WA’s first-class critical minerals province has a new up and comer

Dalaroo holds large ground positions in regions deemed prospective for new world class discoveries. Pic via Getty Images.

The harsh and remote setting of WA’s Gascoyne region is rapidly emerging as one of the hottest critical mineral jurisdictions and with $1m in the till, Dalaroo’s ready to get cracking with exploration.

The Harjinder Kehal-led explorer is on the hunt for two of the spiciest green-tech metals needed to drive the world’s transition to decarbonisation.

As crucial components for a range of different renewable energy technologies from batteries to offshore wind turbines and EV motors; lithium, and rare earth elements (REEs) have become two highly sought after ‘must have’ minerals for ASX explorers.

Around 14 million electric vehicles are expected to be sold this year, up 35% YoY against 2022, and experts claim there could be over 400 million on the world’s roads by 2030.

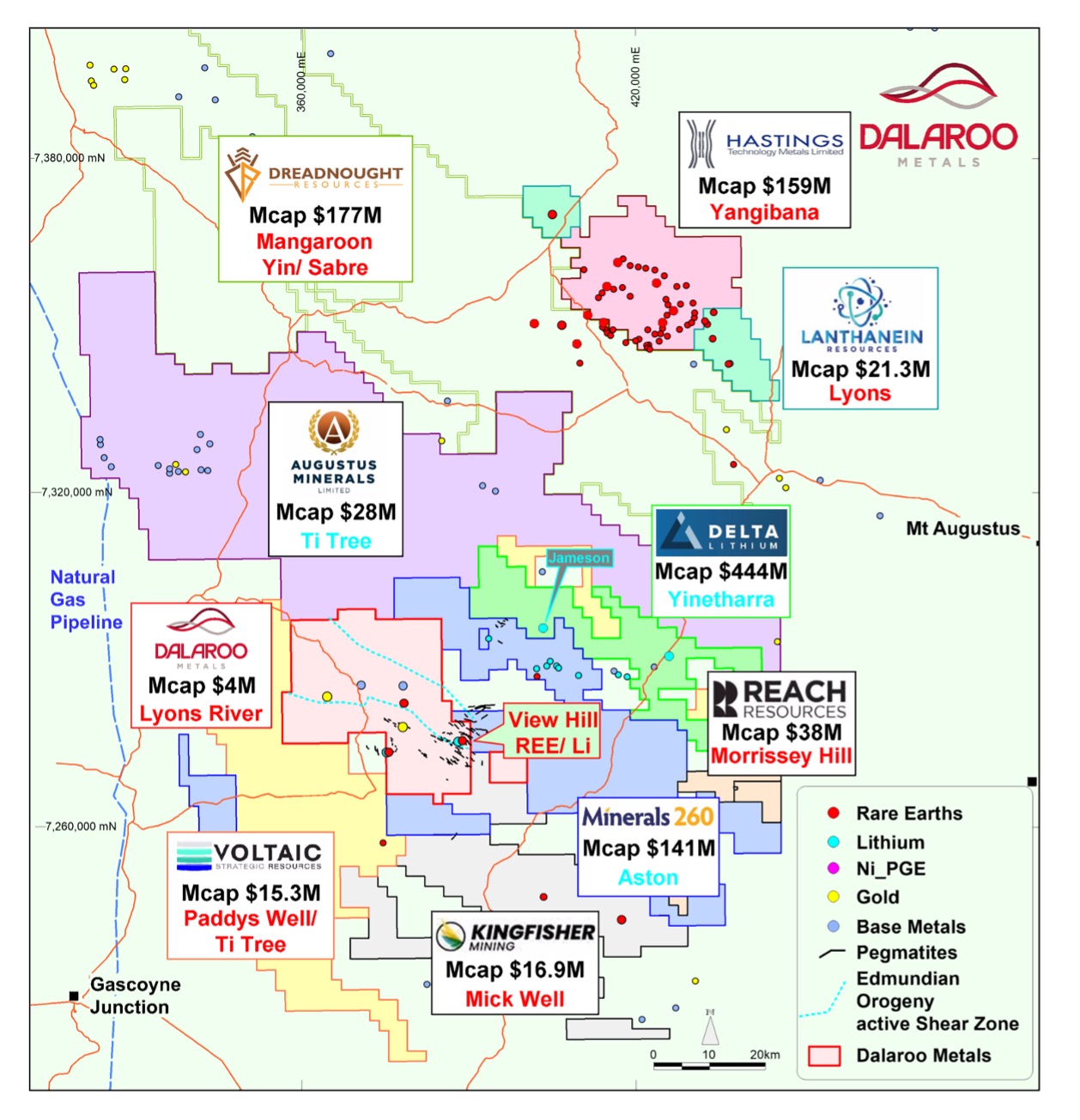

This is good news for junior explorers like Dalaroo Metals (ASX:DAL), a Perth-based critical mineral company actively searching for both commodities in WA’s Gascoyne region.

Rare earths exposure surrounded by key ASX peers

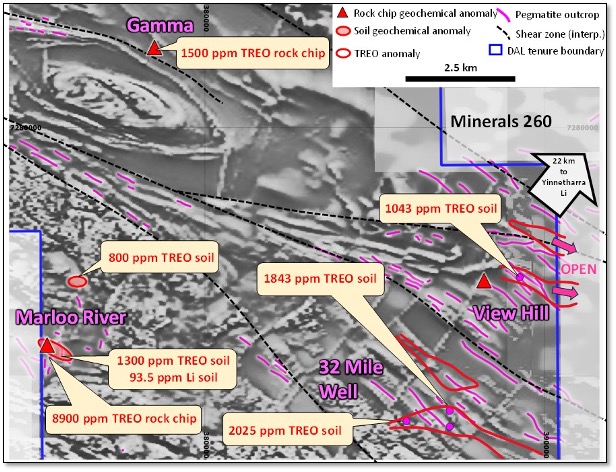

After listing on the ASX in September 2021, the stock has been focused on proving up drill targets across its 1,200km2 land package where recently two significant REE anomalies have been outlined at the View Hill and 32 Mile prospects in addition to its Marloo River REE/Li prospect located adjacent to Arthur River old tantalum/niobium mine.

It’s still early days but Dalaroo believes its REE anomalies at View Hill and 32 Mile are adjacent to a major NE-trending structure and compatible with relationships seen at Kingfisher Mining’s (ASX:KFM) REE discovery, could be prospective for either hard rock or near surface clay-hosted mineralisation drill targets.

Recent REE anomalism at View Hill returned a peak value of 1,043ppm TREO (total rare earth oxides) as well as a strike length of 2.2km, while REE anomalism at 32 Mile Well hit a peak value of 2,025ppm TREO with a strike length of more than 3km.

“What we are seeing in the region is subtle variations in the geology,” Harjinder Kehal said in an interview with Stockhead.

“But we are part of the same stratigraphy that hosts significant REE deposits to the north such as Hastings’ Yangibana, Dreadnought’s Mangaroon project, and Kingfisher Mining’s Mick Well project to the south.

“These are the only areas, along with Delta Lithium’s Yinnetharra, where there are ‘economic discoveries’, everyone else is still at various stages of exploration and have yet to make any sort of meaningful results.

“But our objective is like every other play there, and that is to make another rare earths or lithium discovery.”

Dalaroo’s exploration team has commenced work to infill the soil sampling and once those results are received, the next steps will be to plan a drilling program over the various targets.

Lithium prospectivity

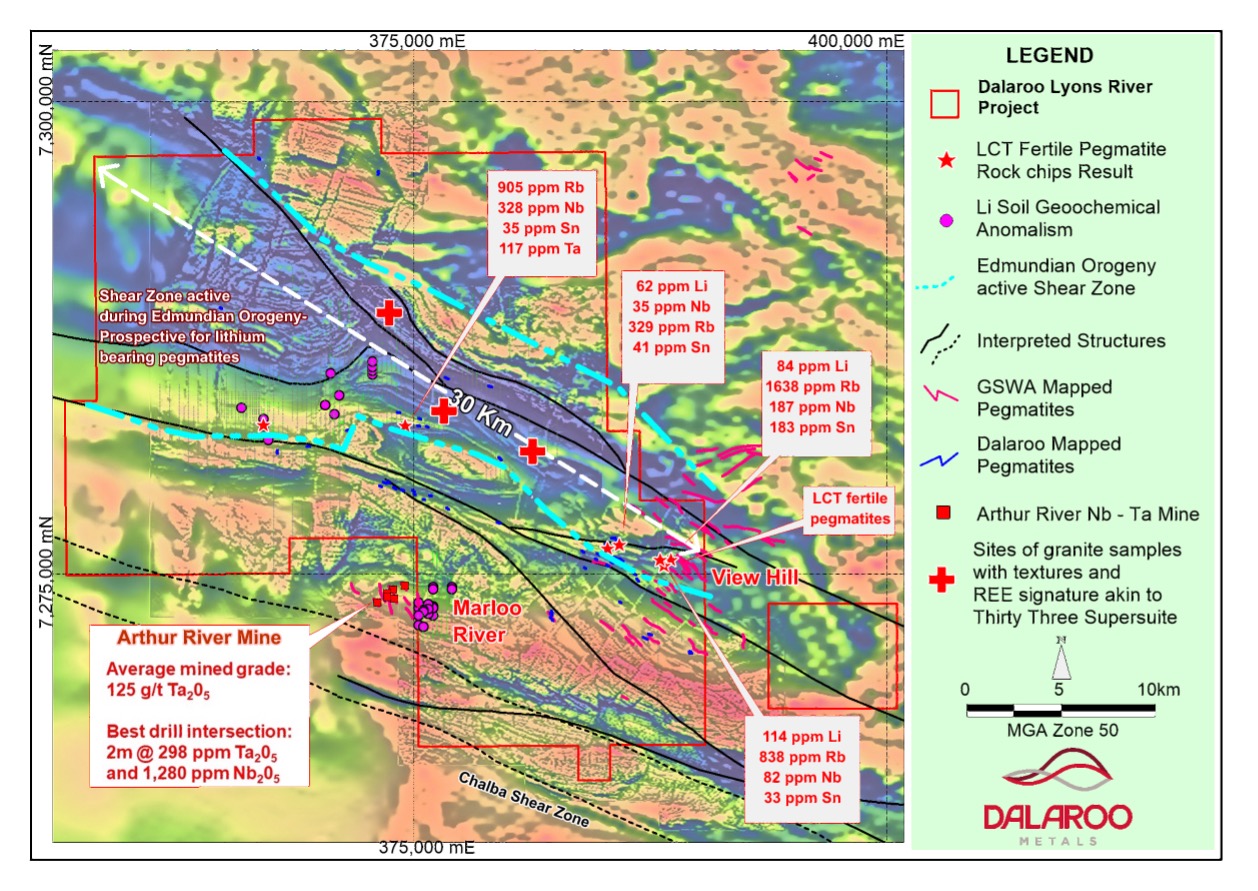

Alongside the rare earths exploration work, recent anomalous rock chip values of 114 ppm Li, 1,638 ppm Rb, 187 ppm Nb and 183 ppm Sn have been returned within the 30km strike length shear zone that was active during the Edmundian Orogeny.

Analyses of granitic rocks demonstrates that intrusions of the Thirty Three Supersuite are present, which confirms interpretation of Edmundian deformation, and underlines prospectivity for lithium bearing pegmatites similar to Delta Lithium’s Yinnetharra discovery in Dalaroo’s tenements.

Rock chip sampling has kicked off to discover lithium-bearing pegmatites within the 30km shear.

The Browns prospect

While green-tech metals are very much the focus for Dalaroo, the company has also identified a Broken Hill Type (BHT)/ Sedimentary Exhalative (“SEDEX”) base metals prospect at Browns within the Lyons River Project, where mineralisation has been outlined over a strike length of 800 metres. Dalaroo believes the district is an emerging BHT deposit setting. The Browns prospect is one of six Pb-Zn soil geochemical prospects identified at Lyons River within a Proterozoic Age basin setting covering an area of 30km by 10km.

In April this year, the company inked a $180,000 EIS grant to co-fund 50% of the direct diamond drilling cost of four deep diamond core holes over an area of 2km X 1km.

So far, shallow AC drilling has returned quite encouraging first pass results including 10m at 1.04% lead, 0.49% zinc, 2.85g/t silver from 37m and a Programme of Work Exploration (POW) for the diamond drill program has been approved by DMIRS.

“We are encouraged by the continuing indications of fertility for BHT/SEDEX style mineralization in the Browns prospect area,” Kehal said.

“There is further evidence for anomalism in Pb, Zn, or Ag (63m @ 1.76 g/t Ag) within thick and extensive sections of stratigraphy, and localized high grade Pb intercepts of up to 3.13% Pb confirmed, in a geological setting compatible wit h the target mineral system style.

“We will be doing ground geophysics comprising IP surveys over an area of 2km X 1km

and we’re also moving ahead with heritage surveys over that area and hope to begin drilling that target in the December quarter.”

The Namban project, along strike from Chalice’s Julimar

Closer to Perth, Dalaroo’s underexplored tenement package at the Namban nickel-copper-PGE project is also undergoing increased levels of exploration in WA’s Western Yilgarn Province.

The company’s ground position covers a strike distance of 60km adjacent to the crustal-scale Darling Fault, which defines the western margin of the Craton.

In a region dominated by the likes of Caspin (ASX:CPN), Chalice (ASX:CHN) and Minerals 260 (ASX:MI6), Dalaroo’s Namban is prospective for magmatic intrusion related ‘Julimar type’ deposits at both the Cattady and Manning targets.

“As we have Minerals 260 as our neighbour to the east in the Gascoyne, we also have Minerals 260 as our neighbour to the east at Namban,” Kehal said.

“An EIS funded diamond drilling has been completed at the Manning prospect targeting coincident Ni-Cu-PGE and IP anomalies – we have logged and processed the core and awaiting the results,” Kehal says.

“It’s the wheat season; the crops are in which means some paddocks aren’t available for exploration. But once those crops are cut, we’ll have a window of up to five months to do the next phase of exploration work there.”

Look out for more news flow

With a tight capital structure, any positive news that comprises an ore-grade type intersection will re-rate the company’s share price fairly quickly, Kehal says.

“Our market cap is about $4M but with our large ground position in a hot REE and lithium province, such as the Gascoyne, we are a great buying opportunity.”

This article was developed in collaboration with Dalaroo Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.