What does Chile’s national lithium strategy mean for ASX explorers and developers?

Pan Asia expects to benefit from Chile's national lithium strategy. Pic: Rodeno/iStock via Getty Images

- Chile’s national lithium strategy seeks to increase government participation in mining projects

- Government interest expected to speed up its grant of lithium mining leases

- Pan Asia expects its Tama Atacama lithium project to be a beneficiary

Chile’s recently announced national lithium strategy resulted in much angst amongst explorers and producers operating in the country with some commentators raising the spectre of nationalisation.

However as recent events have shown, concerns might not be quite as dire as predicted.

State-owned Corporación Nacional del Cobre de Chile’s (Codelco) terms for the acquisition of Lithium Power International (ASX:LPI) — a 136% premium to the 30-day volume weighted average price — certainly seems to indicate that Chile might be willing to be fair in its dealings with lithium players.

It certainly provides a great deal of certainty for LPI shareholders, who no longer have to worry about how the company would have gone about developing the Maricunga lithium brine project on its lonesome, but get to sit back and enjoy the immediate returns from Codelco’s offer.

Having the Chilean government so involved in the lithium sector also does not appear to have scared off investment.

China’s Tsingshan Holding Group has committed to investing US$233.2m to set up a lithium iron phosphate battery plant in Chile, which incidentally also provides producers with a domestic offtaker for their lithium.

“Concerns overblown”

Pan Asia Metals (ASX:PAM), which entered Chile’s lithium brine sector in July this year – well after Chile announced its lithium policy — certainly seems to think fears are overblown.

Speaking to Stockhead, managing director Paul Lock said the Boric government’s national lithium strategy is focused on the Salar de Atacama and to a lesser extent Salar de Maricunga.

It is also largely about the contracts between lithium brine operators SQM and Albemarle, and the mining lease owner – the Chilean government.

“Therefore, the conjecture regarding nationalisation of lithium in Chile was grossly misguided as, like any owner of an asset that has been contracted to a third party, when that contract approaches expiry the owner is rightfully placed to act in its own interests, regardless of the entity, its jurisdiction or its nationality,” he said.

“On the matter of Chile’s national lithium strategy though, which seeks to increase government participation in a very lucrative sector via the establishment of a national lithium company, this is not new to global minerals markets, and neither is pre-emptively labelling it a nationalisation.”

He added that the government’s proposed state lithium mining company will require considerably more congressional support than it has received to date, which made its future questionable.

Chile’s national lithium strategy a positive

Lock also pointed out that while Chile had previously been slow to grant lithium mining leases, the new strategy actually plans to award more mining leases.

He added that while some of the new projects will be joint partnerships, specifically those on Salar de Atacama and Salar de Maricunga, this is not the case for other salars and won’t be the case unless the Boric Government gains congressional support.

“What does this mean for other lithium exploration and development companies in Chile? It can only mean good news,” Lock said.

“Already, Chile is one of the most prospective countries for lithium, the country has the largest lithium reserves in the world and some of the most prospective lithium exploration ground to match, and now they’re likely to get bigger.”

Pan Asia certainly believes that it is one of those companies that will benefit from the change.

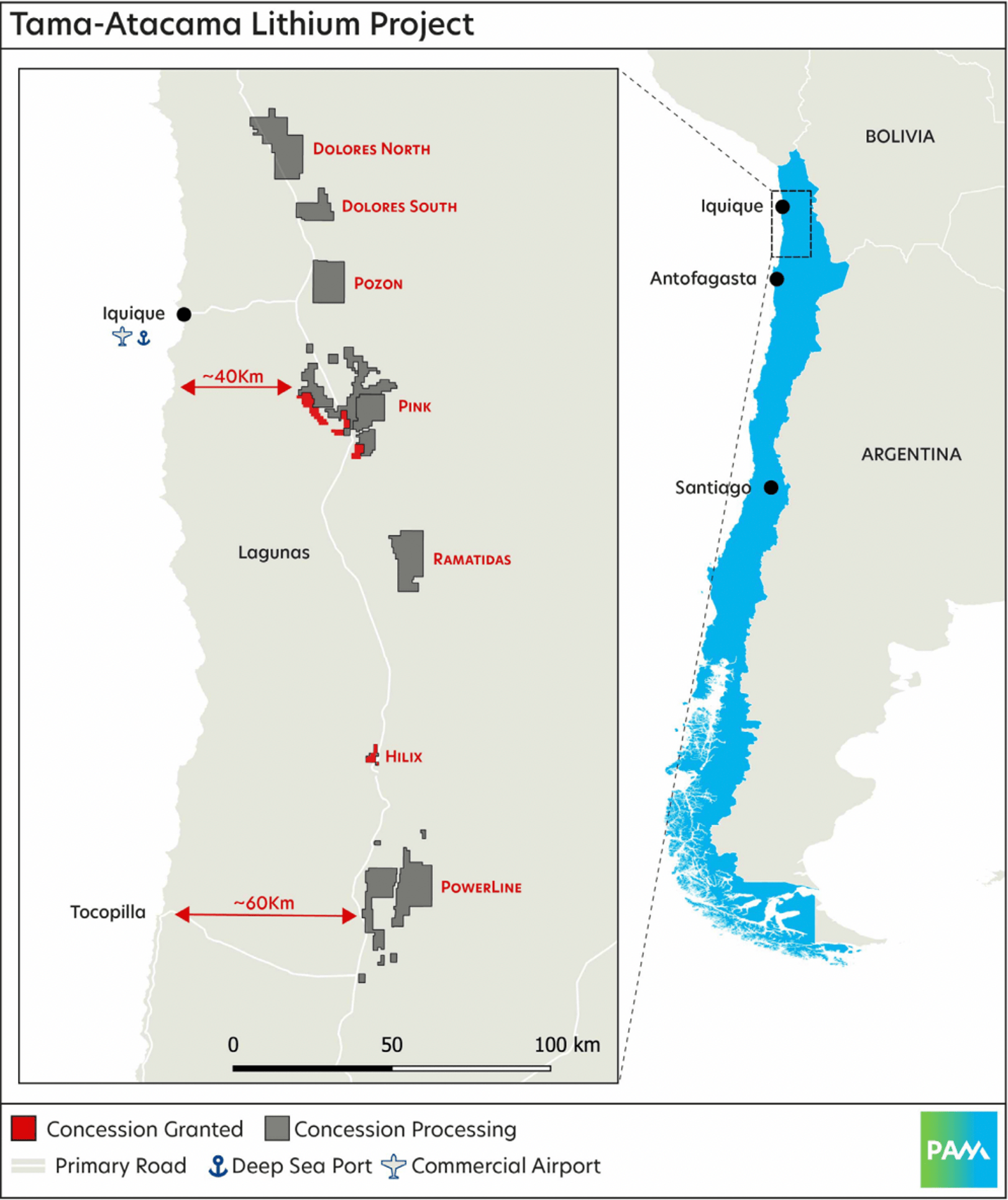

Its Tama Atacama lithium project in Chile consist of six project areas that collectively cover ~1,600km2 or ~13% of the highly prized Pampa del Tamarugal Basin.

Previous sampling has already returned some of the highest grade lithium in surface assays seen in the whole South American lithium brine peer group with 57 of 185 samples returning >250 parts per million lithium and topping up at 2,200ppm lithium.

Tama Atacama covers the Salar Dolores, Pintados and Belavista salars salt lakes that are at much lower elevations than any other lithium rich salars in the global lithium peer group.

While still well positioned for evaporation, the lower elevation also offers options for water replacement options such as the use of sea water to replace brine.

Importantly, for the company, Tama Atacama meets the requirement for high prospective projects which are easily accessible, close to all key infrastructure, with ample water supply.

It has access to excellent infrastructure including major highway access via the Pan Americana 5 Highway, water (salt and fresh), solar power, nearby ports, airports and major logistics hubs.

Targets already locked in

Pan Asia is already positioned to jump straight into exploration at Tama Atacama.

A review has been carried out on data from historical seismic surveying carried out in the 1960s over the Pink, Pozon and Dolores lithium brine prospects, which are interpreted to cover a total area of 1,000km2, half of the prospective lithium brine target area at the project.

At the Pink prospect, the results confirmed that deep basin sediments about 400-600m thick are present while historical groundwater investigations have confirmed shallow saline aquifers that correspond with highly-elevated lithium in surface salt crusts

The company also identified a 2,000km2 area of elevated chlorine levels – a proxy for brine, that corresponds with its surface assays.

Results are currently pending for additional surface geochemical samples acquired by Pan Asia while both geophysical exploration and drilling are being planned.

Upcoming activity

Pan Asia is currently in a trading halt in relation to a capital raising by way of a placement that will be managed by GBA Capital.

The company is also confident that it is well positioned to attract a strategic partner for Tama Atacama, which is greater than 50 times the size of Lithium Power’s Maricunga project.

Preparation work, including discussions with government and drilling contractors, is also underway.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.