West Wits wants to start mining Pilbara gold this year

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

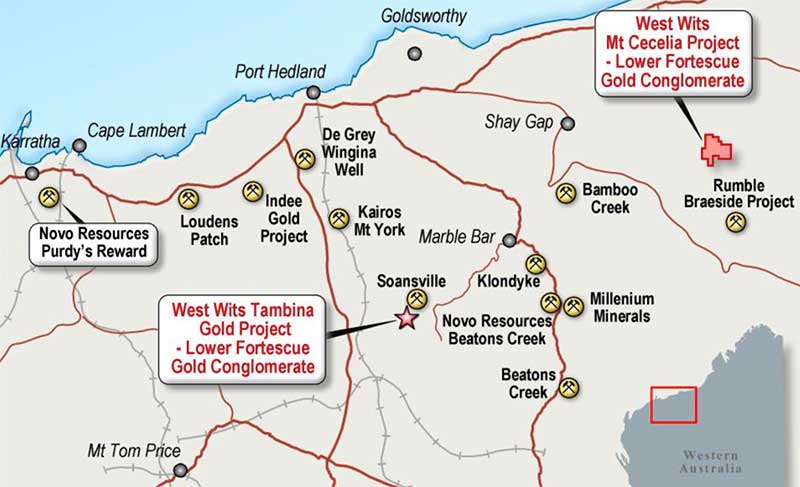

West Wits Mining is aiming to restart small scale mining at its newly acquired Tambina project in Western Australia’s Pilbara region later this year.

“The Board has decided to take an opportunistic approach to the Tambina asset and is now actively reviewing plans to recommence small-scale mining operations there, post an upcoming site visit by the geology team to identify conglomerate hosted gold targets,” chairman Michael Quinert told investors.

West Wits is the only ASX-listed junior to have landholdings with conglomerate-hosted gold in both South Africa’s Witwatersrand Basin and the Pilbara.

The Witwatersrand Basin, or the Wits for short, is a geological formation that houses the world’s biggest known gold reserves, producing about half the world’s gold.

West Wits has already started small-scale mining in South Africa. Its goal is to become a 100,000-ounce producer from a massive landholding in the Central Rand, which alone has produced 275 million ounces.

Since gold nuggets were discovered in the West Pilbara last year by Artemis Resources (ASX:ARV) and its Canadian partner Novo Resources, there has been a rush of explorers looking to grab ground in the area.

In November last year, West Wits announced it was acquiring Tambina Gold, which has the right to acquire three gold mining licences that have a small-scale mining operation already in place.

The geology is similar to Artemis’ and Novo’s Purdy’s Reward project in the West Pilbara and West Wits’ other recently acquired Pilbara asset, the Mount Cecelia project — which are both part of the Lower Fortescue Group.

The Fortescue Group is made up of mafic volcanic rocks found in the Fortescue Basin in the Pilbara Craton which are known to host gold and other minerals.

The restart of mining potentially could result in Tambina contributing modest cashflow toward year end, West Wits said.

In the first two months of the year, West Wits produced 1510 ounces of gold from its South African operations, which generated cash flow at the upper end of the company’s $400,000 to $500,000 target.

West Wits shares fell 9 per cent to 2c on Wednesday. The stock touched a high of 3.3c a year ago.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.