Western investors return to gold as ETFs power demand to record levels

Pic: Getty Images

- Gold demand eclipsed US$100 billion for the first time in a quarter in the three months to September 30: WGC

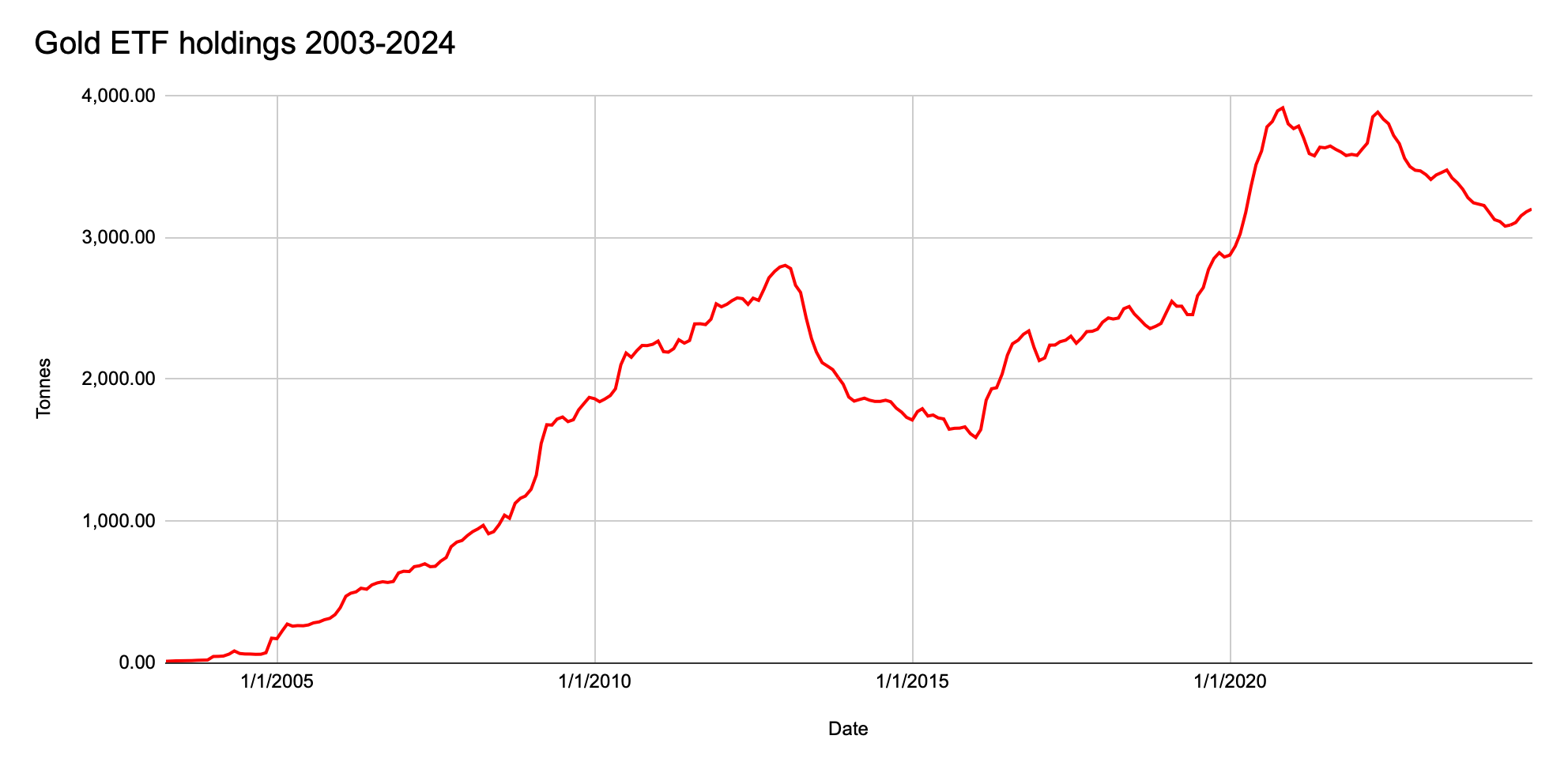

- Gold ETFs have reported inflows for the past six months, with demand in the West returning

- WGC market strategist John Reade says there remains opportunities for demand to rise further as interest rate cuts reawaken North America and Europe

Global gold demand has lifted to over US$100 billion in a quarter for the first time in the three months to September 30 as western investors returned to the safe haven commodity and exchange traded fund inflows turned positive.

The return of retail and institutional demand for gold ETFs in the past six months, reported by the World Gold Council in its latest demand trends report, has released one of the few handbrakes on the gold market as futures soared to a record US$2790.70/oz yesterday.

Gold demand rose 5% YoY to a record for a September quarter at 1313t, according to the WGC.

That places a solid foundation beneath more abstract rationale for the rising price of gold like geopolitical risk and interest rate cuts.

WGC market strategist John Reade, who has spent over four decades attuned to the movements of the gold sector, said there remained more slack for the demand side to pick up as falling interest rates in Europe and the US shifted demand growth back from emerging to developed market.

“If it wasn’t for ETFs then demand would look particularly weak compared to what it ended up doing,” he said.

“The one positive highlight I’d say from Q3 has been the turnaround in ETF demand, particularly western demand.”

Return to favour

While recent years have seen gold prices rise alongside record central bank investment demand, ETFs in the US and Europe have sat on the sidelines.

The past six months have seen overall inflows in ETFs, with a run in Asian domiciled ETFs now followed by North American and European retail and institutional investors.

“Chinese and Indian domiciled ETFs are much smaller than the ETFs in North America and Europe,” Reade said.

“But they’re up about 50% in tonnage terms this year, so they’re a big part of the story.

“But … for the third quarter has come from the West, both North American and Europe, more into North America in both tonnage terms and assets under management.

“I guess the key thing here has been the declines in interest rates we’ve started to see.

“We’ve seen gold demand dominated in the last few years by emerging market buyers, whether that’s emerging market central banks, whether it’s emerging market jewellery demand, with its retail investment, even the bits of pieces of ETF demand we’ve seen.

“As some of that demand has started to slow, a resumption of western demand which we can see beginning with the ETFs is really positive.”

Gold investment demand more than doubled globally in the September quarter to 364t, with ETFs adding 95t in their first overall positive quarter since the first quarter of 2022.

Bar and coin demand, however, fell 9% and continues to lag in the West. It’s still up strongly on the decade YTD average of 774t this year at 859t.

Reade sees a revival in North American and European bar and coin demand as a key opportunity for gold.

“The bar and coin market globally is a lot bigger than the ETF market, so it’s a really important barometer to see that people are buying physically in investment form as well as buying it via ETFs,” he said.

“The recovery that we’ve seen in Western ETFs in Q3 is a really positive sign that Western gold demand is recovering, but it’s not recovered yet (and) there’s more work to be done.”

In Australia, gold ETFs attracted US$203m in new investment in the September quarter, with bar and coin purchases up 8%. That came even as a 19% drop in jewellery demand led to a 5% fall in Australian gold consumption.

Assets under management in Aussie gold ETFs hit a record US$3.6bn on the back of record gold prices.

Good for equities

Reade says the return of Western gold demand could be positive for gold producers as well.

“If you think about it, where the strength has come from in recent years – emerging market investors buy gold but they don’t buy gold equities,” he said.

“The gold equity market may not have been getting as much love as it should have done because gold as a category has fallen out of favour a little bit in the West.

“Now there are signs of that beginning to return. But to me I think keeping an eye on what’;s happening to the sentiment towards gold in Western markets is really important in terms of what happens to the equities.”

But there remains room for gold demand to go higher, Reade says, with inflows into ETFs still relatively small in recent months and bar and coin demand in the West yet to recover.

“There is the potential for investors to own quite a lot of gold if the right triggers come along and those triggers could be further declines in interest rates.”

The US Fed delivered a 50bps rate cut in September, its first since rate hikes began in March 2022.

The CME Fedwatch Tool suggests a 99% chance of a 25bps cut at the next meeting of the board of governors in a week to 4.5-4.75% and 52.6% chance of rates dropping to 4-4.25% by the end of January.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.