US dual-listing hopefuls counting on greater exposure, access to capital

ASX companies chasing a US dual listing will gain greater exposure and access to capital. Pic: Getty Images

- Companies list shares on second exchange for more investor and customer exposure

- Listing on the US provides access to the world’s largest source of capital

- ASX plays, such as Green Critical Minerals and Trigg Minerals, are seeking dual listings

Dual listing occurs when a company lists its shares on a second exchange – typically in another country – usually to increase the company’s exposure to investors in different jurisdictions.

It can also add liquidity to shares, provide more avenues to raise capital, and increase the amount of trading time.

A listing in the US specifically opens the door to the world’s largest source of capital, enabling a company to tap into financing sources it wouldn’t otherwise be able to access.

Green Critical Minerals (ASX:GCM) managing director Clinton Booth told Stockhead the company had spent six months looking first at different jurisdictions then drilling down to the different exchanges before making a decision.

“Ultimately for us, it came down to two key points and that was how it would support both our commercial and capital market ambitions,” he said.

“For us, a US listing provides such exposure and customer awareness as well as being a significant and a massive market.

“It is such as big market, if we don’t do a US listing, it won’t help us to stand out.

“That’s why we decided to move to a US listing. And also why we’ve decided to look at a NASDAQ and an NYSE as opposed to an OTC.”

Raising awareness

There’s at least one other reason for embarking on a dual listing.

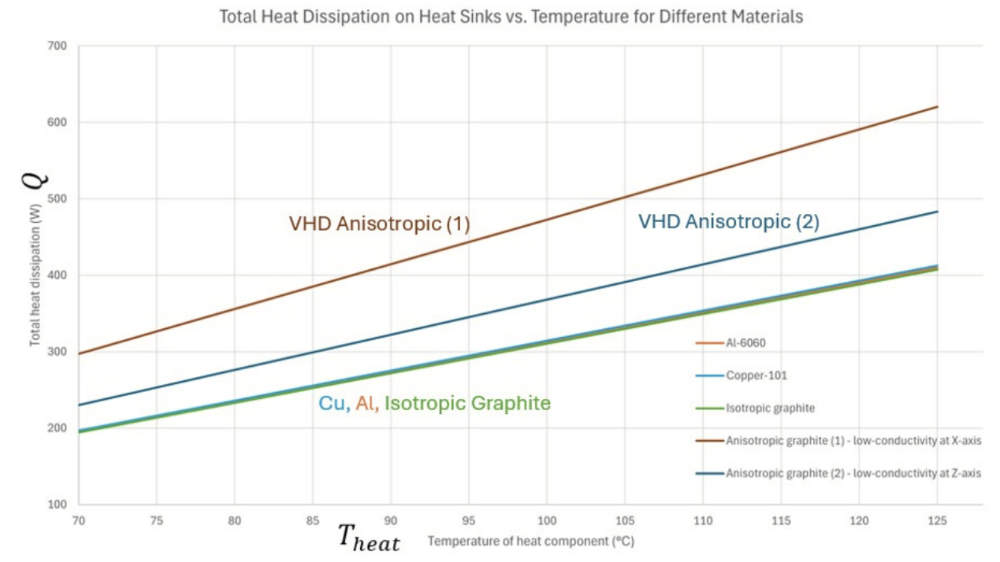

Booth noted that GCM’s primary interest in a US listing is to increase its exposure to target customers in data centres, semiconductors and advanced electronics that would benefit from the thermal management properties of its Very High Density graphite heat sinks.

“A big part of a US listing is to provide access to that and awareness to that ecosystem,” he said.

“The big thing is the size of the market and ecosystem. We’re talking data centres, semiconductors and high performance computing. We’re talking about a market which doesn’t need to be created. This is a massive market today and a market, which is growing exponentially.”

However, he acknowledged that access to capital markets was also important, noting that a listing would attract investors that understood the tech sector and value the industrial innovation represented by the company’s offering.

“You’re talking about the biggest capital markets in the world, which is very liquid, very deep (pockets) and very aware of what we bring and what we are. So there’s good alignment there,” Booth added.

He also acknowledged the potential to access government funding opportunities, some of which see a US listing as proof the company is a sort of local provider.

Benefits outweigh cost

Dual listing does come with costs, though.

Listing on another exchange means extra costs related to listing fees, ongoing fees and having to meet regulatory and compliance requirements.

This could be potentially onerous for companies that go into the listing without a clear understanding of what they are seeking.

However, this isn’t true for GCM.

“For us, we looked at all of the costs and they are not trivial, but we accept that and think they are very manageable,” Booth said.

“We see this as an investment. This is about increasing exposure to both the customer market and the capital market.

“For us, it’s a huge net positive. It’s an investment in us actually growing the business.”

Companies seeking US listings

Green Critical Minerals is looking to carry out a US listing in H1 2026 after assessing market opportunities across the United Kingdom, Europe and North America.

It noted in its announcement in late July that North America presented a “significant growth runway” due to accelerating demand for advanced thermal management solutions across data centres, semiconductor manufacturing and high-performance computing.

Booth said the company’s VHD blocks could solve the market’s energy and water challenges – its sustainability issues.

“They are going to be a big anchor on this industry continuing to grow,” he added.

“What we and the product we have is one of the steps and one of the parts of helping to make these sectors more sustainable and more efficient in the things they use.

“We’re part of that ecosystem which is really see us moving into a sustainable data centre style high performance computing environment to really enable the sector to go to the next levels that it can go to.”

He notes that in the next 12 months, the company will move from being pre-revenue to revenue generation with announcements about production facilities, customer engagement, further partnerships with other bodies and demonstrating real-world prototypes and how they behave in real- world situations to take validation to the next level.

Booth added that while the company currently had a commercial pilot facility operating in Australia, it expected to be talking to market about a manufacturing facility in the US within the next 12 months.

It is far from the only company in the process of chasing a US listing, though.

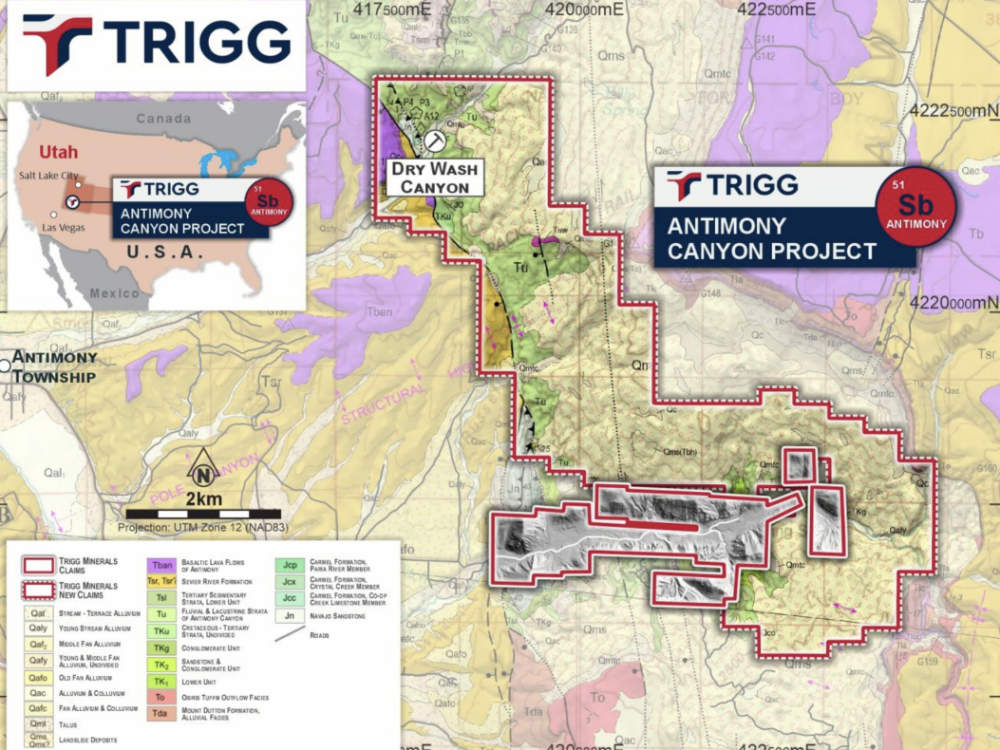

For example, Trigg Minerals (ASX:TMG) is also working on a mainboard listing in the US to fast-track its antimony production plans via its Antimony Canyon project in Utah.

It appointed international markets veteran James Graff as a non-executive director at the end of July to leverage his deep cross-border experience in banking and special purpose acquisition company to support the listing.

This follows the company defining an exploration target of 12.8 to 15.6 million tonnes at 0.75% to 1.5% antimony, or between 96,000t and 234,000t of contained metal that ranks Antimony Canyon amongst the country’s largest and highest-grade undeveloped antimony systems.

It is based on detailed trench sampling, geological mapping and historical reconnaissance exploration conducted by the US Bureau of Mines (USBM) and US Geological Survey (USGS) between 1941 and 1942 that was subsequently verified and expanded upon through field validation, geological mapping and digital modelling undertaken by the company.

A detailed geological program led by Dahrouge Geological Consulting is carrying out activities to validate the exploration target and progress Antimony Canyon towards the completion of trenching and drilling across high-priority areas.

This will ultimately lead to the delivery of a maiden resource estimate in accordance with SEC S-K 1300 and JORC 2012 reporting standards.

Meanwhile, Resolution Minerals (ASX:RML) is closing in on a listing on the OTCQB Markets, a move that’s expected to boosting its visibility, liquidity and accessibility for North American investors, and is progressing a listing on NASDAQ, which is a major national stock exchange for more established companies and offers greater visibility and liquidity.

This could attract investors in the same way that NASDAQ-listed Perpetua Resources, whose Stibnite antimony-gold project with a resource of 4.8Moz gold and 148Mlb antimony shares its western boundary with RML’s Horse Heaven antimony-gold-tungsten project in Valley County, Idaho.

Horse Heaven boasts strong gold, antimony and silver mineralisation in two prospects – Antimony Ridge Fault Zone and Golden Gate Fault Zone – and includes past-producing antimony and tungsten mines.

Its geological model of Horse Heaven is a direct analogue to Stibnite with the project known to host strong gold, antimony and silver mineralisation in the Antimony Ridge Fault Zone (ARFZ) and the Golden Gate Fault Zone (GGFZ).

Highlighting its potential value, RML has received an unsolicited, non-binding and indicative offer from NASDAQ-listed Snow Lake Resources for the project that values it at $225m.

At Stockhead, we tell it like it is. While Green Critical Minerals and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.