Which ASX stocks have a uranium play in Canada’s Athabasca Basin?

Picture: Getty Images

- Uranium sentiment – and prices – are looking good for explorers and near-term developers

- The USA and Canada just made a deal to secure North American nuclear fuel supply chains

- There are 6 ASX stocks with a uranium play in Canada’s Athabasca Basin

Nuclear energy has had a bad rap since the Fukushima disaster in 2011 and the closure of Japan’s entire reactor fleet sending prices spiralling and deflating any motivation to explore and develop new mines.

But market analysts believe the medium to long term outlook for uranium is promising, and prices even hit the mythical US$60/lb mark in April last year, which is what a lot of aspiring developers use to justify the profitability of their future operations.

While the price didn’t stay there for long, Peter Strachan, capital markets veteran and resource analyst, recently told Stockhead’s Jessica Cummins that we could see it “jump towards the mid $60s and even as high as US$70/lb, which will be sufficient to get new projects up and running.”

Plus, sentiment has definitely shifted into positive territory in recent years, with a continuous flow of endorsements from global governments around the role of nuclear in the clean energy transition.

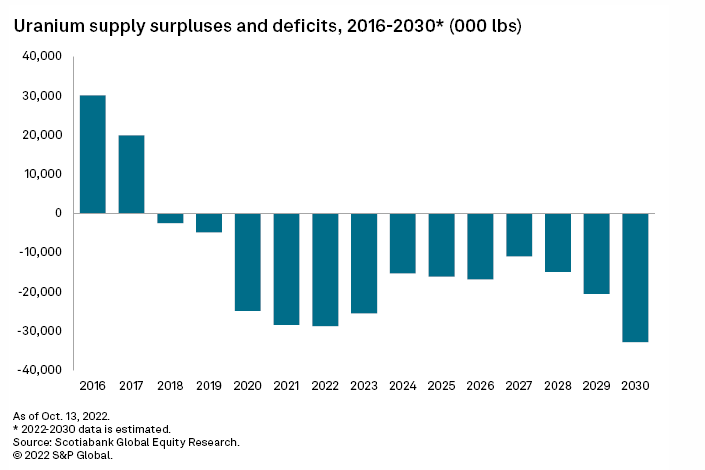

Not to mention persistent concerns about tight supplies due to Russia’s war on Ukraine have put the wind up the Western world, with S&P Global predicting the looming shortage could send ore prices up by about 25% by 2030.

The heat is on to secure supply chains.

In late March US President Joe Biden and Canadian Prime Minister Justin Trudeau announced in March that Canada will fund and provide in-kind support for the Foundational Infrastructure for Responsible Use of Small Modular Reactor Technology (FIRST) program, the Biden Administration’s international initiative to help partner countries develop nuclear energy programs under the highest standards for safety, security, and non-proliferation.

“The United States and Canada will also coordinate efforts to develop secure and reliable North American nuclear fuel supply chains that do not rely on authoritarian-based suppliers and will build broader partnerships with longstanding allies and partners, both of which will support ensuring access to low enriched uranium and High-Assay Low Enriched Uranium,” the White House said in a statement.

Plus, Andre Liebenberg, the CEO of London-Listed physical uranium fund Yellowcake PLC told Stockhead’s Josh Chiat that the Biden’s Inflation Reduction Act (IRA) has reserved as much as US$30b of loan guarantees and incentives for the nuclear energy sector.

Canada primed to supply US uranium

Conditions are looking good. So good that uranium giant Cameco even recently greenlit the restart of the world’s biggest uranium mine, McArthur River, in Canada’s Athabasca Basin – home to some of the highest-grade uranium deposits globally.

The region has a long history of uranium production, and produces around 20% of the world’s uranium supply.

And with well-established infrastructure it’s an attractive jurisdiction for early-stage explorers and developers because the higher the grade, the lower the costs to mine.

Just look at NexGen Energy (ASX:NXG) which announced this week interest from lenders for over US$1 billion in debt financing to build what will become the world’s largest uranium mine at Rook 1 – which hosts Measured Mineral Resources of 209.6Mlb of U3O8 contained in 2.18m tonnes grading 4.35% U3O8.

“The receipt of these expressions of interest are a clear de-risking step demonstrating lender confidence in the economics of the Rook I Project, the uranium market fundamentals incorporating the project and the elite ESG manner NexGen is delivering in the development of the project,” CEO Leigh Curyer said.

The $2.8b market cap company is not alone in the area. It’s choc-a-bloc full of explorers and near term developers on the hunt for their own, massive, high-grade uranium deposit, just look at the busy map below (it’s a bit old but you get the idea).

DYK? Seven #uranium exploration companies have Winter #U3O8 drilling/survey programs currently underway in #Canada‘s Athabasca Basin. Results coming soon from NexGen $NXE, Fission $FCU, Denison $DML, $UEX, ALX $AL, IsoEnergy $ISO, & Azincourt $AAZ. Wishing them good luck! ☘️ pic.twitter.com/WaHJys7qVx

— John Quakes (@quakes99) February 23, 2018

Let’s take a closer look at the ASX stocks with an Athabasca play

BASIN ENERGY (ASX:BSN)

The $8.93m market cap company has an interest in three highly prospective projects in Canada’s Athabasca basin, including North Millennium which is 7km north of Cameco’s Millennium Deposit which contains 104.8Mlb U3O8 at 3.76%, Geikie close to 92Energy (more on them later) and Baselode Energy, and Marshall which is 10km from the Millennium Deposit.

The company recently completed airborne geophysics on the Geikie project which it says has been largely overlooked for uranium exploration since the initial phase of work which concluded in the early 1980s.

BSN wrapped up the quarter ending 31 March with a cash balance of $7.3m which will fund an aggressive 2023 exploration campaign, including maiden diamond drilling programs.

VALOR RESOURCES (ASX:VAL)

Valor has four key Canada-based uranium projects in its portfolio and plans to kick off 2023 field programs at Hidden Bay, Surprise Creek and Cluff Lake in June.

At Hidden Bay, the company has identified priority targets with potential for both basement hosted and Athabasca hosted uranium deposits – “all it needs is a drill rig on it to find the prize we are looking for,” VAL executive chairman George Bauk says.

The $19m market cap company has expanded its land package at Surprise Creek and combed through the historical drilling data with six surface samples returning above 1% uranium with associated copper.

At Cluff Lake, four priority targets have been identified following a comprehensive review of all available exploration data with two targets at the Moose prospect the main focus for upcoming drill testing.

OKAPI RESOURCES (ASX:OKR)

Okapi has six advanced exploration tenements in the Athabasca Basin, and in the last quarter completed an airborne geophysical survey at its Newnham Lake and Perch Uranium Projects to further refine drill targets ahead of maiden drilling later this year.

The proposed drill campaign at Newnham Lake is fully permitted and is expected to total up to 2,500m of drilling over 10 to 15 holes to test the highest priority drill targets.

Historically drilling at the project encountered multiple intercepts with grades between 1,000ppm U3O8 and 2,000ppm U3O8 in relatively shallow historical drilling within a 25km conductive trend.

OKR also announced plans to invest $3.1m in uranium enrichment company Ubaryon back in Feb, which it says uses a unique process that does not require significant temperature or pressure and significantly reduces technical risk and cost.

“Uranium enrichment is a US$6 billion market and crucial to the nuclear fuel cycle with only a few facilities operating worldwide,” the company said.

“Ubaryon’s enrichment technology provides Okapi with exposure to potential future fuel production opportunities. Enrichment is currently dominated by Rosatom (controlled by Russian state) and there is escalating political pressure for utilities to move away from material enriched in Russia.”

The company has a market cap of $23.13m at the time of writing.

Nuclear energy is essential to reach a zero carbon future. @OkapiResource (ASX: OKR) has a dominant uranium position in North America and exposure to the uranium enrichment industry through its investment in Ubaryon. #uranium #nuclearenergy #nuclear #energy pic.twitter.com/BxniettGe9

— Okapi Resources (@OkapiResource) March 30, 2023

92ENERGY (ASX:92E)

The explorer owns five projects in Canada’s Athabasca Basin, the area where Cameco owns two of the world’s largest high grade uranium mines.

The company is focused on its GMZ uranium within the Gemini project in the Athabasca Basin, Saskatchewan, where it last year it flagged high-grade uranium (> 1.00% U3O8) in two drill holes.

For context, 1.00% U3O8 is over 10 times the average grade of mined uranium deposits elsewhere in the world.

But it gets better. Just a few months ago 92E hit high grade result of up to 6 per cent eU3O8 .

Given the rapidly growing size of the discovery and the company’s market capitalisation of just $34.75m, MD Siobhan Lancaster describes 92E as being “in the investor sweet spot”.

“These latest results show we are creating substantial shareholder value,” she said at the time.

“Gemini is a significant, shallow discovery in the world-class uranium province of the Athabasca Basin.

“The value of our discovery is made even greater when viewed against the strong demand outlook for North American uranium due to growing use of nuclear power and the push to diversify supply away from Russia.”

Follow up drilling is now being planned.

TERRA URANIUM (ASX:T92)

Terra Uranium is one of the new kids on the scene, backed by uranium veterans/executive chairman Andrew Vigar, the co-founder of several public listed companies including $105m market cap uranium company Alligator Energy (ASX:AGE), and ex-head of operations at Cameco Mike McClelland.

The $10.08m market cap company holds 22 claims covering a total of 1,008km2 forming the Hawk Rock Project, the Parker Lake Project, and the Pasfield Lake Project on the eastern side of the Athabasca Basin.

And just this week they flagged strong ground geophysical responses and highly elevated RC hole helium analyses from airborne geophysics, ANT, and geochemical analysis at the Pasfield Lake project where T92 identified one of the largest anomalies in the region since Cameco’s McArthur River uranium mine.

Helium concentration in samples from RC hole PS-23-RC04 is 234 times greater than background, indicating local high-grade uranium emplacement at depth, the company says.

“We are confident in our rigid results based technical framework with use of the best modern technologies for undercover depth resolution and are now ready for our first Diamond Drilling program, which is to commence in the next few weeks,” Vigar said.

NXG, BSN, VAL, OKR, 92E and T92 share prices today:

At Stockhead we tell it like it is. While Basin Energy, Valor Resources and 92Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.