Warren Buffett’s Barrick Gold investment tipped to inspire investors

Indirectly investing in "rat poison"? Berkshire Hathaway CEO Warren Buffett. (Getty Images)

Legendary investor Warren Buffett’s decision to buy into Canadian gold giant Barrick Gold could trigger a stampede of retail investors into gold shares, according to analysts.

Buffett’s company Berkshire Hathaway bought 20.92 million shares in Barrick Gold during the June quarter at a cost of $US563.6m ($786m), according to company records lodged with the US Securities & Exchange Commission.

Berkshire Hathaway’s investment in Barrick has already increased in value by $42.5m.

The gold miner’s share price closed Wednesday at $US28.98, while the average cost of his company’s investment was $US26.94/share.

Signal to retail investors to buy into gold companies

Known as the Oracle of Omaha after his home town in Nebraska, also the base of Berkshire Hathaway, Buffett has a loyal following among retail investors who follow his stock picks.

One market analyst said Buffett’s entry onto the Barrick Gold share register could act as a market signal to astute retail investors.

Some may be influenced to replicate his trade by buying into Australian gold companies.

Another market analyst called Buffett’s Barrick investment a significant moment for the gold market given his high profile in the investment world.

Buffett’s Hathaway a newcomer to gold investing

As chief executive and chairman of investment company Berkshire Hathaway, Buffett and his company appear to be recent converts to gold company investments.

A March quarter SEC filing showed Berkshire Hathaway had no investment in Barrick Gold.

Buffett has previously said he preferred to invest in assets that generated income and capital gains such as shares.

Gold generates no income unless it is leased out and can only increase or decrease in value against currency.

In a speech at Harvard University he famously said of gold that it had “no utility”, meaning that it lacked much practical use outside of jewellery.

“[It] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it,” he was reported as saying.

Barrick Gold ‘printing money’ at current gold prices

One market analyst, Bram de Haas at Seeking Alpha, said Berkshire Hathaway’s entry onto the Barrick Gold share register may be driven by simple economics.

“Barrick Gold is one of the largest mining companies in the world. It has an all-in cost of mining around $US950/oz of gold,” he said, while the gold price is near to $US2,000/oz.

“Currently, the company is printing money,” he said.

Peter Grosskopf, chief executive of Sprott — an investment company that favours gold and founded by Eric Sprott, told the Financial Post he believed Berkshire Hathaway’s Barrick Gold stake showed the company and Buffett were comfortable with gold as a store of value.

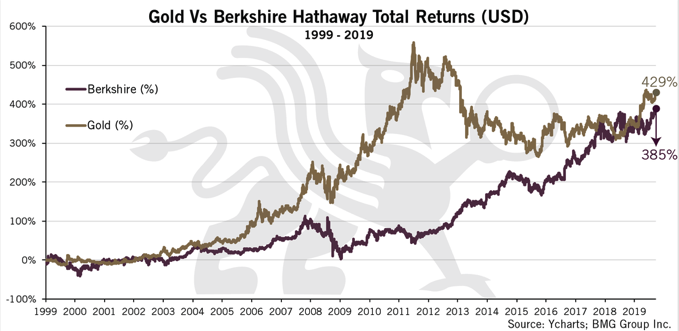

Berkshire Hathaway versus gold

Meanwhile, Nick Barisheff, the founder of BMG Group — a gold bullion investment firm, said in an article on its website that gold had outperformed Berkshire Hathaway over a 20-year period.

From 1999 to 2019, gold has returned 429 per cent, while Berkshire Hathaway has returned 385 per cent, according to Barisheff.

“This indicates that gold outperformed both value investing and growth investing indexes, as well as Berkshire, throughout the investment period,” he said.

“Warren Buffett’s Berkshire Hathaway outperformed its respective index as well as growth stocks, however, it could have performed even better with gold,” Barisheff added.

Indeed, if one had invested in gold in 1999 and sold in August 2011 when its price hit $US1,900/oz and then put some of this cash into Berkshire Hathaway shares then trading at $US107,600/share, it may have turned into the trade of the decade.

Berkshire Hathaway’s A share price at Wednesday’s market close was $US310,800/share.

The price of gold has dropped to under $US2,000 per ounce after declining for five straight trading sessions, and as selling pressure on the US dollar has eased, analysts said.

Spot gold was trading at $US1,932/oz ($2,693/oz), in early Thursday trade, according to precious metals news website Kitco.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.