We need 10 new REE mines by 2030 to meet magnet rare earths demand

Pic: cynoclub, iStock / Getty Images Plus

- “For magnets in particular, by 2030 we are talking about a 70% increase in total demand”: Wood Mackenzie

- World needs +10 NdPr-dominant projects in production by 2030

- Probably “only 3-4 [projects like this] which are close to coming into production, and they are still several years away”: Lindian Resources

Rare earths sentiment is flying.

In mid-2021 we counted ~15 REE-focused stocks on the ASX.

Now there are ~50, with new stocks are added to the list almost daily.

| CODE | COMPANY | 1 YEAR RETURN % | 1 MONTH RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|

| DM1 | Desert Metals | 79% | 127% | 0.5 | $23,995,909.00 |

| WC1 | Westcobarmetals | 0% | 117% | 0.25 | $7,687,518.75 |

| KFM | Kingfisher Mining | 177% | 89% | 0.54 | $23,892,300.54 |

| WCN | White Cliff Min Ltd | 62% | 83% | 0.021 | $15,699,670.60 |

| RR1 | Reach Resources Ltd | -22% | 75% | 0.007 | $13,370,354.47 |

| EMT | Emetals Limited | -15% | 70% | 0.017 | $14,450,000.00 |

| M24 | Mamba Exploration | -24% | 53% | 0.145 | $6,115,375.44 |

| AOA | Ausmon Resorces | 21% | 42% | 0.0085 | $6,858,314.74 |

| ABX | ABX Group Limited | 42% | 31% | 0.17 | $38,010,438.38 |

| ARU | Arafura Resource Ltd | 124% | 27% | 0.38 | $655,337,194.70 |

| LIN | Lindian Resources | 917% | 23% | 0.295 | $250,262,368.84 |

| ITM | Itech Minerals Ltd | 0% | 23% | 0.435 | $39,512,500.29 |

| ODE | Odessa Minerals Ltd | 300% | 21% | 0.02 | $10,743,022.16 |

| DRE | Dreadnought Resources Ltd | 216% | 20% | 0.12 | $365,104,026.12 |

| TAR | Taruga Minerals | -40% | 19% | 0.032 | $18,497,543.68 |

| MOH | Moho Resources | -54% | 15% | 0.03 | $4,983,892.92 |

| LOT | Lotus Resources Ltd | -12% | 10% | 0.23 | $304,958,987.43 |

| PTR | Petratherm Ltd | 53% | 9% | 0.0795 | $17,867,715.55 |

| VMS | Venture Minerals | -47% | 7% | 0.029 | $48,646,270.17 |

| REE | Rarex Limited | -41% | 5% | 0.062 | $35,335,445.36 |

| AOU | Auroch Minerals Ltd | -59% | 4% | 0.072 | $26,348,937.73 |

| GRL | Godolphin Resources | -43% | 1% | 0.089 | $10,534,880.78 |

| MRD | Mount Ridley Mines | 25% | 0% | 0.005 | $29,374,854.71 |

| IDA | Indiana Resources | 7% | -2% | 0.062 | $29,840,898.78 |

| KTA | Krakatoa Resources | -13% | -2% | 0.062 | $21,372,014.85 |

| ILU | Iluka Resources | 3% | -2% | 9.27 | $4,136,305,358.25 |

| NTU | Northern Min Ltd | -11% | -2% | 0.04 | $194,419,651.96 |

| NWM | Norwest Minerals | -41% | -4% | 0.044 | $9,772,725.03 |

| AS2 | Askarimetalslimited | 55% | -4% | 0.325 | $14,647,512.75 |

| HAS | Hastings Tech Met | -16% | -6% | 4.11 | $479,496,922.98 |

| AR3 | Austrare | -63% | -6% | 0.365 | $34,748,566.48 |

| ARR | American Rare Earths | 34% | -8% | 0.235 | $104,429,487.77 |

| VML | Vital Metals Limited | -39% | -10% | 0.037 | $193,279,509.28 |

| HRE | Heavy Rare Earths | 0% | -10% | 0.18 | $10,707,827.40 |

| IXR | Ionic Rare Earths | 17% | -11% | 0.042 | $162,649,406.64 |

| LYC | Lynas Rare Earths | 14% | -11% | 7.86 | $7,331,089,761.00 |

| RMX | Red Mount Min Ltd | -33% | -14% | 0.006 | $9,854,183.15 |

| GGG | Greenland Minerals | -58% | -16% | 0.052 | $70,498,688.62 |

| 1VG | Victory Goldfields | -21% | -18% | 0.205 | $7,883,920.14 |

| MEK | Meeka Metals Limited | 43% | -19% | 0.066 | $69,857,189.49 |

| RBX | Resource B | -56% | -25% | 0.09 | $3,687,884.73 |

| M2R | Miramar | -52% | -26% | 0.1 | $6,739,599.62 |

| ASM | Ausstratmaterials | -76% | -30% | 2.47 | $375,974,443.06 |

| PVW | PVW Res Ltd | -15% | -37% | 0.17 | $15,348,609.38 |

Over the past few months, exploration stocks have been rewarded for buying REE projects, reviving REE projects, or unearthing REE prospectivity in existing projects.

Why the step change in investor sentiment?

One: EV and wind turbine demand is about to go exponential

Firstly, there is the expectation that demand for magnet rare earths — the main two being neodymium and praseodymium — will increase rapidly alongside growth in the EV and wind power sectors.

Ionic Rare Earths (ASX:IXR) is developing the large scale Makuutu ionic adsorption clay (IAC) deposit, which the company says has one of the highest value ‘baskets’ of all REE projects in evaluation today.

Ionic share price chart

43% of the REEs produced will be magnet rare earths, it says, which also contribute a massive 93% of forecast value from the project.

“There is about 750g of magnet rare earths on every EV motor,” IXR managing director Tim Harrison told Stockhead.

That adds up quickly if BNEF’s prediction is correct and ~40m EVs are sold each year by 2030.

Then there’s the gigantic offshore wind turbines.

“Some of the beasts they are building now have 6 tonnes of magnets in them, or about 2 tonnes of rare earth metals,” Harrison says.

“And then you look at the number of wind turbines set to be installed over the next 30 years … and yeah. There’s a [supply] conundrum.

“This is an application where substitution is not an option.”

So, there it is. Two industries, growing exponentially, in tandem, and both requiring large amounts of rare earths.

Wood Mackenzie rare earths expert David Merriman says the increase in total rare earths demand to 2030 is just ~38%, but when you break it down it becomes much more interesting.

“For magnets in particular, by 2030 we are talking about a 70% increase in total demand, which is really what is driving the growth in the rare earths market,” he told Stockhead.

Two: The move to combat China’s REE dominance is gathering steam

China’s total dominance in the rare earths industry has been identified as a major problem by other major global powers.

About 95% of the world’s heavy rare earths come from China and neighbouring Myanmar. All that production is effectively funnelled through China’s downstream industry, then used domestically or exported overseas.

In 2009, prices shot through the roof when a diplomatic dispute saw China unofficially block rare earth exports to Japan. As tensions rise globally, governments are worried it could happen again.

There’s been a lot of talk about establishing downstream processing ex-China, but for a while it has been mostly talk and not a huge amount of action.

But there are moves in the right direction.

Earlier this month, the Pentagon delayed deliveries of new F-35 aircraft after Lockheed Martin determined that all 825 of the fighters delivered so far contain Chinese rare earth magnets illegal under US law and Pentagon regulations.

While the Defence department doesn’t consume a huge amount of magnet rare earths, the announcement itself was significant.

“The fact they reported out to the press is telling — this is the direction they are going, and they will increasingly enforce that into the future,” Merriman says.

How many operations need to come online to meet predicted magnet REE demand?

Benchmark Mineral Intelligence expects we will need at least 336 new graphite, lithium, nickel, and cobalt mines in the next 12 years to feed a 500% increase in battery demand by 2035.

But what about magnet rare earths?

Lindian Resources (ASX:LIN) has rerated heavily since making a deal to acquire ‘Kangankunde’, one of the world’s largest REE projects outside China.

Lindian share price chart

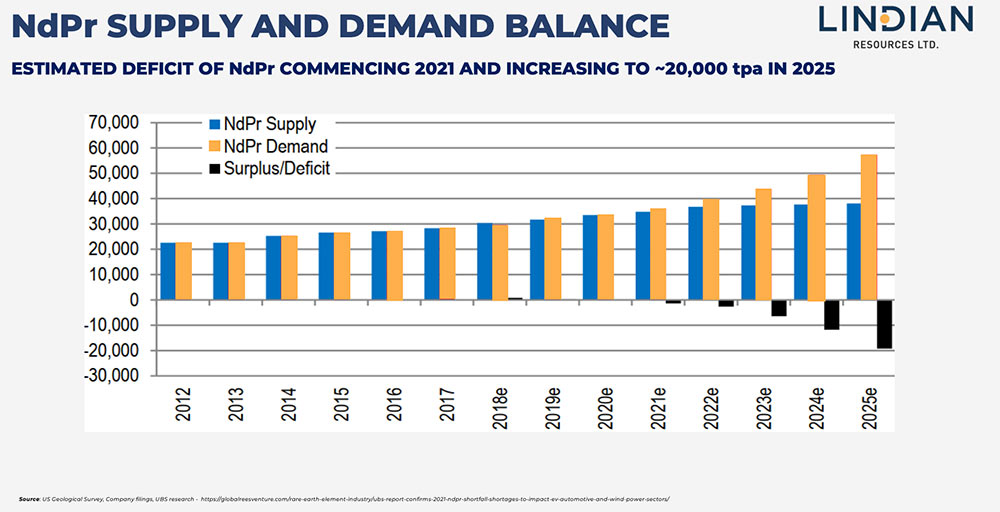

LIN boss Alistair Stephens says NdPr deficits are already widening.

We’ll need an extra 45,000t of extra NdPr for EVs by 2030, he tells Stockhead, and near-term Western operations will struggle to meet that shortfall.

“[Near term producer] Arafura (ASX:ARU) is talking about 15,000tpa in total, of which about 4,400tpa is NdPr,” he says.

“The numbers don’t even scratch the surface.”

That’s at least 10 of ARU’s flagship NdPr-dominant Nolans projects in production by 2030 to meet magnet demand.

“And there are probably only three or four [projects like this] which are close to coming into production, and they are still several years away,” Stephens says.

“That’s a lot of mines for EVs, and we haven’t even talked about wind turbines, which use a few tonnes themselves.”

Arafura share price chart

Is this lithium boom 2.0?

The early stage of the lithium boom was volatile, but, since early 2021, the thematic has gone from strength to strength. Stephens says the same story could play out in the REE space.

“[Lithium demand] is not going to abate; there will be more lithium mines coming online, more capacity, more demand. It is a huge growth market.

“You will see exactly the same thing in rare earths.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.