Verity Resources has big plans to boost its Monument project as Laverton gold district runs hot

Verity Resources has plans to expand its Monument gold project in WA’s Laverton region. Pic: Getty Images

- WA’s Laverton region is well known for its gold endowment but bargains are hard to come by

- Verity Resources’ Monument gold project already has an inferred resource and plenty of exploration potential

- Company has plans to carry out work aimed at boosting confidence and scale of Monument resource

Special Report: Western Australia’s Laverton region is a gold exploration hotspot that is seeing increasing attention as gold prices continue to trade beyond the $5200/oz mark.

This combination of rich potential and high commodity prices has predictably led to major players paying top dollar for projects in the gold rush community that sits about 390km northeast of Kalgoorlie.

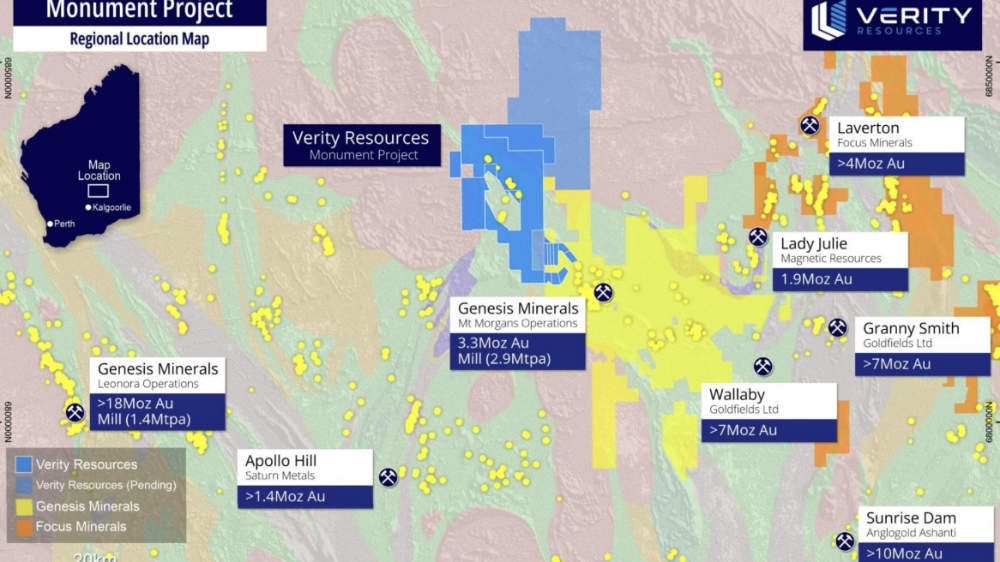

Look no further than Genesis Minerals’ (ASX:GMD) deal to acquire Focus Minerals’ (ASX:FML) Laverton gold project for $250m, a move which delivers a ~4Moz gold resource close to its 3Mtpa Laverton mill.

Explorers in this region have also seen significant growth, with shares in Magnetic Resources (ASX:MAU) rising some 46% since this beginning of this year on the back of success at its Lady Julie gold project. It’s got a dataroom open and has been regularly viewed as a M&A target for the region’s major players.

But relatively unsung Verity Resources (ASX:VRL) could present the cheapest entry-point for this emerging theme.

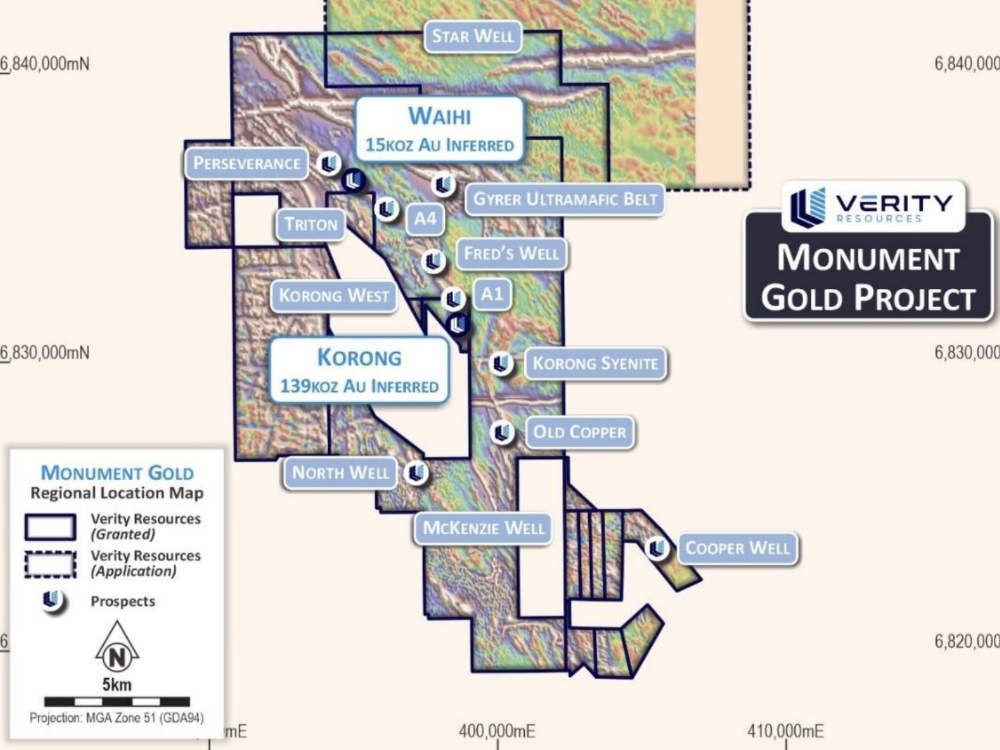

Its Monument gold project already hosts 154,000oz of inferred resources and it’s abutting the tenements at GMD’s Mount Morgans project.

And there’s competitive tension. Genesis isn’t the only player with a hungry and underfed mill.

Bargain barrel

Verity is capitalised at about $7m, despite holding the intriguing Monument gold project.

There is much going for the 195km2 project, which is just 40km west of the town of Laverton.

Monument already hosts that inferred resource of 3.26Mt grading 1.4g/t for 154,000oz of contained gold, split between the Korong and Walhi deposits.

Mineralisation is open in all directions, which offers plenty of options for growth.

It sits within the same stratigraphy as that which hosts Goldfields’ 7Moz Granny Smith and 7Moz Wallaby, AngloGold Ashanti’s +10Moz Sunrise Dam and MAU’s +1Moz Lady Julie projects.

Multiple styles of target mineralisation have also been identified such as banded iron formations and basalt-hosted, though the focus is now on syenite hosted intrusive targets –similar to multi-million ounce discoveries such as Wallaby and Genesis’ Jupiter.

To date, VRL has identified over 60 untested BIF, basalt, and intrusion-hosted drill targets along 20km of strike in the same unit that hosts the 1.4Moz Westralia gold deposit.

This makes for significant district-scale exploration potential given that just 10% of this potential has been drilled to date.

There is also significant greenfields potential outside of established stratigraphy with large application over underexplored ground to the northeast. Its Star Well prospect on the border of the application area recently returned rock chips up to 6g/t Au, indicating the bonus potential of this expanded area.

Resource-focused strategy

VRL has now started a strategy aimed at first upgrading the resource to the higher confidence indicated category before moving on to expand numbers.

Studies are progressing to determine an infill, twin drilling, and step-out drilling program that aims to expand the resource base.

The company has already completed a preliminary pit study and is currently progressing validation of historical drilling and data as well as the definition of the drill program.

Additional step-out holes are planned to expand the Korong-Waihi resource.

It has also started metallurgical studies aimed at evaluating optimal gold recovery to inform future scoping and feasibility studies.

Not just gold

Besides the Monument gold project, VRL also has a 70% interest in the Pimenta rare earths project in Brazil’s prolific mining state of Minas Gerais.

Minas Gerais is well known for its lithium and rare earths endowment with significant spodumene resources discovered by companies such as Sigma Lithium and fellow Australian Latin Resources (now acquired by big fish Pilbara Minerals), and major rare earths discoveries by Meteoric Resources (ASX:MEI) and Viridis (ASX:VMM).

Pimenta targets a granite-hosted REE system centred on the Mesoproterozoic-age Santo Antônio do Jacinto Granite Complex, where allanite—a weathering-resistant REE-bearing mineral—hosts the majority of the rare earth mineralisation.

This geological setting has similarities to other significant REE deposits.

Surface sampling at the project has returned exceptional grades of up to 2.58% total rare earth oxides with valuable magnet rare earths such as neodymium, praseodymium, terbium and dysprosium making up about 25% of the REE content.

Magnet REEs are used to manufacture permanent rare earth magnets that are used in electric vehicle motors and wind turbines.

Adding interest, significant gallium values of up to 89g/t and titanium oxide of up to 9.26% have been reported.

This article was developed in collaboration with Verity Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.