‘We maintain our buy rating’: Gold explorer Predictive bounces back after Sprott quashes environmental concerns

Pic: Via Getty

Yesterday, popular goldie Predictive Discovery (ASX:PDI) fell 25% after announcing it was getting ahead of a “pending media report questioning the legality for the company to establish mining operations” at the flagship Bankan project in Guinea.

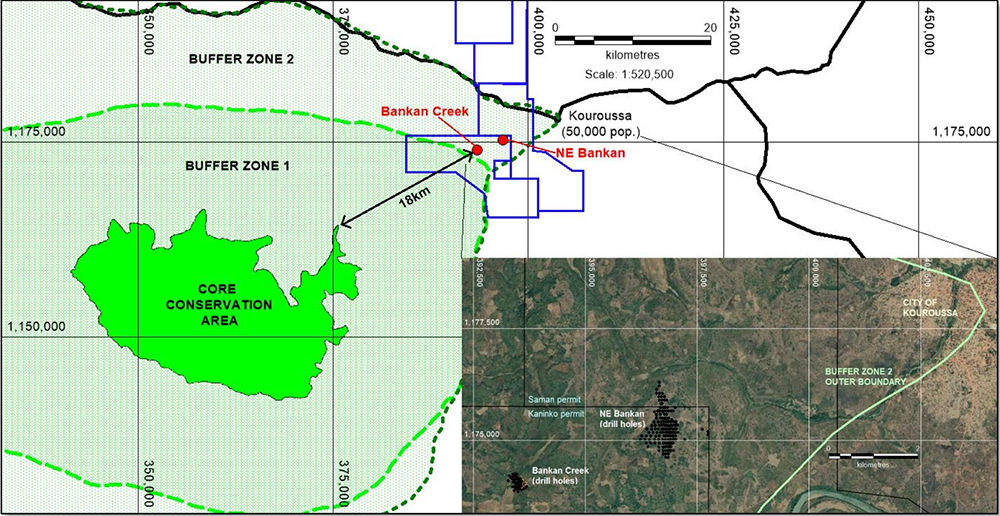

PDI acknowledged the flagship Bankan project in Guinea was in the ‘Outer Buffer Zone’ of the Upper Niger National Park.

While exploration permits are all in good standing, PDI mentions that “the Upper Niger National Park is a protected area where the mining of mineral deposits is not permitted”.

Mining is years away, and there are plenty of precedents for mining permits to be granted in the national park, it says — but the news still scared some investors.

Zone well into the regional centre, the City of Kouroussa. Pic: PDI

Sprott says PDI still undervalued, reinforces 42c price target

In a note released overnight, Sprott clarified that this news isn’t new, with the National Park of Upper Niger well flagged on Google Maps.

However, with a recent maiden resource of 3.646 million ounces now in the books Bankan is no longer just an early stage discovery, an need to be treated a development prospect, it says.

“We’re glad CEO Paul Roberts is travelling to Guinea shortly to do just that,” Sprott says.

“Mining on excised cut-outs of national parks is common globally, in EU, Africa and elsewhere (in this case the buffer zone is peripheral to the core protection zone).”

“With the outer buffer already denuded (including the regional capital), post PFS / EISA as part of mining licence application we expect the area to be excised as is practice in the western world.”

Gazetted in 1997 with the buffer added in 2002, the opportunity of an excise and additional funding to protect the core/ wider park could be win-win, Sprott says.

“In emerging markets, Western miners adopting high ESG standards very simply improve the livelihood, health and wellbeing where they operate,” it says.

“In Predictive’s case, our valuation includes A$1bn of tax, A$400m in royalties and A$360m minority interest payments to the government; life-changing funds for the people of Guinea.”

As a result, “we maintain our BUY rating”, Sprott said.

The fund has a price target of 42c, based on implied gold price of US$1,850 and an indicative valuation of 0.4xNAV (net asset value).

“We see this as a buying opportunity with the stock trading at 0.16xNAV,” Sprott said.

“We remind investors that African names are high on headline / volatility risk,” Sprott said.

Have, they also have “far less precedent of permitting fails or nationalisation than elsewhere, with share prices typically recovering from moves like this”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.