US eyes domestic graphite plays with $7.5bn and 300 new mines needed by 2035

China dominates global graphite supply, but the US is looking to boost domestic sources. Pic: via Getty Images.

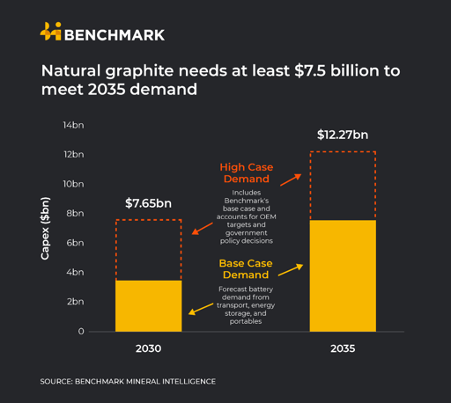

- Benchmark Minerals Intelligence says $7.5bn needed to meet base case graphite demand

- It takes 10x more graphite than lithium to make a Li-ion battery

- US looks to domestic supply; China looks to work around tariffs

Flake graphite production will require $7.57 billion in capital expenditure (capex) investment to meet battery demand in 2035, according to Benchmark Minerals Intelligence data.

This is the level of investment needed to bring online more than 4 million tonnes of annual flake graphite production to meet 2035 demand. But that’s just the base case scenario.

While lithium-ion batteries are the gold standard for energy storage, transport and mobile electronics, graphite is the conductive anode (negative electrode) and the biggest commodity component by volume, as it takes up to 10x more graphite than lithium to make a Li-ion battery.

Currently, there is no viable alternative to graphite and shortages could last for 20 years.

To put it in a broader context, BMI said that to meet the projected demand for electric vehicle and energy storage batteries, more than 300 new graphite mines will need to be built before 2035.

That works out to around 30 new mines each year for the next decade.

And in the event of such high demand, the supply gap rises to more than 6.5 million tonnes and that base case capex figure more than doubles to $12.27 billion.

“We forecast battery sector demand for raw material graphite to rise by more than 1,400% between 2020 and 2050,” BMI said.

“By the end of the forecast period, total graphite demand could be three times the 2021 supply level.”

China could still dominate supply

In 2023, China produced 67% of the world’s flake graphite. By 2033, this is estimated to fall to 39% as supply from Mozambique, Madagascar, and Tanzania ramps up.

But, if there isn’t enough investment in the sector, this is likely to lead to even more dependence on Chinese supply at a time when the US is leading the charge to reduce the country’s chokehold on global graphite.

“The lack of investment in flake graphite projects today could lead to demand destruction and increase dependence on China,” Benchmark anode product director Shruti Kashyap said.

“The country continues to increase graphite production and has the potential to step up when required.”

In the case of uncoated spherical graphite, the product of processing flake graphite for use in batteries, nearly 100% of supply came from China in 2023; by 2029, this is 56%.

“However, the growing desire to de-link from China through policy initiatives will nevertheless support ex-China supply growth,” Kashyap said.

“The Inflation Reduction Act in the US and the Critical Raw Materials Act in Europe are key examples of government intervention to boost domestic supply and friend-shoring to reduce dependence on China.”

Subsidiaries work around US tariffs

The US has also placed a 25% tariff on Chinese natural graphite (starting in 2026) in the hopes of giving domestic miners a foot in the door – and allowing US OEMs time to source ex-China graphite.

But on the flip side, they’ve also delayed the implementation of Foreign Entities of Concern requirements to 2027 following mounting pressure from battery supply chain players who were chasing an extension on the use of Chinese graphite to qualify for EV tax credits.

Even so, the US government’s moves in the space have already pushed China’s battery giant BTR to build projects overseas where they can produce material that will qualify for aforementioned US federal EV credits.

Already BTR’s 80,000 tonne Indonesian anode material project entered phase I production earlier this month, and plans are in the works for a $300 million Morocco-based cathode facility, its first cathode projects overseas.

Plus, they’re inking deals with Ford as a work around to reach US consumers despite the rise of US policies aimed at protecting the domestic battery industry from lower-cost Chinese-owned supply.

That $120m deal will see Ford sourcing synthetic graphite anode materials from Mediterranean New Material Technology, a BTR subsidiary.

Benchmark said moves like this demonstrate how major mid to downstream battery players are responding to low prices – along with the legal manoeuvres Chinese battery materials firms are undertaking to de-risk from mounting policy barriers to US market access.

“Facing intense domestic competition and persistent market surpluses, Chinese anode active materials majors are actively seeking overseas sites to expand their global operations and customer base,” BMI senior analyst Tony Alderson said.

More OEMs go direct to the source

A similar recent deal involved Stellantis’ Fiat Chrysler Automobiles, which signed an offtake with natural graphite anode producer Westwater Resources in July.

These strategies of direct purchasing and vertical integration can buffer automakers against cell price fluctuation, and Benchmark said the fact that more OEMs are adopting these methods shows the mounting cost-cutting pressures they are under.

Westwater is currently developing its Kellyton graphite plant in Alabama which is forecast to start production of natural active anode material next year.

Then there’s Graphite One, which signed a non-binding supply agreement with Lucid Motors – making it the first offtake signed between a US-based anode active material aspirant and US-based EV player.

Graphite One is set to provide the EV maker with 5,000 tonnes per year of anode active material for at least five years.

Opportunity for ASX listed graphite plays?

Hexagon Energy Materials (ASX:HXG)

The company hosts the McIntosh project in WA and Ceylong project in Alabama.

At McIntosh, HXG has an earn-in deal with Green Critical Minerals (ASX:GCM) where GCM has the right to earn up to 80% in the graphite mineral rights only – with the tenements to remain wholly held and managed by HXG.

In Alabama, the company has a similar deal with South Star Battery Metals (TSXV:STS), which can earn up to 75% in the project in return for C$750,000 in expenditure.

So far around 2,000m over 15 holes has been completed, the results of which will feed into a preliminary economic assessment, which is scheduled for completion in Q3 2024.

QGL recently filed a Letter of Interest funding application with US EXIM bank – in conjunction with Sunlands Energy Co. – for its Uley 2 project in South Australia.

The project represents the next stage of development of the century old Uley mine, one of the largest high-grade natural flake deposits in the world.

The aim is to finance an end-to-end supply chain from the mine site production of flake concentrate to the production of >99.6% high purity graphite (HPG) in the Southeast of the United States.

The company estimates that a single Chinese company represents more than three quarters of the overall flake being processed into anode material.

The collaboration with Sunlands Energy has established a demand source, long duration energy storage, that has a market size many times that of the Li-ion battery market.

The collaboration has also delivered a path for Uley 2 production to be refined into high purity graphite at a highly scalable level essential for the future development of the non-China market Li-ion battery supply chain.

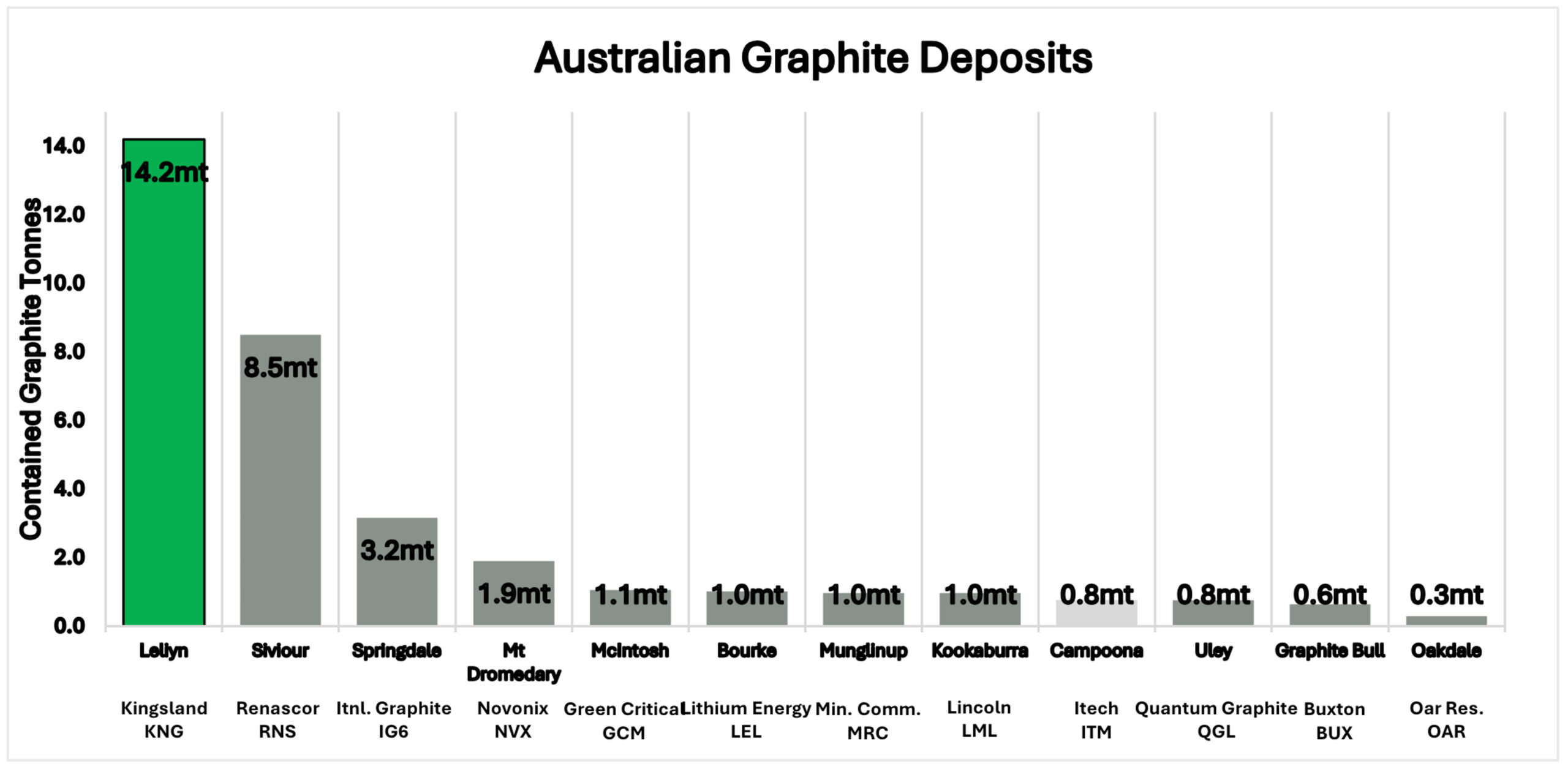

The discovery of the Leliyn graphite deposit in Australia last year provided the company with a world class development project of an important critical mineral.

The project has an inferred resource estimate of 194.6 million tonnes grading 7.3% total graphitic carbon (TGC) for 14.2Mt of contained graphite, confirming the project as not only the largest graphite deposit in Australia but one of the largest in the world.

And with an exploration target of 700Mt to 1.1 billion tonnes at 7-8% TGC for 50-90Mt of contained graphite, there’s room to grow.

“The next 12 months are expected to be even more transformative than the previous 12,” MD Richard Maddocks said.

“Additional drilling is planned to upgrade some of the inferred mineral resources to indicated.”

Plus metallurgical test-work – which has already produced a graphite concentrate of >94% TGC grade with a recovery of 80% – is ongoing with the aim of producing a bulk concentrate sample for processing into purified spherical graphite, an important pre-cursor for lithium-ion battery anodes.

“These important outcomes will enable the project to progress to a scoping study to assess the economic viability of establishing a flake graphite production facility in the Northern Territory,” Maddocks said.

At its 35.2 Mt at 6.0% TGC Eyre Peninsula graphite project in South Australia, the company is focused on developing a low-cost graphite operation.

In its annual report, ITM flagged the challenging price environment with China’s continued dominance of the global graphite markets and heavily subsided pricing of synthetic graphite, meaning a new pricing system is emerging.

“This system places a premium on non-Chinese sourced graphite and reflects the rising demand, from Western markets, for graphite that meets the West’s environmental, social and governance standards and most importantly is geographically diversified from the Chinese supply chain,” the company said.

“The company is well placed to deliver graphite, processed using the state’s abundance of renewable energy, into this growing high value market.

“The potential to expand graphite resources on the Eyre Peninsula continues to grow with a $1.1m research project being undertaken in collaboration with UniSA and METS Engineering.”

The project aims to unlock an economic beneficiation process for the impressive Sugarloaf graphite project which has an exploration target of 158 – 264 Mt at 7 – 12% TGC.

LML’s Kookaburra Graphite Project (KGP) in South Australia’s Eyre Peninsula has recently been added into the new digital Australian Critical Minerals Prospectus.

One of the 55 projects included, the company said this confirms Kookaburra’s status as a leading Australian critical minerals project.

“We believe the inclusion of our exciting KGP project in the digital prospectus will enhance our plans to engage with downstream stakeholders and potential offtake and funding groups once our updated PFS is complete in October,” CEO Jonathon Trewartha said.

“We have outlined that we are pursuing a staged development strategy for KGP, and with our updated PFS imminent, we continue to execute plans to reach Decision to Mine status by the end of CY2025.”

LML is also completing test work for its battery anode material scoping study examining a vertically integrated, mine-to-battery strategy for the project, due in Q4 2024.

At the Siviour graphite project in South Australia, the company has recently collated a 730t bulk sample to produce graphite concentrate in China.

It’s a key step to establish a downstream graphite processing plant here in Australia, with RNU hoping to produce the concentrate for a planned Purified Spherical Graphite (PSG) demonstration facility, making it the first Australian producer of a key component in the production of lithium-ion batteries, albeit at a pilot level.

Production is scheduled for Q4 this year, while back home, engineering for the PSG facility and commissioning of demonstration plant are slated for Q2 next year.

The company owns the world-class Kasiya rutile and graphite project in Malawi and just last month scored an increased strategic investment from mining giant Rio Tinto, which upped its stake in the company to 19.9%.

Kasiya ranks as the world’s largest rutile and second largest flake graphite deposit, marking the investment as a major step into the battery metal for Rio, which last year made an initial strategic investment in the company, spending $40.4m to take an initial 15% stake.

Sovereign’s Kasiya orebody in Malawi contains a whopping 1.8Bt at 1% rutile and 1.4% graphite, two thirds of that in the higher confidence indicated category.

While rutile is facing severe deficits in the next five years, it’s Sovereign’s graphite by-product that’s the trump card.

The graphite from Kasiya could reduce its all-in sustaining costs and make it a low-cost supplier to challenge Chinese dominance of a key part of the lithium-ion supply chain, especially considering China’s recent restrictions on graphite exports.

Kasiya would cost US$597m to build but generate US$415m in average annual EBITDA and US$16bn in revenue over its first 25 years of operations, according to a pre-feasibility study released last year.

At 222,000tpa it would be the world’s largest single rutile operation and one of the largest ex-China flake graphite producers at 244,000tpa. Costs of US$404/t would make it the lowest cost producer of both products around the world.

The company is spinning off its Burke and Corella deposits with Novonix’s (ASX:NVX) Mt Dromedary deposit in north-west Queensland into Axon Graphite, which is seeking an ASX listing under the ticker AXG.

As part of the initial public offering process, Axon Graphite undertook a review of Mt Dromedary that led to the updating of its resource to 12.7Mt grading 14.5% TGC, or 1.83Mt contained graphite. Burke has a resource of 9.1Mt at 14.4% TGC, or 1.31Mt of contained graphite, while Corella has a resource of 13.5Mt at 9.5% TGC, or 1.28Mt of contained graphite.

The combination of Mt Dromedary and Burke creates the potential for significant operational synergies and economies of scale through a potentially larger scale open-pit mining operation.

This will in turn provide feedstock for a vertically integrated battery anode material facility based in Queensland.

On completion of the IPO and its entry into the ASX, Axon plans to review existing drilling data and resource models for the Burke and Mt Dromedary deposits to delineate a combined resource. It will also carry out resource development drilling to increase and upgrade the combined resource.

At Stockhead we tell it like it is. While Kingsland Minerals, iTech Minerals, Renascor Resources, Sovereign Metals and Lithium Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.