Venture picks up more nickel-copper-PGE ground near Kulin

Venture has acquired more nickel-copper-PGE prospective ground. Pic: via Getty Images

Venture has doubled the size of its nickel-copper-PGE portfolio following the acquisition of highly prospective tenure at its Kulin project in Western Australia.

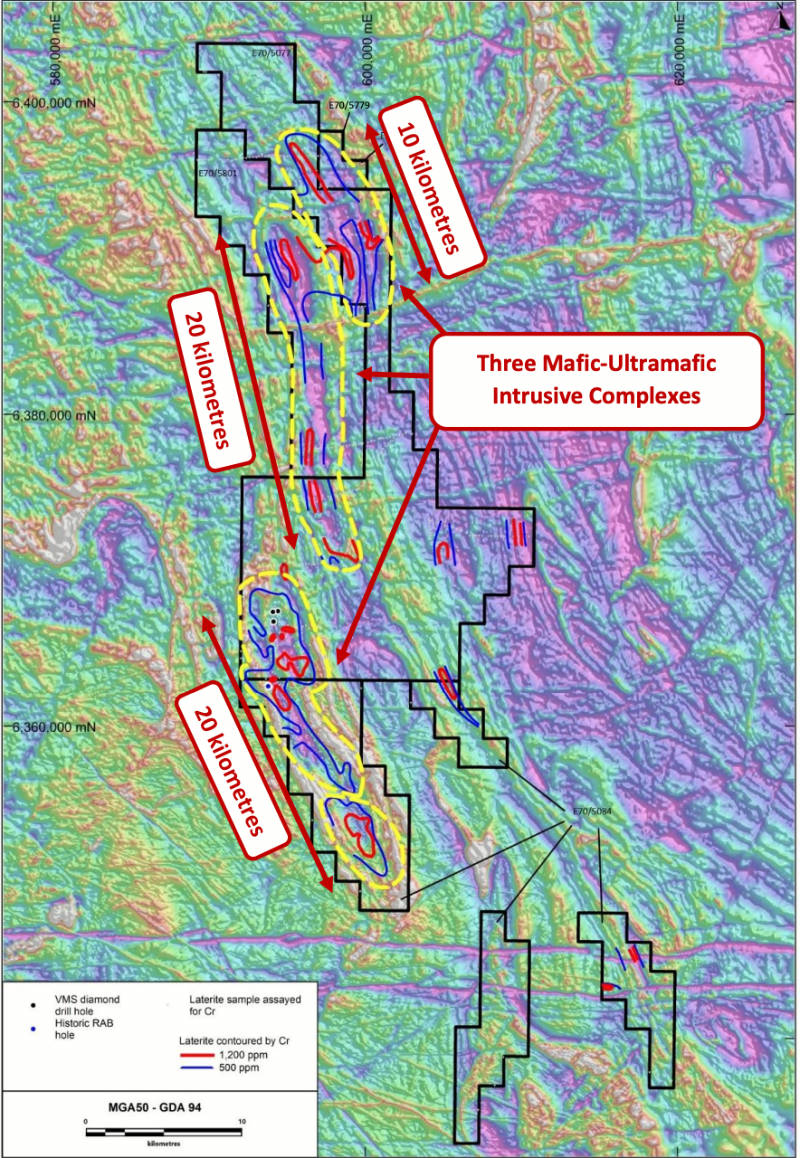

Importantly, the acquired tenure includes two highly prospective, 20km long interpreted mafic-ultramafic intrusive complexes that are along strike of the Jimperding Metamorphic belt that hosts the exciting Julimar nickel-copper-platinum group element discovery.

Venture Minerals (ASX:VMS) notes that the southern target is now considered to be a priority target that will be the subject of a detailed work program that will include surface sampling and an airborne electromagnetic survey.

This target was defined by aeromagnetic anomalies and coincidental +500 parts per million chromium surface samples along with several reconnaissance surface samples assaying over 30 parts per billion platinum + palladium.

“Venture has made some excellent acquisitions around the Kulin Project, which sees the company now control a highly sought after ground position in close vicinity to the recently discovered Julimar Ni-Cu-PGE deposit,” managing director Andrew Radonjic said.

“When paired with our Chalice JV on the South West Project, Venture now has an enviable portfolio of Ni-Cu-PGE assets.

“These complement Kulin’s gold potential, which has been highlighted by our latest drill results situated within what is considered to be an exciting emerging Western Australian gold province.”

Tenure acquisition terms

Under the earn-in agreement, Venture can secure a 51% joint venture interest over the 173sqkm tenure, which includes the southern target, by spending $250,000 within two years.

This can be increased to 80% by spending a further $500,000 over the following two years after paying the vendor $10,000 in cash.

Venture will then free-carry the vendor’s 20% interest up to the completion of a Bankable Feasibility Study after paying $20,000 cash.

Upon completion of the BFS, the vendor can elect to contribute or dilute its interest.

If the vendor’s interest in the project dilutes to below 5%, it will convert to a royalty equivalent to 2% of the net smelter return.

Additionally, Venture has applied for another 121sqkm of exploration tenure at the northern end of the project that contains the second 20km target.

This target is also defined by aeromagnetic anomalies and coincidental +500ppm chromium surface samples from reconnaissance programs by previous explorers.

A third mafic-ultramafic intrusive complex has been interpreted in the northern end of the project mostly within Venture’s original tenement.

Gold exploration

Meanwhile, the company’s maiden drill program at the Kulin gold prospect has returned results such as 18m grading 0.6 grams per tonne (g/t) gold from 329m including higher grade zones of 9m at 1.2g/t gold from 338m and 3m at 3.4g/t gold from 341m.

Venture said the results from drilling, where earlier soil sampling and trenching at surface had delivered high order gold in soil anomalies, bode well for future drilling.It added that these holes are the only meaningful drill holes within a 40km radius of the Kulin project within an emerging gold province that includes the +30 million-ounce Boddington deposit, the 2.2Moz Edna May deposit, the 1.2Moz Katanning deposit and the 700,000oz Tampia project.

This article was developed in collaboration with Venture Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.