WA gold bolter Brightstar lifts confidence in Lord Byron mine with drilling success

Gold stars all round in BTR’s Jasper Hills drilling. Pic: Getty Images

- Brightstar pulls in thick intercepts from 8,000m infill drilling program at the 293,000oz Jasper Hills gold project in WA’s Goldfields

- Mining tipped for 2025 at Lord Byron open pit where most drilling at the project has taken place

- Acquired in the Linden Gold deal, drilling affirms Brightstar’s aggressive corporate strategy amid record gold price run

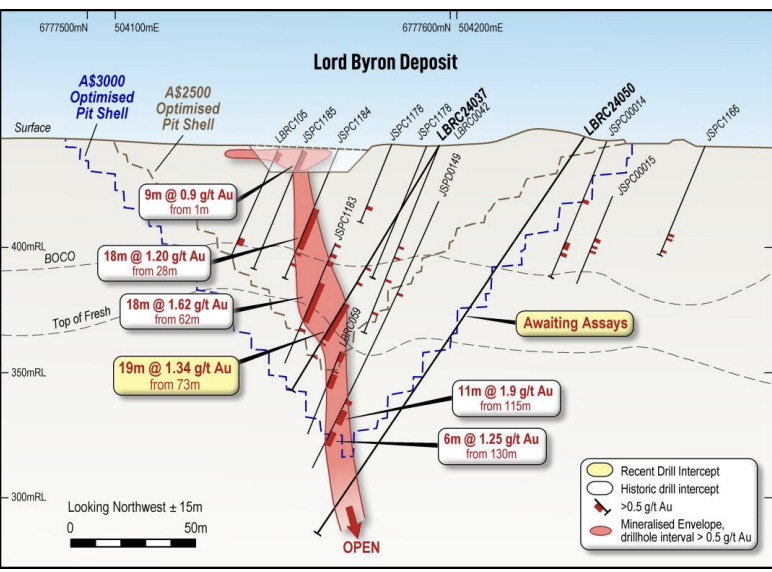

Special Report: Thick intercepts from infill drilling at the 244,000oz Lord Byron gold deposit have boosted confidence in the Goldfields mine as it heads towards production in 2025.

The mine is one part of a province-scale play Brightstar Resources (ASX:BTR) is writing across three historic WA Goldfields around Laverton, Menzies and Sandstone in a bid to push the one-time junior explorer into Australia’s gold mid-tier.

An 8,000m infill reverse circulation drilling program is ongoing at the Jasper Hills project, which contains 293,000oz and was acquired in the first stage of a major regional consolidation push by Alex Rovira’s Brightstar with the acquisition of Linden Gold.

Located just 50km from Brightstar’s processing facilities near Laverton, early results from the RC program have performed to spec, setting the stage for an upgrade in JORC classification to underpin the start of open pit mining at Lord Byron next year.

The tight 20m by 20m spacing will help upgrade its resource to an indicated classification, a key step ahead of a DFS which will assess a potential fast-tracked mine development.

54 RC and two diamond holes have been drilled at Lord Byron, with assays still pending for 25 more holes. Another nine diamond holes are still to be drilled, with a 1,500m diamond program to wrap up early next month.

30 RC holes and eight diamond drill holes have also been punched into the Fish underground deposit, where assays are still due for geological, metallurgical and geotechnical purposes.

A few highlight assays from Lord Byron included:

- LBRC24034: 32m at 1.25 g/t gold (Au) from 53m

- LBRC24007: 24m at 1.53 g/t Au from 53m

- LBRC24037: 19m at 1.34 g/t Au from 73m

- LBRC24001: 14m at 1.44 g/t Au from 77m

- LBRC24015: 12m at 1.73 g/t Au from 177m

- LBRC24016: 15m at 1.47 g/t Au from 178m

- LBRC24008: 5m at 4.29 g/t Au from 92m

- LBRC24054: 9m at 1.47 g/t Au from 29m, and 7m at 3.36 g/t Au from 129m

- LBRC24032: 9m at 2.05 g/t Au from 95m, and 4m at 3.12 g/t Au from 71m; and

- LBRC24027: 5m at 2.13 g/t Au from 52m

Emerging gold player

RC drilling has already moved on to Menzies to drill out the Lady Shenton deposit, demonstrating the numerous options available to Brightstar after a wily consolidation strategy in recent years.

Its most recent M&A transaction – taking its future gold inventory beyond 3Moz – was carried out in tandem with a merger with Alto Metals (ASX:AME) and purchase of Gateway Mining’s (ASX:GML) Montague project to consolidate the Sandstone gold district.

A scoping study has already shown tidy numbers at Lord Byron, which Brightstar will be able to operate to generate cash and build a war chest for future developments in its bulging WA gold portfolio.

To that end, managing director Alex Rovira was excited the recent assays would boost the miner’s confidence in its Jasper Hills resource ahead of mining.

It is the first major drilling to have been undertaken by BTR at the Linden Gold tenements after their acquisition this year.

“These assays represent the first results from the recently acquired Linden Gold exploration package at the Jasper Hills Gold Project. The results are highly encouraging and align with grades and widths we expected from the existing 244koz Au mineral resource,” Rovira said.

“The increased confidence from this infill drilling will feed back into future resource estimates and ultimately help guide the near-term development of open pit mining operations at Lord Byron, as detailed in our recent scoping study, which outlined the highly profitable production of 2.2Mt @ 1.6g/t for 115koz gold over three years.

“Drilling continues with two drill rigs currently active at the Jasper Hills and Menzies Gold Projects, which will generate ongoing news flow in the coming months as assays are received and our geological understanding develops across our portfolio.”

Already has production chops

Unusually for a company of its size, Brightstar is already a producer, having previously produced and sold over 8,000oz in a JV with mining partner BML Ventures at the Selkirk mine near Menzies.

Now worth ~$106m, Brightstar’s corporate strategy and the lift in Aussie gold prices to over $3700/oz has made the company a 90% gainer over the past year.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.