West African gold explorer Sarama Resources gearing up to list on the ASX next month

Pic: Tyler Stableford / Stone via Getty Images

- The gold explorer is already listed on the TSX

- The Sanutura deposit hosts 2.9Moz on the Houndé Belt

- CEO Andrew Dinning was previously CEO of Moto Gold Mines

TSX listed Sarama Resources is gearing up to list on the ASX next month and CEO Andrew Dinning says the company is confident that its gold projects in Burkina Faso have got the potential to grow.

And its flagship Sanutura project is already pretty big, with mineral resource of 2.9Moz, including 9.4Mt at 1.9g/t for 600,000oz in the indicated category and 52.7Mt at 1.4g/t for 2.3Moz inferred.

“Sanutura is a bit over 1400 square kilometres, and that’s currently got just under 3 million ounces of resource on it – and that underpins the value of the company,” Dinning said.

“Within the next 12 months our main focus is exploration, we’ve got 50,000m of drilling lined up for Sanutura and that’s mostly extensional exploration drilling.

“There’s already a substantial resource that underpins the value of the project, but there’s still a lot of exploration runway left in that project.

“We’ve got our guys already mobilised in Burkina so as soon as the cash from the IPO hits, we’ll start drilling.”

Strategic landholding in a prolific gold belt

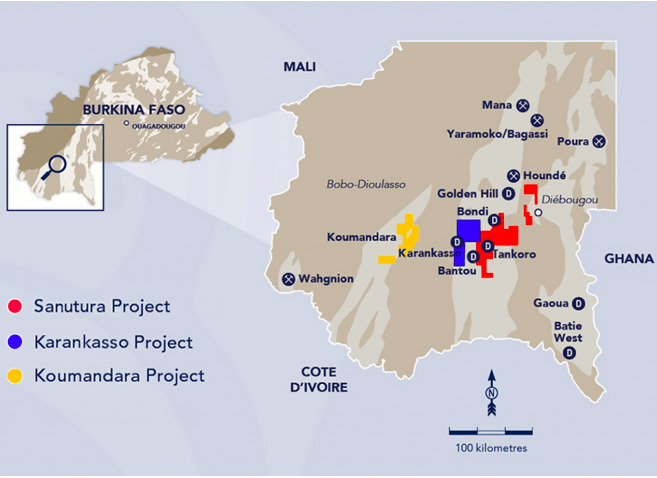

Not only is Sanutura a large land package with a large resource, it’s on the Houndé Belt.

“It’s probably the most prolific gold belt in Burkina and one of the most prolific belts in West Africa,” Dinning said.

“There’s already several substantial mines on that belt and we control 70km length of it.”

Plus, Sanutura has two deposits on it, and the bigger one Tankoro is 2.5 million ounces – and it’s just up the road from Endeavour Mining’s Houndé mine.

“Endeavour has got ground to the west of us and six kilometres away where they’ve got another 1.5 million ounces,” Dinning says.

“The land holding is highly strategic from that point of view, because there’s 4 million ounces within a 6km radius of Tankoro.

“So, we’ve got a big land holding within a belt that has a lot of substantial deposits already.”

Solid credentials in front and behind the camera

Notably, Dinning is a gold-mining veteran.

He was previously COO of Moto Gold Mines which found the 22Moz Kibali deposit in the DRC – a company that got taken out by Randgold (now Barrick) and AngloGold Ashanti for US$600 million in 2009.

And $2 billion market cap gold producer Silver Lake Resources (ASX:SLR) is already a major shareholder in the company with 11%.

Plus, US hedge fund Sun Valley Gold holds a 15% stake in the company.

Not just a one trick pony

Dinning flagged that Sarama is not just a “one trick pony” and there will be plenty of news flow post-listing.

“There’s a lot of strategic value to the asset base that we’ve got, we’ve got line of sight to mine development, we’ve got a very big oxide resource already – and that will allow us to build fairly plain vanilla mine initially to build the operation,” he said.

“We’ve got a highly strategic land position, it’s large, 100% owned, the value of the company is underpinned by the current resource, there’s still a lot of exploration runway and relative to our peer group, we trade at a pretty heavy discount.”

Sarama is aiming to raise $8 million at $0.21 per CHESS depositary interest.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.