When the Nullarbor heats up, these are the small caps with first-mover advantage

Pic: Getty

Sirius’ Nova, Sandfire’s DeGrussa or Rio Tinto’s Winu – there’s something about frontier-type mineral discoveries which capture the collective imagination.

And when it comes to making a big mineral find in an under-explored region, ‘first movers’ often have a big advantage.

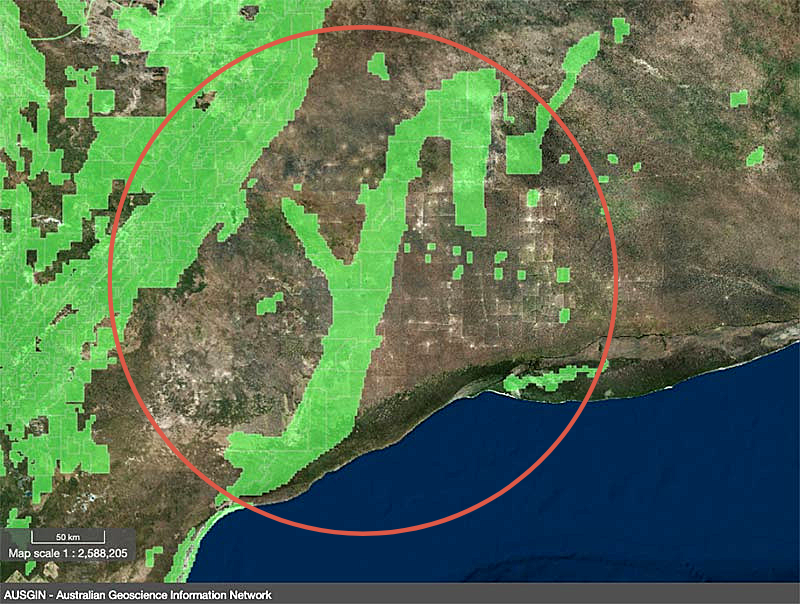

Earlier this year, BHP Nickel West quietly picked up a massive amount of ground in the unknown and untouched Madura Province on the Nullarbor Plain, about 500km east of Kalgoorlie.

They call it “Seahorse”, for obvious reasons.

The semi-arid Nullarbor Plain, which straddles the Western Australian/South Australian border, is the largest area of limestone on Earth.

The reason it’s such a big mineral frontier is because, until recently, no one knew how thick the limestone ‘cap’ was.

But in 2015/2016, a comprehensive set of new geological images were released by the Geological Survey of South Australia, Geoscience Australia, and the Geological Survey of Western Australia.

We now know the cover’s only between 250m and 400m thick – the same sort of thickness as the cover over Olympic Dam. A large, high grade deposit becomes economic at those sorts of depths.

But this is brand new, untouched region, which means that only a handful of explorers have pegged ground so far.

Besides BHP, these include Chalice Gold Mines (ASX:CHN) and Red Metal (ASX:RDM), as well as private companies like Romardo, West Resource Ventures, and Acuity Resources.

It’s unlikely the Nullarbor is a priority target for any of them at the moment. But longer term, these are the guys with first mover advantage when regional exploration really starts ramping up.

One decent mineralised intercept could be all it takes to turn the Nullarbor into the next exploration hotspot.

Red Metal staked ground in the region few years back after the new Geoscience Australia data “opened our eyes to the as yet unproven mineral potential of this region”, managing director Rob Rutherford says.

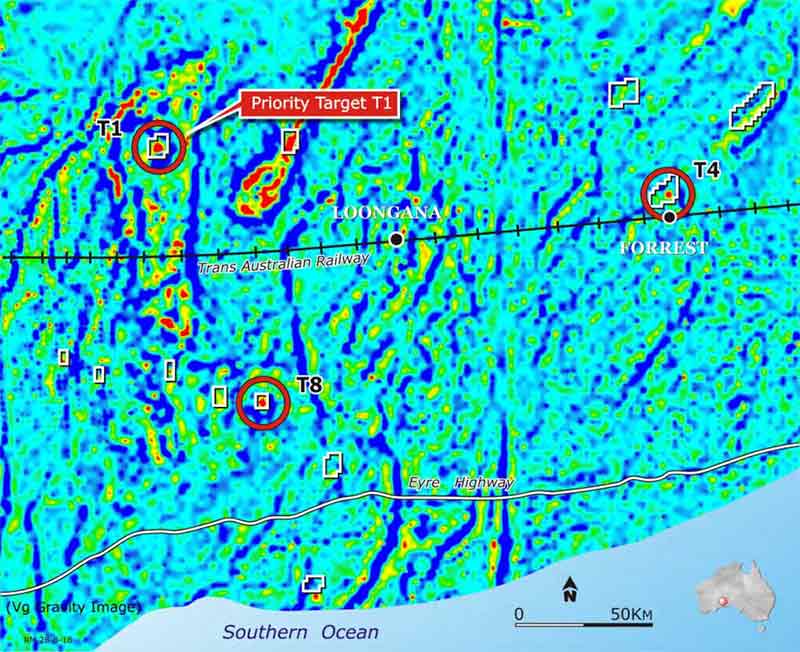

The company immediately pegged a number of regionally significant targets (T1, T4 and T8) considered prospective for IOCG or nickel-copper mineralisation.

“There are very few regions left in Australia where you can be a first mover into a relatively unexplored terrain – this is one of those regions,” Rutherford told Stockhead.

“Based on where BHP (Nickel West) have pegged I would expect that they are looking for Broken Hill-type mineralisation or mafic volcanic and intrusion related copper and nickel styles.

“They certainly have the cash to be able to fund such a large regional endeavour.”

Red Metal’s exploration is not being heavily driven by any one geological model, Rutherford says.

“We are simply aiming to test some of the stronger ore deposit scale geophysical targets with a first drill hole then see what the geology is telling us.”

In January, the explorer signed an $8m Discovery Alliance Agreement with copper producer OZ Minerals (ASX:OZL) to fast-track exploration in a number of areas, including the Nullarbor.

The JV is actively undertaking infill gravity surveying at the moment and hope to do a series of first pass, proof-of-concept holes in the Nullarbor later this year.

“While it is encouraging to see BHP in the Nullarbor region the best validation of our ideas would be a drill hole into some mineralisation,” Rutherford says.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Chalice managing director Alex Dorsch says that the company picked up ground immediately after BHP pegged its huge landholding.

“We made a few enquiries to BHP as to what they were planning,” Dorsch told Stockhead.

“They said Nickel West had basically been unable to do its own exploration for a number of years.

“Now that Nickel West is more of a core business, they have a licence to go out — using the BHP global exploration function — and find something new and something big.”

Dorsch says BHP have gone over the top of tenements held by private prospect generator Romardo, which is managed by former BHP execs with a handful of big discoveries under their collective belt.

“Romardo is headed by Doug Haynes. Doug is one of the discoverers of Olympic Dam – so this is obviously a very well-regarded group of people,” he says.

READ: For investors, this is why ‘prospect generators’ are more likely to deliver the big returns

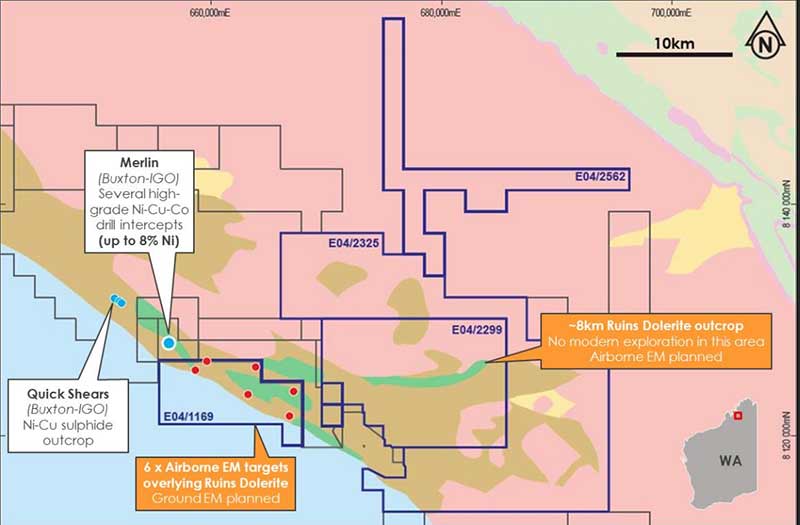

Chalice itself is sitting on a “tadpole shaped” intrusive body, which had just been dropped by a previous explorer.

“So, we went ahead and staked the head and tail of the tadpole shaped magnetic feature,” says Dorsch.

“There has been some previous drilling into it which hit ultra-mafic rocks, so it is definitely a legitimate nickel-copper-PGE target.”

“At this stage our ground is under application, so we have to wait until the end of this year to get them granted. Then we will look to do some ground-based EM to hopefully identify some nickel targets.”

Dorsch says there’s a real benefit to being a first mover into a prospective region.

“You have to keep the pipeline full of opportunities and that’s what we saw in the Nullarbor,” he says.

“It’s not a region that’s going to make the news straight away, but it’s something that we can build on over a few years.”

Last week, Chalice made a play into another frontier nickel province — the west Kimberley region of WA.

The newly acquired Ruins nickel project is right next door to Buxton Resources’ (ASX:BUX) recent nickel sulphide discoveries at the Merlin Project.

Buxton has now entered into two option and earn-in JV agreements with major miner Independence Group (ASX: IGO) in the region.

“We think this another frontier nickel province,” Dorsch says.

“The recent entry by IGO into this largely unexplored province and the substantial ramp-up of exploration activity is a sign that this area is primed for new high-grade nickel sulphide discoveries.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.