Western Gold to toll-treat Gold Duke and transition to producer

Western Gold Resources is close to gold production after executing a binding toll milling agreement for its Gold Duke project. Pic: Getty Images

- Western Gold Resources executes binding toll milling agreement for Gold Duke project

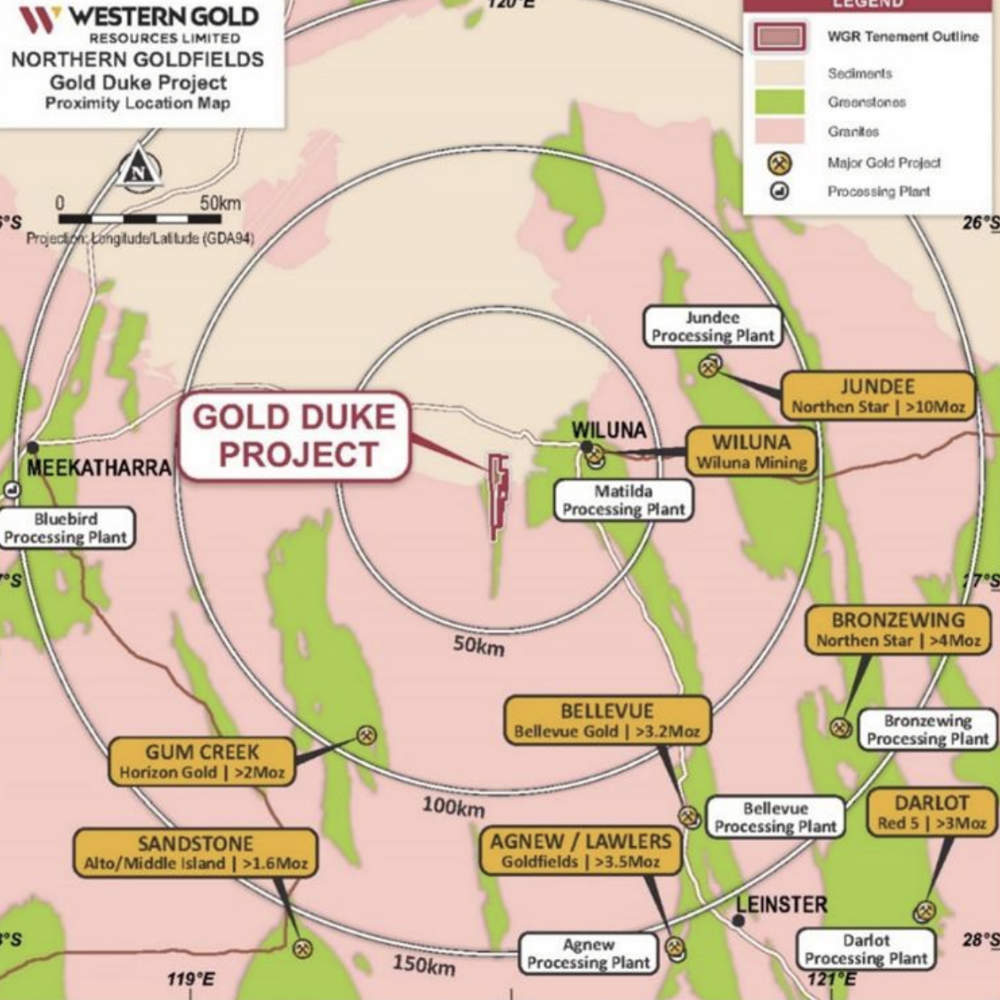

- Ore from the project will be processed at WMC’s Matilda processing plant about 46km away

- With all mining approvals in place and contractors secured, deal paves the way for gold production

Special Report: Western Gold Resources could soon be enjoying the fruits of the high gold price environment after reaching a binding toll milling agreement with WMC for its Gold Duke project in WA’s Northern Goldfields.

Under the 24 month contract, which WMC can extend for a further six months, ore from the project will be processed at the Matilda processing plant.

The conventional carbon-in-leach facility is the closest and most logical third-party processing facility as it is just 46km away – enabling low-cost haulage and proximity to established infrastructure.

This provides Western Gold Resources (ASX:WGR) with a defined processing solution to support staged development of the Gold Duke project.

Under the 2024 scoping study, the company had forecast an undiscounted cash surplus of $38.1 million from stage 1 production of 34,000oz of gold from the Eagle, Emu, Gold King and Golden Monarch deposits.

However, this was based on an assumed gold price of $3500/oz, well below the current Australian gold price above the $5100/oz mark.

“Securing this agreement represents a critical step in our path to production. With a nearby, established processing facility now in place, and all required approvals and contractors secured, WGR is well positioned to transition to be a gold producer,” managing director Cullum Winn said.

Toll treatment

WGR is responsible for delivery of the ore to WMC’s ROM pad, while WMC will undertake crushing, processing and delivery to the refinery.

The company will retain title to the ore during this process.

Processing will be undertaken on a campaign basis over a 24-month term.

All mining approvals are in place for the four mining pits and SSH Group (ASX:SSH) has been appointed as preferred mining contractor – an appointment that will become binding on execution of a master services agreement.

Earlier this year, a review of brownfield targets such as Bottom Camp, Joyners Find, Emu/Eagle Saddle Zone, Gold King and Gold Monarch Saddle Zone as well as Bower Bird and Comedy King indicated a high likelihood of adding to project scale and operational flexibility.

All of these are outside the proposed optimised pit designs for the four pits covered by the scoping study and could support extensions to the Life of Mine (LOM).

This article was developed in collaboration with Western Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.