West Africa: A tale of risk and reward

Pic via Getty Images

Few regions have experienced as much growth in their mining and exploration sectors over the last three decades than West Africa. So too, unfortunately, has the risk profile for investors.

West Africa is a big region. Sixteen countries crammed into more than 5 million km2. That’s a lot of prospective exploration ground to cover – in theory, of course.

It is no surprise that several intrepid Australians were among the first modern-day explorers to test the region’s mineral potential in the early 2000s as large parts of West Africa began to open up for business following the end of many long-running civil wars in countries such as Liberia, Sierra Leone and Côte d’Ivoire.

Ampella Mining and Orbis Gold both made multimillion ounce discoveries in Burkina Faso before being acquired by larger companies, as did Gryphon Minerals where Steve Parsons of Bellevue Gold (ASX:BGL) and now Firefly Metals (ASX:FFM) fame originally made a name for himself.

Perseus Mining (ASX:PRU) went one better and developed its Edikan discovery in Ghana into a profitable mining operation and is now stands as one of the region’s most formidable gold producing companies.

Other gold explorers to have successfully transitioned into production in recent years include West African Resources (ASX:WAF) and Tietto Minerals (ASX:TIE), while the likes of Leo Lithium (ASX:LLL) and Atlantic Lithium (ASX:A11) are looking to emulate those feats in West Africa’s emerging lithium space in the coming years.

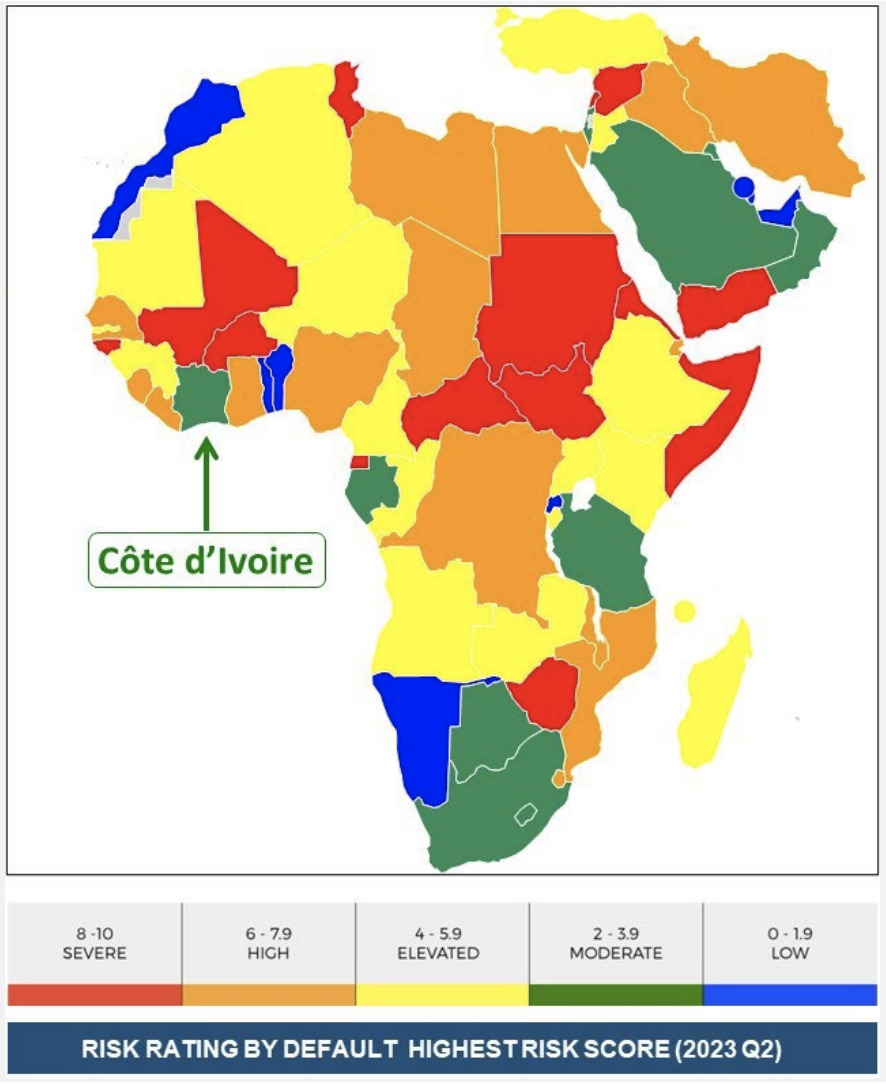

Unfortunately for many of those currently exploring or operating in the region, geopolitical issues continue to be the biggest hurdle when it comes to landing and maintaining long-term investment.

Investors received an untimely reminder of how quickly things can turn in West Africa only a fortnight ago when Sierra Rutile Holdings (ASX:SRX) announced it had no choice but to suspend production from its longstanding Area 1 operations in Sierra Leone after receiving notice from its host country government that the current fiscal arrangements would revert back to the original terms signed in 2001, rendering the mine “uneconomic”.

Last year the Government of Mali ordered Leo Lithium to cease initial DSO operations from its Goulamina project. Shares in the company have been suspended since September last year while it works towards what managing director Simon Hay recently described as “a constructive resolution” with government officials to build West Africa’s first major spodumene mine.

There are also extreme security concerns hanging over Mali and neighbouring Burkina Faso. Since 2012, Islamist insurgents have progressively taken control of the former and in recent years the violent attacks have spilled over into the latter where WAF is now essentially the only active ASX-listed company.

Given West Africa’s ongoing geopolitical issues was once again a key topic of discussion at the annual Investing in African Mining Indaba conference in Cape Town last week, Stockhead spoke to some of the senior leaders of companies committed to exploring and developing projects in the region.

‘Some of the richest resources in the world’

It has been a whirlwind five months for First Lithium (ASX:FL1) since completing the acquisition of the Gouna permit in Mali.

Undoubtedly the highlight was a discovery intercept of 111m @ 1.57% Li2O at the Blakala prospect, which was first identified alongside Goulamina as one of two Tier-1 lithium targets in Mali by CSA Global back in 2008.

However, perhaps due in part to Leo Lithium’s travails at Goulamina as well as sputtering lithium prices, FL1’s success with the drill bit is not being reflected in its share price, which peaked as high as 83c following the discovery in December before tailing off over the next two months.

Despite this, FL1 director Jason Ferris says interest in the company remains strong, particularly with a maiden resource for Blakala due in the near term.

“We closed the prospectus for our September listing on the ASX oversubscribed and we’ve had great support from high-net-worth investors, as well as the broking community,” Ferris told Stockhead.

“The project announcements are starting to paint a picture of the size of the potential deposit for FL1, and major shareholders remain enthusiastic and motivated about bringing the company’s maiden JORC resource to the market.

“Given the background and potential of the project, due to its location and status as a Tier-1 target within Mali, we consider the appetite to remain strong within our own investor base, however, as the maiden resource gets closer, we expect the wider investor community will begin to take notice.

“West Africa has some of the richest resources in the world and has been identified as one of the largest worldwide growth regions over the next 20-30 years. Leo Lithium and Kodal Minerals (LON:KOD) have been operating in West Africa for a number of years and have both enjoyed continued investment, as and when required over that time.”

Location, location, location

According to Ferris, FL1 often fields questions from investors about where its permits lie in relation to the ongoing Mali conflict as well as what the company is doing to keep key personnel safe in such a high-risk jurisdiction.

Gouna sits about 200km southeast of Mali’s Bamako capital, with most of the terrorist activity confined to the north of the country.

“As with any foreign country, we advise all of our workers to remain vigilant and act with care, and where possible, our teams are supported by security at all times,” Ferris says.

“This sounds excessive to any developed Western civilisation, however, is considered standard and best practice in many African regions, not just West Africa.”

Ferris added the company had received nothing but support from the Mali Government since first setting foot in the country last year and also remains unperturbed about the challenges which have halted Leo Lithium’s progress at the nearby Goulamina project over the past year or so.

“The Mali Government is a progressive and motivated government looking to develop Mali as a business and investment destination and expand its untapped resources,” he says.

“Although Leo Lithium have had some adverse experience, we believe this has come about through some miscommunications and misunderstandings, however, should be resolved at any moment,” he says.

“We remain very confident in the Government of Mali and jointly look forward to delivering further positive news flow for the country.”

Attracting capital despite a high-risk profile

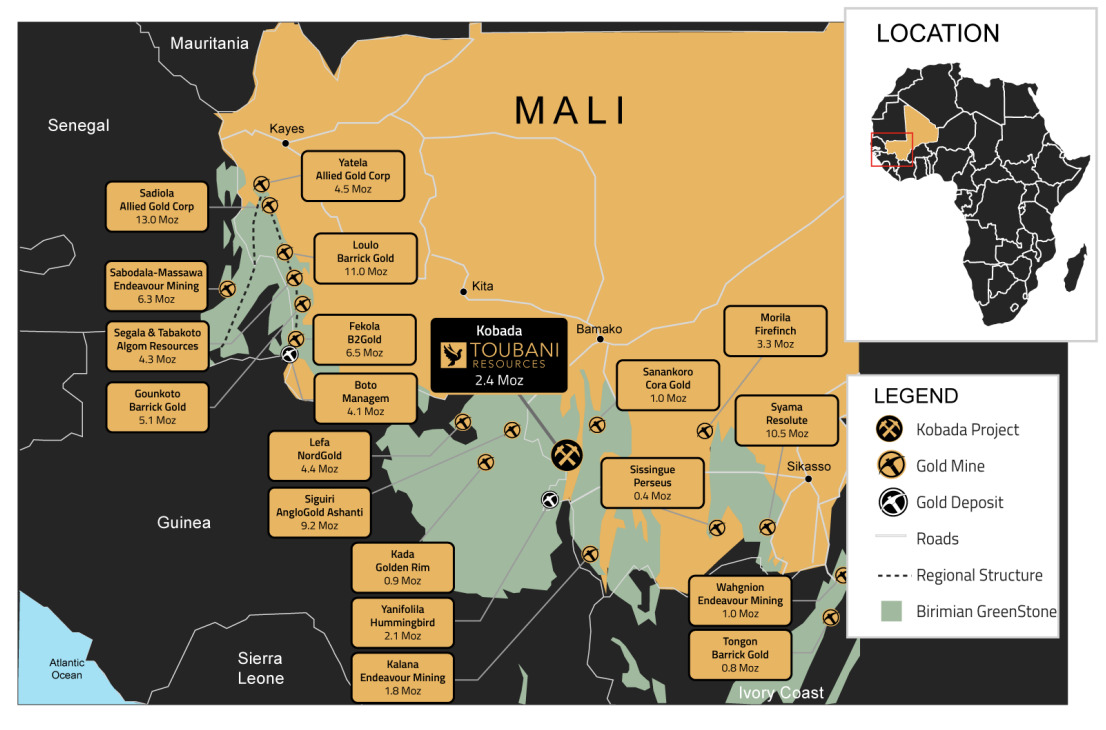

Gold developer Toubani Resources (ASX:TRE) is also keeping a close eye on Leo Lithium’s negotiations with the Malian Government given the potential ramifications it could have for its flagship Kobada project.

Like Ferris, TRE chief executive Phil Russo holds no concerns over Mali’s commitment to developing new mines, nor its ability to support existing producers such as Resolute Mining (ASX:RSG) to continue operating without geopolitical interruption.

“I’m really constructive on West Africa, and specifically Mali, in terms of its ability to support its mining industry,” Russo tells Stockhead.

“Discussions around geopolitical risk and the other factors at play in the region are going to happen, but for us, it’s about delivering a project that will attract capital through all the types of risk profiles.

“I think we’re going to see some positive signs with respect to the recent mining code implementation in Mali, I think the industry gets back on its feet over there this year. It’s an elevated profile right now, but we all know that for good projects, capital still finds a way through the door.”

Russo’s main pitch to investors at this week’s Indaba focused on TRE being the leader of a small group of single-asset developers remaining in West Africa.

While overcoming the geopolitical hurdles in Mali is just part of the almighty challenge that Russo and his team will face in the quest to develop Kobada, it is worth noting WAF not only finished the construction phase but exceeded all production benchmarks in the first 12 months at its Sanbrado gold mine in Burkina Faso during the height of the COVID pandemic and amid growing security concerns in the country.

TIE also brought its +3.8Moz Abujar gold project in commercial production within 18 months of breaking ground in Côte d’Ivoire.

A coup here and a coup there, but should we be concerned?

Burkina Faso in no stranger to a military coup and in 2022 experienced two in just nine months.

Violence in the country has now got to a point where almost all ASX-listed companies bar WAF have either indefinitely paused work on their projects or exited entirely.

Mako Gold (ASX:MKG) originally listed in 2018 on the back of early-stage exploration assets in Côte d’Ivoire and Burkina Faso, but is now solely focused on the former after the company’s directors conceded it was no longer safe for its geologists to continue working in the latter.

A veteran of the West African resources industry, MKG managing director Peter Ledwidge was working for Orbis Gold in Burkina Faso at the time of the 2014 uprising. He says many investors make the mistake of grouping one African country’s problems with the next.

“It’s amazing how many of them don’t realise how diverse Africa is, there’s over 50 countries that constitute Africa,” Ledwidge told Stockhead.

“Just because you have a coup in one country, they often assume it’s going to happen in the next one.

“And speaking of coups, look at Guinea, Niger, Burkina and Mali – they’ve all had coups recently with no fatalities, not a single one.

“It’s actually no different than a few years ago when our prime ministers were stabbing each other in the backs here in Australia and all of a sudden you had a new face in charge of the country.”

At Stockhead, we tell it like it is. While First Lithium, Toubani Resources and Mako Gold are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.