Vanadium prices are surging again. Who’s set to benefit?

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Vanadium prices are now rallying strongly, driven by low inventory levels and increasing demand from battery manufacturers.

In late July, the Chinese V205 98% spot price surged to finish at highs of $US10.74/LB; a nice bump from lows of about $US7/lb earlier in the month.

And V2O5 stocks remain very low, according to consultancy Mastermines, which expects “more upward price pressure” during August in what is traditionally a very good month for vanadium.

It is likely that new battery projects may be behind some of the recent swings, Mastermines’ director David Gillam says.

“Dalian City has just signed a syndicated loan agreement to fund the first stage of the world’s biggest vanadium battery installation at 200/800MWh,” Gillam told Stockhead.

“It is likely that other signed contracts that were on hold due to high V205 pricing will have been brought back into consideration.”

That Dalian battery would use an estimated 8000 tonnes of V2O5 for a 800MWh installation.

That’s a big chunk of current global production — 140,000t a year — of which about 90 per cent of goes into the steel industry. And Dalian isn’t the only big VRFB in the works.

HOT NEWS #Vanadium #Dalian City has just signed a syndicated loan agreement to fund the first stage of 200/800MWh #VRB. First stage of the project would be 100/400MWh. Construction has officially commenced and the first stage is expected to be completed by Mid 2020.

BIG !!! pic.twitter.com/BrsfktEbDN— Mastermines (@VanadiumWorld) July 23, 2019

[Tweet w/ Dalian announcement]

Mastermines are hopeful that high spot pricing will hold below $US12/LB – a scenario the most favourable for new vanadium mining projects as battery suppliers look to lock in long term supply.

“There is no doubt that some of the wild swings in V205 should create more awareness as to the need to take a longer-term view,” Gillam says.

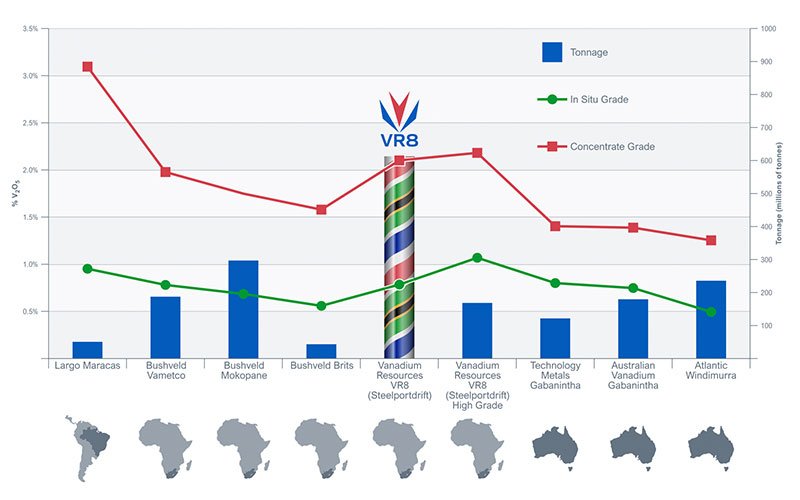

One stock poised to benefit from the price appreciation is Vanadium Resources (ASX:VR8), which is developing one of the largest and highest grade vanadium deposits in the world.

The Steelpoortdrift project, located within the Bushveld complex of South Africa, includes a high-grade resource of 169Mt at an in-situ grade of 1.07 per cent V2O5. That’s world class.

This resource also generates a high grade, high quality ~2.2% V2O5 concentrate with low impurities.

This project (that striped column) is big, it’s high grade, and it produces a high-quality concentrate.

This makes VR8 well placed to take advantage of this upsurge in vanadium prices, and to join major players Bushveld and Glencore as part of a genuine global vanadium production hub.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with Vanadium Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.