What a ripper! De Grey’s Hemi study has everyone hopping on board Australia’s next big gold producer

All eyes are on De Grey after a DFS of the 6Moz Hemi deposit shows gold production will average 530,000oz over an initial 10 years. Pic via Getty Images.

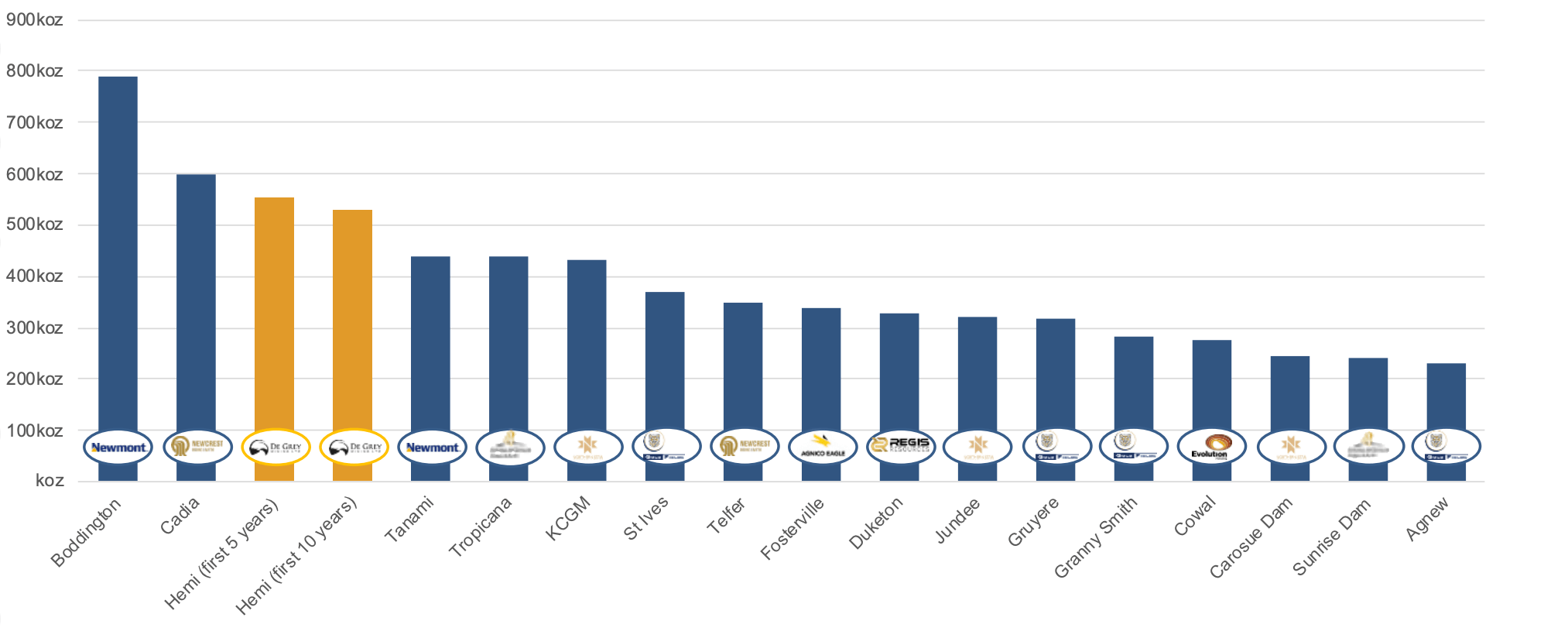

- The DFS envisages 530,000ozpa over the initial 10 years at Hemi, making it a future top-5 Australian gold mine

- All in sustaining costs (AISC) pencilled in at a low $1,299/oz with payback on the $1.3bn capex in 1.8 years

- $300m is being raised to support development-work, with first gold targeted for H2 2026

De Grey Mining’s Board has given the go ahead to push ahead with pre-development activities as it prepares for environmental approvals and a final investment on the world-class Hemi gold project in the Pilbara.

The development of Hemi would catapult De Grey Mining’s (ASX:DEG) into one of the ASX’s biggest gold producers, according to a project DFS released today.

Less than four years old, the Hemi discovery is now comfortably one of the largest Australian gold developments in recent decades.

On a global scale, it stands out as one of the top three undeveloped gold projects based on annual production and is right at the lower end of capital intensity for its scale of production.

Alongside its spectacular gold endowment, the project has also been fortunate with its location in the major mining services centre of the Pilbara with world-class infrastructure on tap.

“De Grey’s Board has endorsed the outcomes of the DFS and approved the commencement of preliminary Project development activities,” Managing Director Glenn Jardine says.

“These activities include ordering critical path long lead items, continuing detailed engineering and refining the Project execution plan, advancing major tenders and finalising the contracting strategy.

“This will establish the platform for a Final Investment Decision and full Project financing next year ahead of the start of construction, targeted for the second half of 2024.”

Superb financials: An AISC of $1,229/oz

It’s not hard to see why the Board is pressing ahead. With the Aussie dollar gold price currently sitting at $2,942/oz, the potential margins from Hemi are exceptional.

Let’s look at the production metrics:

- Years 1-5 are projected to yield an average of 553,000oz of gold at a cost of $1,229/oz

- Years 1-10, average production of 530,000oz of gold at a cost of $1,295/oz

- Year 2 expected peak production @ 570,000oz gold

In terms of financials:

- Free cash flow projections of $6.3bn pre-tax and $4.5bn post-tax

- NPV of $4.2bn pre-tax and $2.9bn post-tax @ a 5% discount rate

- IRR of 45% pre-tax and 36% post-tax

- Capex estimate for the 10Mtpa plant infrastructure @ $1.298bn

- Short payback period of 1.5yrs pre-tax and 1.8yrs post-tax

The strong economics are driven from the world-class gold endowment, highlighted by a 6 million ounce Ore Reserve being released alongside the DFS. The Ore Reserves contribute 99% of the DFS production profile, giving investors and potential financiers a higher degree of confidence in the DFS estimates.

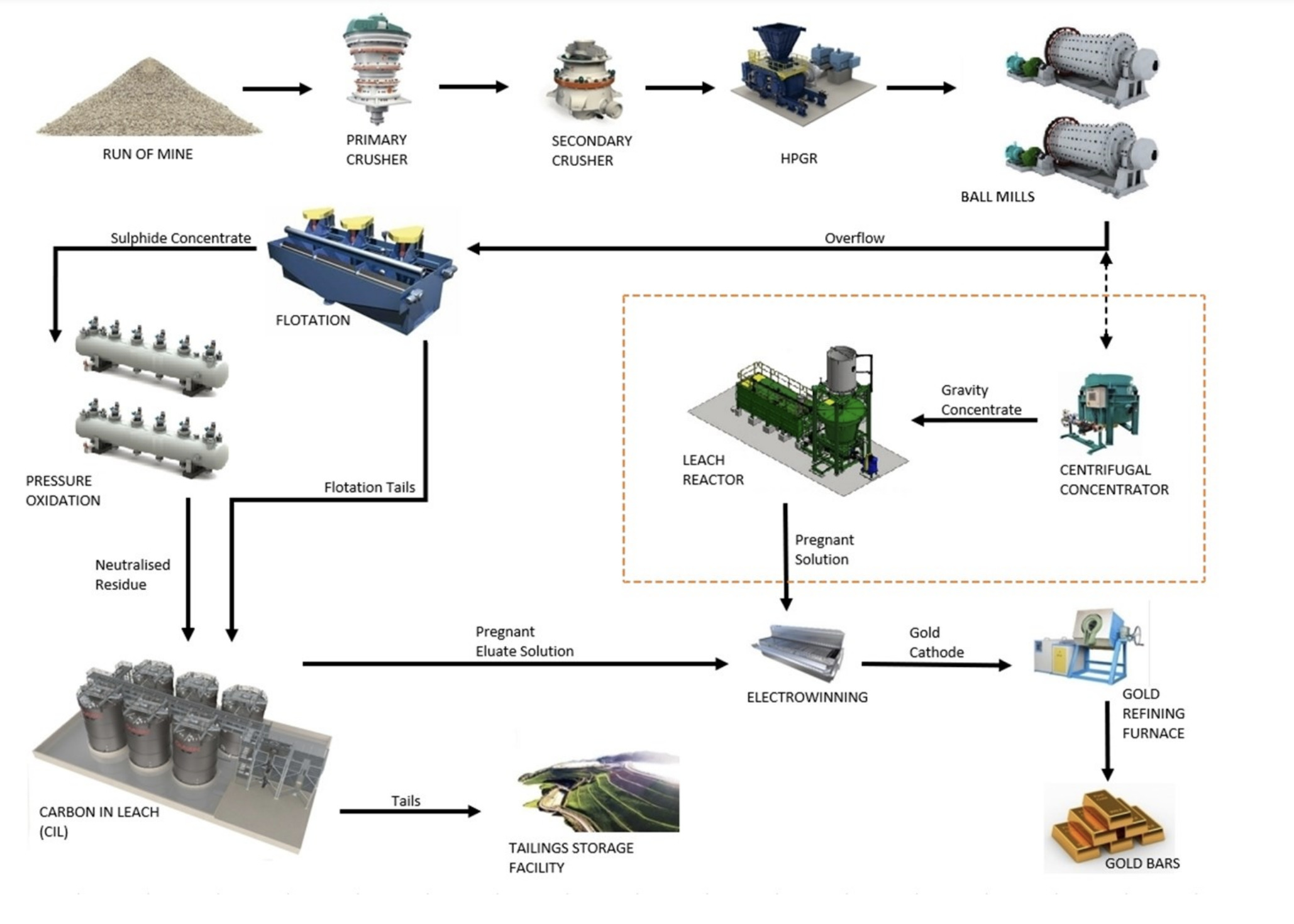

This gold will be extracted from a handful of large, low cost open pit mines and processed in a 10 million tonne per annum plant, located within 4km of all of the Hemi deposits.

$300m raise to drive Hemi development

In tandem with its DFS, DEG has rattled the tin for $300m in a two-tranche institutional placement at $1.05/sh – a 12% discount to the 5-day VWAP.

Major shareholder Gold Road will subscribe to Tranche 1 for 49,438,097 new shares, representing 19.9% of the capital raise.

The funds will be used for pre-development activities, including detailed engineering, contracts and early works ahead of a final investment decision (FID).

DEG will also use some of the capital to continue exploration drilling across Greater Hemi and regional areas within its tenements, with completion of project financing expected mid-next year ahead of the FID.

“With the delivery of the DFS our exploration team can now put greater focus on making our next transformational gold discovery in the region,” Jardine says.

What’s ahead for Hemi?

Flexibility is key to adapting to changing conditions, and the Hemi project is taking this principle to heart with a DFS plant design that’s been crafted with allowances for its scalability.

Additional opportunities that will be assessed include potential underground mining and the construction of a regional concentrator feeding the Hemi plant from the 2.2 million ounces of resources outside of Hemi.

Open pit designs at Hemi reach a maximum depth of 390m below surface. Within it lies a huge mineral endowment of 23,500oz per vertical metre.

Below 390m, a current 1Moz MRE has been calculated based on very limited drilling at Hemi below 400m.

“We believe there remains potential to increase the mine life and production profile of the Project,” Jardine says.

In the near term there is potential to further expand and optimise the Diucon and Eagle open pits based on extensional drill results reported after the DFS mine design cut-off date.

“With further drilling, there is scope to materially increase the scale of this mineralisation with potential for underground mining,” Jardine says.

This article was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.