West Wits’ South African project has right resource in the right location, CEO says

South Africa is a top 5 gold mining country historically. Pic: via Getty Images.

Gold explorer West Wits Mining‘s Witwatersrand Basin Project (WBP) sits in the centre of arguably the largest and richest gold region on Earth – the Witwatersrand Goldfields of South Africa.

The Basin holds the world’s largest known gold reserves and has produced over 1.5 billion ounces (over 40,000 metric tons), which impressively represents about 22% of all the gold accounted for above the surface.

And with a project boasting a resource of 4.28Moz at 4.58g/t, West Wits Mining’s (ASX:WWI) CEO and MD Jac van Heerden says the company stands out for value amongst peer junior gold developers trading on the ASX like $336m market cap Predictive Discovery (ASX:PDI) with its Bankan project resource of 3.85Moz at 1.72g/t, or Canadian player Auteco (ASX:AUT) with its Pickle Crow project resource of 2.8 Moz at 7.2 g/t and market cap of $90m.

“We believe that there is a splendid opportunity for small caps in SA,” he said.

“We have a JORC Resource of 4.28Moz at 4.58g/t gold with a Phase 1 Definitive Feasibility Study (DFS) showing a LOM of 17 years and with production ranging from 55koz-60koz per annum.

Plus, the project is close to infrastructure, power, labour and production hubs, and its shallow deposit ranges from 50-800m below surface, unlike the average of other projects in SA being up to 2,000m below surface.

Eyes on a final investment decision

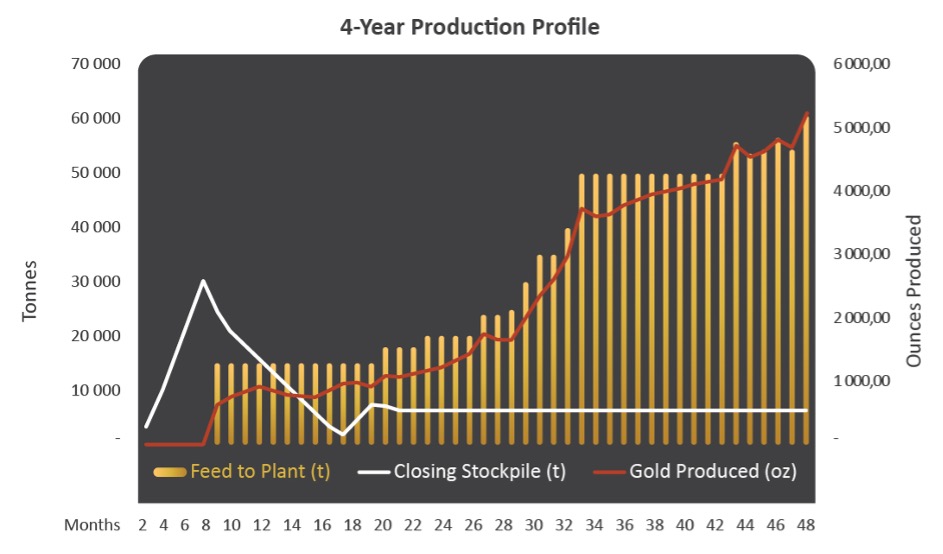

WWI’s Phase 1 Qala Shallows’ DFS supports an underground mining operation with a robust rate of 3.2Mt at 2.81g/t recovered grade for total production 680,000oz Au over a 17-year Life-of-Mine.

To date, the company has undertaken significant capital works to establish the project mine site, including surface infrastructure and the refurbished decline shaft – which will allow it to get in production in a short time frame once funding is secured.

“The company is in the process of securing the funding for the project and once in place, development of the mine and production will commence,” van Heerden said.

“Our DFS has indicated that at a gold price of US$1750/oz and an exchange rate of ZAR15/USD the project will have a Pre-Tax NPV of US$180m and a IRR of 38% and at steady state the mine will operate at a ASIC of $962/oz,” van Heerden added.

“The peak funding requirement will be $63m at the mentioned gold price and exchange rates, but in the current environment, the peak funding will be a lot less.

“The mine will reach full production over a period of three years, and then with a repayment period of two years after full production has been reached.”

Uranium mineralisation a bonus

But it isn’t just gold that makes the project compelling, van Heerden says, with the inclusion of uranium as a targeted mineral at the Bird Reef Sequence – a nice value-add to the WBP.

“This opportunity is significant as it will allow the company to mine uranium concurrently with the gold bearing reefs within the Bird Reef sequence, therefore potentially claiming gold and uranium credits from the same mining activities using the same infrastructure,” he said.

“West Wits Mining offers investors significant leverage to the gold price with 4.28m oz at 4.58g/t.

“And we offer exposure also to rising uranium prices with a exploration target of 12m to 16m pounds of uranium in the Bird Reef deposit which can be extracted as a by-product credit.”

This article was developed in collaboration with West Wits Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.