018 | 0.029 | 61 | $80,013,784.00 |

| CDT | CASTLE MINERALS | 0.005 | 0.008 | 60 | $1,790,367.75 |

| VAL | VALOR RESOURCES | 0.005 | 0.008 | 60 | $15,145,538.00 |

| RXM | REX MINERALS | 0.060 | 0.095 | 58 | $28,175,866.00 |

| ADN | ANDROMEDA METALS | 0.035 | 0.055 | 57 | $74,562,424.00 |

| SCN | SCORPION MINERALS | 0.007 | 0.011 | 57 | $1,947,269.75 |

| GML | GATEWAY MINING | 0.014 | 0.022 | 57 | $28,690,420.00 |

| AZS | AZURE MINERALS | 0.096 | 0.150 | 56 | $20,781,834.00 |

| DEV | DEVEX RESOURCES | 0.060 | 0.093 | 55 | $12,373,703.00 |

| SVL | SILVER MINES | 0.081 | 0.125 | 54 | $95,861,336.00 |

| SKY | SKY METALS | 0.065 | 0.100 | 54 | $25,469,564.00 |

| ORR | ORECORP | 0.280 | 0.430 | 54 | $116,320,512.00 |

| AYR | ALLOY RESOURCES | 0.002 | 0.003 | 50 | $5,079,833.00 |

| CZN | CORAZON MINING | 0.002 | 0.003 | 50 | $4,892,066.00 |

| MRQ | MRG METALS | 0.006 | 0.009 | 50 | $6,855,027.00 |

| A1G | AFRICAN GOLD | 0.125 | 0.185 | 48 | $10,193,500.00 |

| SEI | SPECIALITY METALS INTERNATIONAL | 0.030 | 0.044 | 47 | $43,240,104.00 |

| GMR | GOLDEN RIM RESOURCES | 0.011 | 0.016 | 45 | $14,697,866.00 |

| AQX | ALICE QUEEN | 0.011 | 0.016 | 45 | $11,581,229.00 |

| SCI | SILVER CITY MINERALS | 0.009 | 0.013 | 44 | $3,818,233.25 |

| ARD | ARGENT MINERALS | 0.016 | 0.023 | 44 | $12,409,911.00 |

| NWC | NEW WORLD COBALT | 0.016 | 0.023 | 44 | $17,768,244.00 |

| AUC | AUSGOLD | 0.014 | 0.020 | 43 | $15,842,991.00 |

| BCB | BOWEN COKING COAL | 0.045 | 0.064 | 42 | $47,159,136.00 |

| BSX | BLACKSTONE MINERALS | 0.096 | 0.135 | 41 | $21,728,894.00 |

| MCR | MINCOR RESOURCES | 0.460 | 0.645 | 40 | $ 184,947,744.00 |

| KGM | KALNORTH GOLD MINES | 0.005 | 0.007 | 40 | $6,259,680.50 |

| MRV | MORETON RESOURCES | 0.005 | 0.007 | 40 | $21,748,794.00 |

| CCJ | COUNTY INTERNATIONAL | 0.005 | 0.007 | 40 | $1,675,450.00 |

| MOH | MOHO RESOURCES | 0.045 | 0.063 | 40 | $2,676,529.25 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.