When the tech boom unwinds, these fundies say commodities will be there to pounce

Commodities are getting ready to wake from their slumber. Pic: Getty Images

- Mining stocks globally are undervalued, according to New York fund managers Goehring and Rozencwajg

- They think an unwind of the recent ‘carry regime’ could be on the horizon

- At that point, mining stocks with fundamental value will catch investors’ eyes

The quarterly updates of US fund managers Leigh Goehring and Adam Rozencwajg always make for interesting reading.

And there’s even more to be interested about if you’re a commodities bull (of which there aren’t many these days), with G&R taking a deep dive into their pet trade – calling the end of the broader equities bull market and trying to pinpoint the momentum the pendulum swings back to resources.

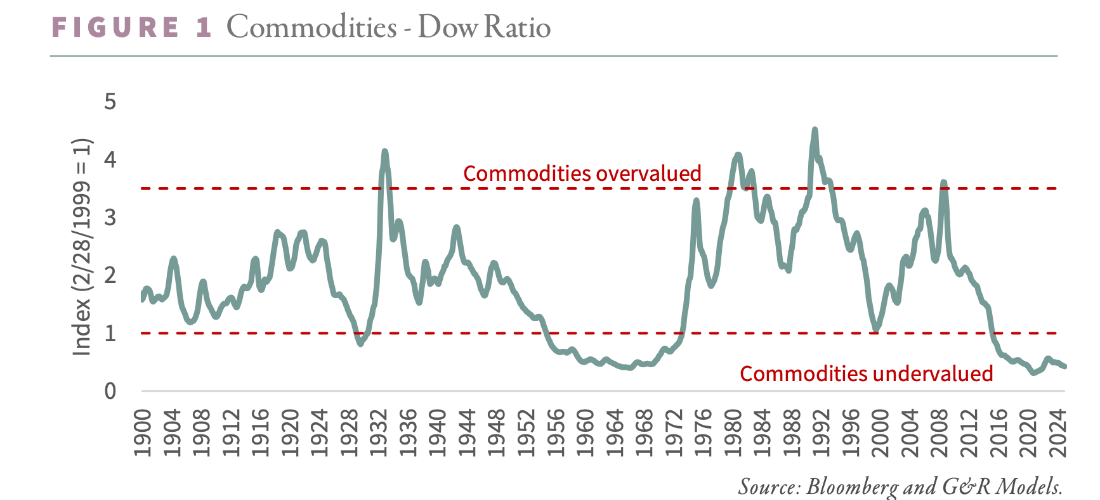

On G&R’s models, which track the relative value to the Dow Jones of mining stocks as far back as 1900, commodities performers have been undervalued for the past decade.

That’s coincided with what they call a ‘carry regime’, a term used by authors Tim Lee, Jamie Lee and Kevin Coldiron in their book The Rise of Carry to describe periods in markets characterised by “suppressed volatility and an abundance of leverage”.

Previously the stocks that have made extraordinary gains in these periods, G&R say, have been high-growth stocks leveraged to technological advancements of the day – radio stocks following the 1929 crash, semiconductors in the 1960s, dot com companies in the late 1990s.

Now Nvidia is the poster child of a “carry regime” led by the Magnificent Seven tech stocks, lifting 500x since 2013.

But G&R think the turnaround for ‘undervalued’ resources stocks is beginning to materialise. And they think it could come with the Trump administration’s arrival and a potential “unforeseen shift” in the global monetary order.

“Historically, every commodity bear market has ended with an unforeseen shift in the global monetary order,” they wrote in a research note last week.

“These so-called “Black Swan” events served as the necessary mechanism to correct the growing distortions in the global financial system and reprice real assets. Each of these shifts was invariably followed by a significant devaluation of the US dollar relative to gold.”

Carry regimes, they say, tend to go on as long as volatility is avoided. But the piling on of consensus that delivers momentum to the trade eventually leaves latecomers vulnerable.

“The more investors pile in, the more yesterday’s trade continues to work today, creating a self-reinforcing cycle,” G&R said.

“Capital floods into momentum strategies, rewarding size over value. Large-cap equities, which attract the most inflows, outperform smaller companies.

“Value investing, which depends on the eventual recognition of mis-pricings, lags behind growth investing, which thrives on investors extrapolating recent success far into the future. Risk premiums compress as volatility remains subdued, driving yields across asset classes toward historically low levels.”

Going to Mar-A-Lago

According to G&R, the last carry unwind came in 2022, when the Ukraine war sent energy prices surging.

“Natural resource equities, by contrast, largely exist outside the carry regime. Unlike long-duration, high-growth assets, they do not attract massive capital inflows during periods of suppressed volatility and cheap financing,” they said.

“Once they begin underperforming, they take on the characteristics least desirable in a carry regime: value and negative momentum.

“As a result, they are systematically starved of capital. However, when the cycle turns, their detachment from the prevailing financial regime can become a rare advantage. During the 2022 carry unwind, energy was one of only two sectors that posted gains, soaring 65% while the broader S&P 500 plunged.”

While highly speculative, G&R say the so-called ‘Mar-A-Lago Accords’ – a reputed set of reforms from the US to restructure the US’ reserves and financial relationship with its allies – could deliver the shock needed to bring about the carry unwind. They say they’d previously assumed the jolt would come from within the BRICS as they pursued efforts to move away from their reliance on the US dollar as a store of value.

“For the first time since we began analyzing commodity cycles, a major catalyst appears to be emerging in the near term. History tells us that these transitions – every one of them – have been marked by a devaluation of the dollar relative to gold,” G&R wrote.

“And if gold is the canary in the coal mine, it is singing loudly. The metal has surged 35% year over year and is already up 11% year-to-date. Perhaps, in its quiet and unambiguous way, gold is signalling that we are fast approaching the turning point. Investors would do well to take notice.

“The assets that thrived under the carry regime are unlikely to perform in the next phase. True diversification – real diversification – will be essential. Natural resource equities, after a strong three-year run, have been mixed in recent months.

“But if history is any guide, this may be the final great buying opportunity before the carry regime unravels and commodities enter their next era of outperformance.”

Gold, uranium, gas

Powerful words, but enough of the crystal ball gazing.

How do G&R feel about the commodities which underlie those mining stocks with their performance?

You’ll find the New York fundies most bullish on the outlooks for gold and uranium.

Some of this will be familiar if you’ve been catching up on your Stockhead of late.

READ: A 10-year bull run: Why gold miners have so much further to go

ALSO READ: Gold Digger: VanEck says gold miners present huge value in bullion boom

“Perhaps the most striking sign of Western apathy is in the gold equities market. Despite gold prices climbing relentlessly since their March 2024 breakout – now up 40% – investor interest in gold stocks has only continued to wane. The number of shares outstanding in the GDX ETF, by far the most popular gold mining stock ETF, has contracted by nearly 20% over the same period,” G&R said.

While gold is up 8% YTD and the GDX gold miners ETF (of the American variety) is up 16%, shares outstanding in the QQQ ETF, which follows the tech heavy Nasdaq 100, is up 3% even with performance up a paltry 2%.

G&R say that’s a disconnect. Investors “continue to pour capital into the most crowded trades while ignoring sectors that are clearly establishing leadership.”

“We do not expect this disinterest to last. Market leadership is shifting, and when Western investors finally take notice, the resulting capital flows could drive an explosive move higher. The gold bull market has begun – it just hasn’t been widely acknowledged yet. But when it is, the revaluation could be swift and dramatic,” G&R conclude.

Uranium has been dicier, with spot prices coming down as speculative buyers take their winnings from the 2022-2023 bull run.

But G&R think the demand backdrop remains strong, with news South Carolina utility Santee Cooper is looking for bids to restart construction of the stalled VC Summer stations showing electricity demand will drive increased nuclear adoption.

The project sent construction manager Westinghouse under when it was canned in 2017, with executives at the contractor and utilities involved later prosecuted over claims they lied about the project’s timeline and cost blowouts.

“If a buyer emerges, it would be another powerful signal that a new investment cycle in nuclear energy is not just beginning – it is accelerating,” G&R claimed.

“The steady stream of positive developments for the nuclear industry shows no signs of slowing. From major corporate commitments to small modular reactor (SMR) investments, to the potential revival of large-scale conventional reactors, the momentum is unmistakable. The long-dormant nuclear renaissance is now underway, and with it, a major structural shift in uranium demand.”

In energy markets like coal, gas and oil, G&R think supply is being overestimated and demand understated.

“Right now, conventional wisdom holds that a sustained bull market in natural gas is impossible. But as the reality of shifting supply fundamentals takes hold, we expect that consensus to unravel. The market is changing – quietly, but decisively. And when recognition comes, it will come quickly,” they said on natural gas.

Copper supply – not so strained?

When it comes to copper, fundamentals at the moment look positive.

But G&R are leaning away from consensus on a couple of points. Firstly, they’re sceptical on the pace of renewables growth, a handbrake on expectations the added pole and wires demand, as well as EV adoption, would see a significant uptick in global copper requirements.

Secondly, they think the narrative that supply is hard to come by could face questions.

“In the first quarter of 2022, we published “The Problem With Copper Supply”, where we detailed widespread forecasting errors among copper market analysts that led to chronic overestimation of future mine supply,” they said.

“Since then, the consensus has shifted toward our view – that mine supply will likely fall well short of expectations as the decade progresses.

“However, our thinking has evolved as well. In the years since we first published that essay, new exploration methods and copper extraction technologies have emerged that could fundamentally alter the supply equation.

“These advances may not only enable the discovery of new copper deposits but also dramatically reduce the cost of extracting copper from low-grade sulfide ores – an area long considered uneconomical.”

The views, information, or opinions expressed in this article are solely those of the fund managers and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.