Venus works to fast track cash flow from WA gold project, picks up more prospective ground

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: With work on the Youanmi joint venture delivering very good results and advancing nicely, Venus Metals is in a good position to advance its Bellchambers gold project towards possible early cash flow and grow its portfolio.

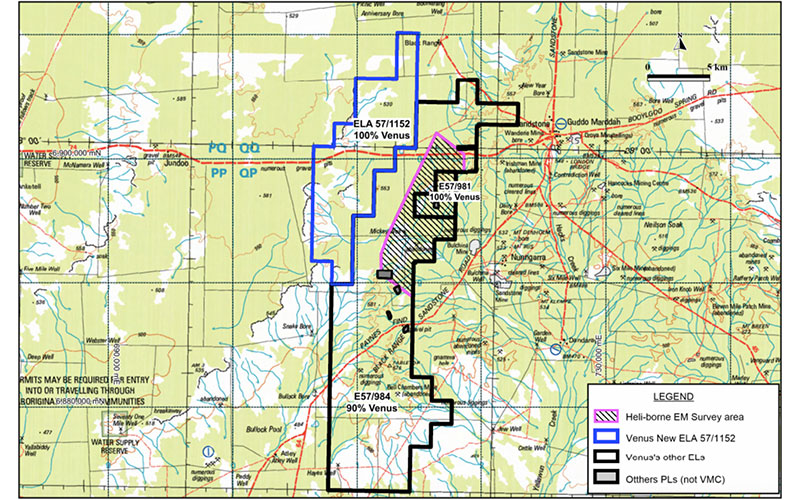

Venus Metals (ASX:VMC) is getting cracking on a heli-borne electromagnetic survey at the Bellchambers project, which sits 23km southwest of the town of Sandstone in Western Australia.

The 218-line-kilometre survey will cover a 12km strike of the northern extension of the Western Ridge gold trend.

Venus’ goal is to pinpoint potential conductive bodies along the trend that may be associated with gold mineralisation similar to that encountered at the Bellchambers gold deposit.

An inferred JORC 2012-compliant resource of 340,000 tonnes at 1.5 grams per tonne (g/t) for 17,000 ounces of contained gold is already on the books for Bellchambers.

Bellchambers is a once operational high-grade mine that produced 3,979 tonnes at a grade of 20.96g/t for 2,682 contained gold ounces between 1907 and 1942.

At today’s Aussie dollar gold price of nearly $2,490 an ounce, that would have netted the very attractive sum of $6.7m.

While anything above 5g/t is usually considered high-grade, given the recent bull run in the gold price, miners can make serious cash from grades as low as 2g/t.

And Venus is hitting near-surface gold, which is cheaper and easier to mine.

Drilling at Bellchambers in June last year delivered wide gold hits of 27m at 2.72g/t from 27m and 64m at 1.7g/t from 10m.

“The results show extensive and continuous gold intersections confirming both the previous geological interpretation as well as grade continuity down dip in the oxide‐transition and fresh rock zones,” managing director Matt Hogan said at the time.

“This is a very positive and robust result for the project.”

Bellchambers is also located in the right neighbourhood – one covered with old mine workings and past producing mines.

Early cash flow potential

Venus is already looking at its options for processing the gold at nearby mills, a path that could give it a faster route to early cash flow.

The company has engaged in initial negotiations with Adaman Resources regarding possible mining and treatment of the oxide gold mineralisation from the Bellchambers deposit.

Adaman is an unlisted company that operates the Kirkalocka gold processing plant. (Would be good to put in proximity to Bellchambers project here)

Drill samples have been provided to Adaman for metallurgical testing.

Growing portfolio

Venus also wants to build on its already prospective project portfolio and has applied for a new exploration licence directly west of the Bellchambers project.

The application covers approximately 20km of strike along the northern extension of the prospective Youanmi Shear Zone – the same structure that is delivering the Youanmi joint venture bonanza hits of 5m at 125.68g/t gold from surface, including 2m at 311.46g/t gold from a depth of 2.5m.

But that isn’t the highest grade the JV partners have hit there – they also reported grades of as high as 1058.49g/t, or about 37 ounces, of gold.

This story was developed in collaboration with Venus Metals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.