We need US$200bn of new mining projects by 2030, but no one wants to build them

Pic: Via Getty

- US$200 billion of new ‘transition metal’ mining projects are required by 2030 to meet demand: Wood Mackenzie

- But new investment suffers as mining companies prioritise debt reduction over exploration and development

- Wood Mackenzie predicts price volatility for copper, lithium, graphite for years to come

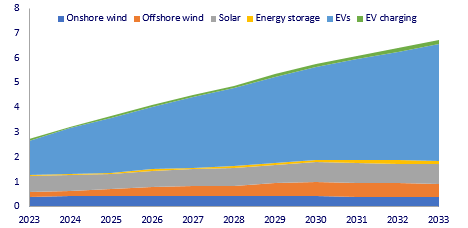

US$200 billion of new ‘transition metal’ mining projects are required by 2030 to meet demand, as well as more efficient and creative methods of recycling, says Nick Pickens, research director of global mining at Wood Mackenzie.

$US200bn – let that sink in a minute.

The 10 critical minerals projects on Australia’s Major Projects list – projects that are economically significant to the country — would cost a total $7.615bn (US$4.86bn) to build. A speck in the cosmos, Carl Sagan might say.

The new forecast supports a late 2022 prediction from pricing agency Benchmark Mineral Intelligence that at least 330 new graphite, lithium, nickel, and cobalt mines are needed in the next 12 years.

Just build them. What’s the problem?

Soft pricing for metals like copper, lithium, graphite and cobalt makes new projects and operational expansions unattractive.

Wood Mackenzie’s James Whiteside says new investment will suffer as mining companies prioritise debt reduction over exploration and development.

“A preponderant concentration on meeting shareholder pay-out expectations takes precedence, while endeavours associated with growth and decarbonisation take a backseat,” Whiteside says.

“Most companies are committing less the 10% of capex to decarbonisation and renewables, and even less on exploration and evaluation.”

This is also known as ‘kicking the can down the road’

Lack of investment leads to volatility in pricing as supply plays catchup with demand, sometimes temporarily overshooting it, before heading back into deficit.

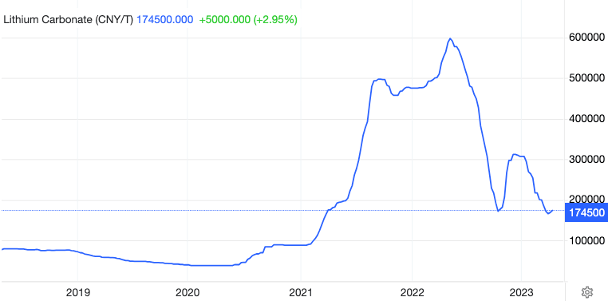

This is what volatility looks like:

A cobalt, graphite or vanadium chart would reveal similar wild swings.

When prices are low no one wants to add or replace production capacity. That leads to undersupply, high prices, and a scramble to explore and build.

This last part can take years.

“A 7-10-year lead time for new mining projects makes meeting supply/demand requirements difficult,” Pickens says.

Even “shovel ready” projects can take 1-2 years to ramp up to nameplate capacity once construction starts. Sometimes they fail completely.

“Combined with mid-term uncertainties for demand and metal prices, the situation does create some serious headwinds for the metals super-cycle,” he says.

This is good news for investors. Sustained higher prices usually means a flood of money into established major producers, up and coming miners, and even flavour-of-the-month shitcos.

More extreme volatility is to be expected in smaller, more undeveloped markets like lithium, graphite, and cobalt over the next several years as they mature, Wood Mackenzie says.

But even copper – already one of the world’s most traded metals — will be volatile as end-users clamour for the metal to support increased electrification.

“Products such as copper wire rod and electrodeposited foil are used extensively in the manufacture of electric vehicles [EVs] and renewable energy equipment,” Pickens says.

“This means investment in support infrastructure to underpin copper end-use demand is essential moving forward.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.