Who are the movers and shakers in Brazil’s burgeoning Lithium Valley?

Brazil's Lithium Valley is getting bigger. Pic via Getty Images.

- The state of Minas Gerais is home to Brazil’s booming Lithium Valley

- ASX juniors are putting their hard rock mining expertise to use in the region

- Latin Resources is nearing the completion of a pivotal DFS for its Salinas project

Explorers and near-term developers with projects in Brazil’s Lithium Valley are back on the radar with a bunch of projects in the well-established Tier 1 mining province.

Brazil’s Minas Gerais state is home to more than just a stack of lithium.

The house of hard rock also comes with a mature mining labour pool, established infrastructure, hydroelectric power and road access that service major iron ore operations run by the likes of BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Vale.

The country is positioning itself to become a major player in the world’s critical minerals space and its hard rock lithium potential is fast becoming a reality as carmakers such as BYD and Volkswagon circle the region looking for supplies of the battery metal.

The Brazilian Geological Service suggests that the region has the lion share of the nation’s at least 45 identified hard rock lithium deposits – similar to those mined in WA – such as Pilbara Minerals (ASX:PLS) Pilgangoora mining operation.

The area has been mined for hard rock lithium since the early 1990s, when Companhia Brasileire De Litio discovered and developed its Cachoeira mine that’s producing Li2O at a run rate of 42,000tpa. It also hosts AMG’s lithium-tantalum-niobium-tin mine which has the capacity to produce 130,000tpa.

Newcomers to Brazil’s Lithium Valley

Canadian miner Sigma Lithium leads the pack in the region, having just established itself as the 4th largest lithium mining complex in the world with a resource of its Grota do Cirilo project up to 109Mt @ 1.41% Li2O.

The company’s exploration target has that figure pegged to increase up to 150Mt this year as it drills a whopping 57 targets outside the current resource base.

It’s also investing almost US$100m on a new plant to up the mine’s current throughput of 270,000tpa up to 520,000tpa.

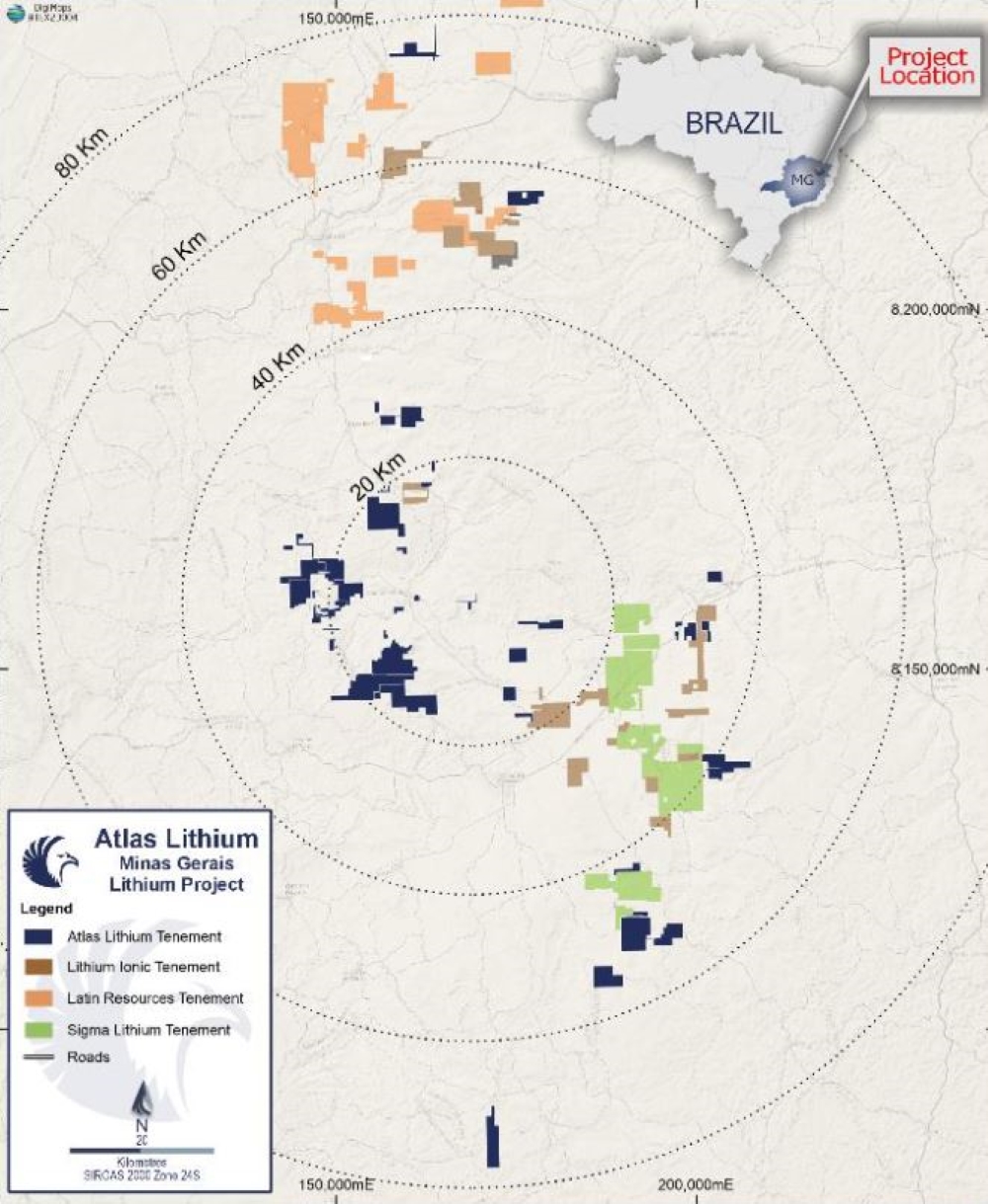

Sigma’s impressive hard rock endowment has not gone unnoticed, and there are a swarm of explorers and near-term developers busting in and around its tenements.

Owning Brazil’s largest lithium portfolio and touted to be the next cab off the Li2O rank on the continent is NASDAQ-listed Atlas Lithium, which is nearing production status at its Minas Gerais project.

The project is pegged to be rolling out 150ktpa of spodumene concentrate in Q4 this year and doubling that to 300ktpa by mid-2025.

Peer Latin Resources (ASX:LRS) is also looking at first production on the horizon, with hopes to check that box at the end of H1 2026 at its Salinas lithium project.

Salinas is world-class, measuring 70.3Mt @ 1.27% Li2O and is nearing the release of a pivotal definitive feasibility study (DFS) whilst the company pursues a further resource increase of the project’s main Colina deposit (the largest single lithium deposit in Brazil according to the US Geological Survey).

Multiple high-grade assays are continuing to come in, with one of the largest intersections recently showing 32.92m @ 1.62% Li2O.

“Our exploration efforts at the Colina deposit continue to yield excellent results, with high-grade assays demonstrating significant thickness in pegmatite formations, reinforcing the resource potential of the area,” LRS MD Chris Gale says.

“We are also advancing steadily towards the DFS milestone, with key steps such as the submission of the Environmental Impact Assessment and Environmental Impact Report completed, and a team of experts appointed to oversee and expedite the study.”

16 drill rigs are on site for 2024 drilling program encompassing resource definition, metallurgical and geotechnical studies.

These programs, LRS says, will continue throughout the 2024 drilling season “aimed at increasing tonnage and upgrading the confidence level in the current Colina resource model and to further identify and validate new priority drill targets at Colina, Planalto, Salinas South and Fog’s Block”.

20km to the south of Colina is newcomer to the region Lightning Minerals (ASX:L1M) which has just snapped up two lithium projects – Caraíbas and Sidrônio – from Bengal Mining.

Early-stage exploration shows multiple pegmatites identified at Caraíbas already, with peak lithium rock chip assay results grading up to 0.53% Li2 O (lepidolite), and significant tantalum, rubidium and caesium.

Fieldwork is about to commence to define targets for a planned drill program.

Another near-term producer with nearology to Sigma’s Grota do Cirilo is fellow Canadian Lithium Ionic and its 23.7Mt @ 1.34% Li2O Bandeira project.

A recent preliminary economic assessment shows a target to produce 217,700tpa over a 20-year mine life.

Also in the region is Alderan Resources (ASX:AL8) that’s conducting soil sampling across its seven lithium projects covering 472km2.

Further north in the state of Ceará, Oceana Lithium (ASX:OCN) is awaiting environmental permits to get drilling at its Solonópole project, where soil samples returned up to 524ppm Li.

At Stockhead, we tell it like it is. While Latin Resources and Oceana Lithium are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.