Who made gains in August? Here are the top ASX resources winners

Rare earths explorers stole the spotlight in August, with a little help from the Pentagon. Pic: Getty Images

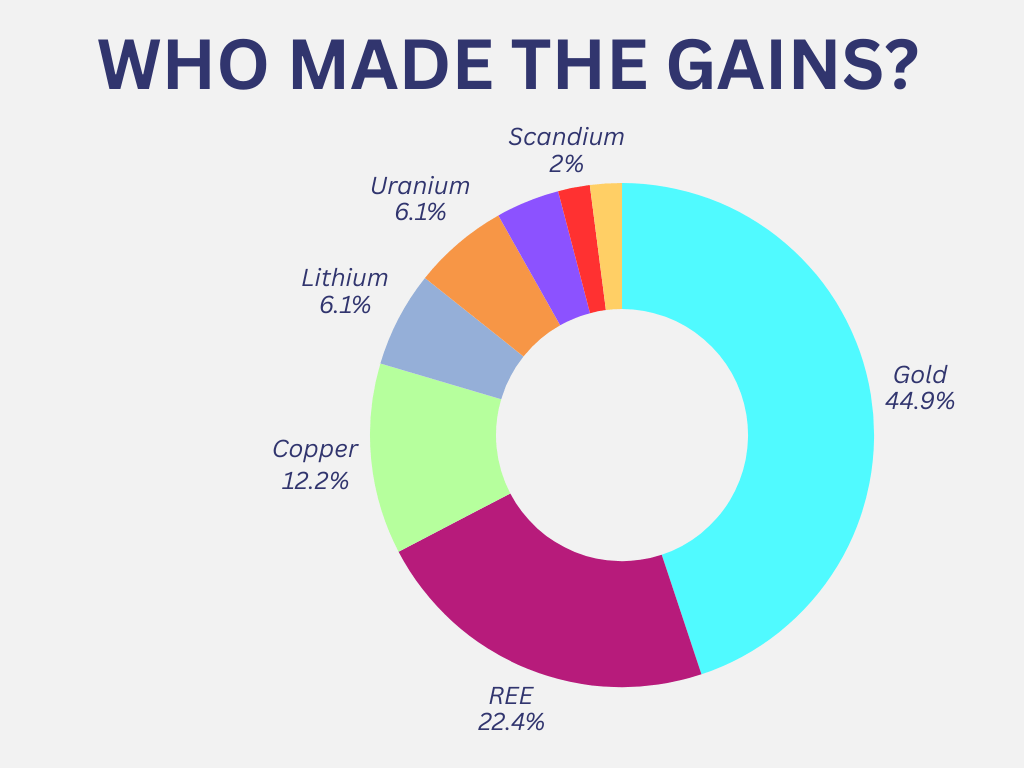

- The top market moving commodities for August include gold, rare earths and copper

- Kaili Resources takes top spot for the biggest monthly stock gain

- Mountain Pass nearologists Great Northern Minerals and Bayan Mining and Minerals also make the podium

Gold, rare earths and copper resource stocks stole the spotlight in August, with the biggest individual gainer, Kaili Resources (ASX:KLR), up a frankly quite ridiculous 10,983%.

The rare earths explorer, which was until recently majority-owned by a Chinese coal company, has so far copped four speeding tickets and been cast as the market’s newest meme stock.

Shares jumped more than 8000% on August 18 to $3.18. Both the ASX and ASIC confirmed at the time they were aware of KLR’s share price surge, though ASIC declined to comment further.

The company announced last week it had secured regulatory approval to start drilling at its Limestone Coast rare earth project in South Australia. The program will cover three tenements — Lameroo EL 6856, Karte EL 6977, and Coodalya EL 6978 — located in the Murray Basin near Australian Rare Earths’ (ASX:AR3) Koppamurra project.

MP nearology powers rare earth gains

While gold made the gains overall, rare earths stocks took out second place with Great Northern Minerals (ASX:GNM) up 322% for the month.

The company secured second place after announcing the acquisition of the Catalyst Ridge project, a string of 119 mineral claims near Mountain Pass in California’s Mojave Desert.

GNM, which will be looking for rare earths and antimony, is following fellow ASX hopefuls Dateline Resources (ASX:DTR), Bayan Mining and Minerals (ASX:BMM) and Locksley Resources (ASX:LKY) in the hot district.

Oh, and MP Materials, the owner of America’s only rare earths mine at Mountain Pass – the subject of a multi-billion dollar investment package from the US military and US$500m supply deal with Apple.

It’s been perked up since the Department of Defense decided to come on board as a strategic investor, promising a floor price of US$110/kg NdPr to secure future US supplies of the magnet metals, critical to defence, energy and EVs.

GNM’s deal to enter the district came alongside a $2.6m raising led by Perth’s CPS Capital.

“Catalyst Ridge represents an exciting opportunity to explore for significant discoveries of rare earth elements, antimony and gold in one of the most strategically important regions of the United States,” GNM non-exec chair Eddie King said. “This area is emerging as the focal point of the US critical minerals supply chain, with major recent developments reinforcing its importance.”

Bayan Mining and Minerals (ASX:BMM) was up 308%, also thanks to its proximity to MP.

Last month, the company announced a placement raising $3.27 million at 20 cents a share, representing a 47.8% premium to the 15-day VWAP with the funds will help the company step up exploration efforts at the Desert Star and Desert Star North projects.

BMM director Fadi Diab said the company was well positioned to define and advance high-priority targets following the completion of sampling.

“The strategic location of our projects, within close proximity to MP Materials’ world-class Mountain Pass rare earth mine and Dateline Resources’ Colosseum gold mine, highlights the exceptional potential of our ground,” he said.

“This funding allows us to rapidly progress exploration in a district that is both geologically proven and strategically important to the North American critical minerals supply chain.”

Most popular commodities in August:

Here are the top 50 ASX resources stocks for the month of August>>>

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % Month | Market Cap |

|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.665 | 10983% | $98,021,241 |

| GNM | Great Northern | 0.078 | 322% | $12,451,068 |

| BMM | Bayan Mining and Minerals | 0.245 | 308% | $26,938,970 |

| GLA | Gladiator Resources | 0.024 | 243% | $18,199,124 |

| ALR | Altair Minerals | 0.013 | 189% | $59,107,674 |

| PIM | Pinnacle Minerals | 0.11 | 175% | $6,251,205 |

| BSN | Basin Energy | 0.046 | 171% | $5,650,148 |

| LIN | Lindian Resources | 0.275 | 162% | $366,665,395 |

| WTM | Waratah Minerals Ltd | 0.715 | 155% | $195,412,313 |

| FAL | Falcon Metals | 1.095 | 152% | $232,846,305 |

| MTB | Mount Burgess Mining | 0.01 | 150% | $4,256,383 |

| TKL | Traka Resources | 0.0025 | 150% | $6,055,348 |

| LKY | Locksley Resources | 0.26 | 148% | $63,918,832 |

| OD6 | OD6 Metals | 0.061 | 135% | $11,537,910 |

| DTR | Dateline Resources | 0.265 | 121% | $851,922,216 |

| CC9 | Chariot Corporation | 0.1 | 108% | $15,980,377 |

| GML | Gateway Mining | 0.056 | 107% | $106,893,937 |

| ITM | Itech Minerals Ltd | 0.064 | 106% | $10,762,629 |

| FUN | Fortuna Metals Ltd | 0.061 | 103% | $11,427,989 |

| AYM | Australia United Min | 0.004 | 100% | $7,370,310 |

| ENT | Enterprise Metals | 0.007 | 100% | $9,599,221 |

| TMB | Tambourah Metals | 0.05 | 100% | $8,273,802 |

| VML | Vital Metals Limited | 0.225 | 96% | $26,527,335 |

| PR2 | Piche Resources | 0.155 | 94% | $12,940,842 |

| ETM | Energy Transition | 0.084 | 91% | $150,318,329 |

| SMS | Star Minerals | 0.055 | 90% | $10,290,866 |

| PXX | Polarx Limited | 0.017 | 89% | $40,383,517 |

| BNZ | Benz Mining | 1.13 | 85% | $226,230,791 |

| DBO | Diablo Resources | 0.033 | 83% | $5,547,824 |

| I88 | Infini Resources Ltd | 0.21 | 83% | $10,997,704 |

| WYX | Western Yilgarn NL | 0.048 | 78% | $6,618,487 |

| AHK | Ark Mines Limited | 0.345 | 77% | $22,825,441 |

| BPM | BPM Minerals | 0.083 | 77% | $7,245,927 |

| SRL | Sunrise | 1.745 | 76% | $205,197,681 |

| DMG | Dragon Mountain Gold | 0.007 | 75% | $2,762,702 |

| BCA | Black Canyon Limited | 0.48 | 75% | $63,941,524 |

| CRN | Coronado Global Res | 0.365 | 74% | $645,434,686 |

| ZNC | Zenith Minerals Ltd | 0.06 | 71% | $31,767,330 |

| OCT | Octava Minerals | 0.057 | 68% | $4,346,781 |

| AQX | Alice Queen Ltd | 0.005 | 67% | $6,923,481 |

| RB6 | Rubixresources | 0.14 | 67% | $8,603,000 |

| EPM | Eclipse Metals | 0.03 | 67% | $89,974,571 |

| LMG | Latrobe Magnesium | 0.025 | 67% | $65,862,478 |

| GED | Golden Deeps | 0.043 | 65% | $7,616,405 |

| BCN | Beacon Minerals | 2.16 | 64% | $228,341,424 |

| CRR | Critical Resources | 0.008 | 60% | $22,160,684 |

| SLZ | Sultan Resources Ltd | 0.008 | 60% | $2,088,669 |

| CRS | Caprice Resources | 0.096 | 60% | $64,246,759 |

| OCN | Oceanalithiumlimited | 0.11 | 59% | $18,314,602 |

| 1AE | Auroraenergymetals | 0.073 | 59% | $13,071,653 |

Small cap standouts

Gladiator Resources (ASX:GLA)

Another explorer gaining a REE foothold in the US last month was Gladiator Resources, which entered an agreement with Apex USA Resources LLC with the aim of identifying and developing potentially promising rare earth tenements.

The Apex team has been heavily involved in the US REE industry and Gladiator believes it is well placed to assist in identifying promising REE tenements.

“We are excited to enter into an agreement with Apex USA,” Gladiator chairman Matthew Boysen said.

“While we remain committed to our Tanzanian uranium projects, the board believes the company’s potential entry into the US REE exploration and development space, which takes advantage of the current geo-political environment for critical minerals, provides excellent diversification.”

Altair Minerals (ASX:ALR)

The company is off to adjudication at the Wardens Court with BHP (ASX:BHP) over the mining giants intents to use Altair’s project area for purposes of infrastructure and development of the neighbouring 1.34Bt at 0.66% copper and 0.33g/t gold Oak Dam deposit.

ALR says BHP made an offer which it believes significantly undermines the value for its Olympic Domain project, a counteroffer was made but the companies have not been able to come to an agreement – thus the Wardens Court.

Altair’s project sits directly between and covers the 30km stretch of land from BHP’s Oak Dam deposit to the Olympic Dam Highway.

ALR says the deal failed to account for the ~$8m in exploration spend to date, and two notable intercepts (0.32% and 0.33% copper) which have narrowly missed the core of geophysical phase anomalies and represent high-priority follow-up targets.

“The path of least resistance, for any infrastructure corridor in the district, inevitably requires Altair’s involvement and an adequate valuation for any proposed agreement,” the company said.

They’re also advancing negotiations with two other majors regarding joint venture and/or investment into the project, which Altair says reaffirms it’s belief the offer presented by BHP significantly undermines the value proposition discussed with other majors.

Basin Energy (ASX:BSN)

Basin has signed an agreement to acquire large prospective uranium and rare earth packages in the Mount Isa region of northwest Queensland which are adjacent to Paladin Energy’s (ASX:PDN) Valhalla uranium deposit and Red Metals’ (ASX:RDM) Sybella rare earth discovery.

The company has signed a binding agreement to acquire 100% of NeoDys, a privately held critical minerals explorer.

This provides Basin with a commanding position over one of Australia’s emerging and underexplored provinces for uranium and rare earth elements (REE).

The projects provide compelling walk-up drill targets that can be rapidly and cost-effectively tested using aircore and reverse circulation (RC) drilling.

NeoDys has an existing Queensland Collaborative Exploration Initiative funding agreement for $150,000, which is available for Basin to support upcoming drilling.

There are also Valhalla-style uranium targets with multiple untested radiometric anomalies, in proximity to the Valhalla, Skal and Odin deposits which host a combined 116Mlbs U3O8.

To support the acquisition, BSN has received firm commitments from institutional and sophisticated investors to raise $1.25m at 2.5c per share, representing a 9% premium to the 20-day VWAP.

With the placement and Queensland grant, Basin Energy is fully funded to test the drill-ready high priority targets, enabling it to fast-track multiple uranium and rare earth drill programs.

Detailed targeting and drill planning is underway with exploration planned to start in Q4 2025 to test shallow, high-priority targets via aircore and RC drilling.

At Stockhead we tell it like it is. While Bayan Mining and Minerals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.