West African gold miner Tietto Minerals gains 23pc on ASX debut

Pic: Schroptschop / E+ via Getty Images

The ASX’s newest gold explorer Tietto Minerals gained as much as 55 per cent on Thursday following a $6 million Initial Public Offering.

Tietto shares (ASX:TIE) were issued at 20c and commenced trade at 25.5c before reaching highs of 31c.

The shares closed Thursday at 24.5c.

Tietto are sizing up gold prospects in the Ivory Coast and Liberia in West Africa, areas they say have the largest proportion of gold prospective belts in the area.

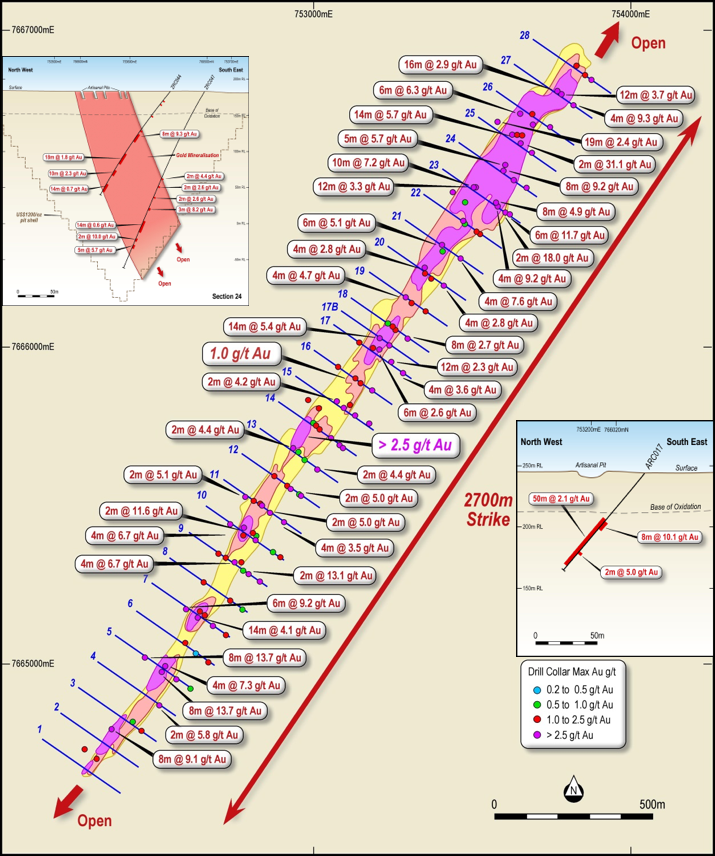

Their main focus is on the Abujar Project in Cote d’Ivorie, which has a maiden mineral resource estimate of 10.4 million tonnes at 2.1g/t Au for 703,600 ounces of gold.

The three tenements in the area total 1114 sq km of land area 30km from the major city of Daloa, of which only 5 per cent has been explored previously.

“At Abujar, Tietto has more than 70km of mineralised strike to explore. The existing resource forms less than 3km of that strike length, and has been drilled to an average depth of only 180m, providing a strong opportunity for Tietto to rapidly expand that resource through planned programs of up to 30,000 of RC and DD drilling during 2018,” managing director Dr Caigen Wang told the market.

They say the Ivory Coast is substantially under-explored relative to Mali, Burkina Faso and Ghana – hoping to follow the success of Rangold Resource’s (LON:RRS) Tongon mine which produces 320,000 ounces or Endeavour Mining’s (TSE:EDV) Ity and Agbaou mines which together produce over 280,000 ounces.

Tietto say their immediate goals are to expand the JORC resource estimate at Abujar, and to commence intensive exploration as well as exploring its other projects in Liberia.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.