Uranium’s price rally bodes well for these small caps

Pic: Schroptschop / E+ via Getty Images

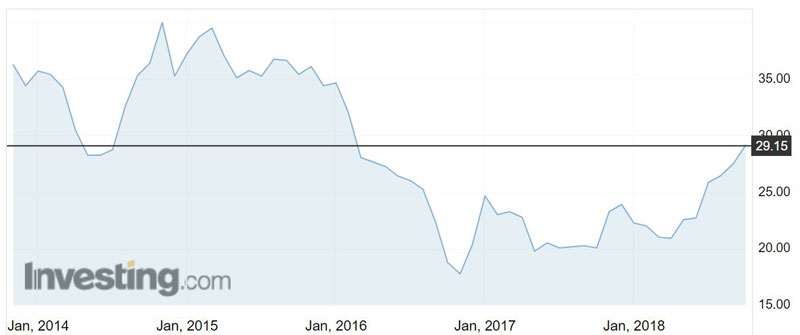

The uranium price is continuing its upwards trajectory and is close to hitting $US30 ($41.48) per pound — its highest point in over two and a half years.

The spot price bottomed at $US19.60 per pound in May last year and after a few false starts has now witnessed seven months of increase.

The uranium price bombed heavily in 2011 from the over $US70 per pound it was trading at after the Fukushima Daiichi nuclear disaster that forced Japan to shut down its entire reactor fleet.

But several factors have now contributed to the price turnaround, not least of which was Canadian uranium heavyweight Cameco’s decision to mothball its McArthur River mine — the world’s largest uranium operation.

The move cut 11 per cent of global supply from the market.

That news came not long after Paladin Energy (ASX:PDN) halted production at its Langer Heinrich mine in Namibia.

Meanwhile, KazAtomProm, the world’s largest uranium producer, announced a 20 per cent cut in forecast production.

French energy giant Orano also announced supply cuts in Niger and uranium production in the US has also been declining.

About 36.5 million pounds of uranium has been taken out of the market since 2016 — the McArthur River closure alone removed 18 million pounds.

Vimy Resources (ASX:VMY) boss Mike Young said recently the expected demand for uranium in 2018 is 173 million pounds, which will result in an immediate shortage of 47 million pounds.

“This gap can be managed by utilities in the short-term through stockpile management at the utility level, and secondary supplies on the sell side.

“However, this is not sustainable and at current production levels, the market is heading towards a structural deficit.”

Vimy is advancing its “Mulga Rock” project in Western Australia towards production.

Bannerman Resources (ASX:BMN) chairman Ronnie Beevor said the supply cuts are forecast to put the uranium market into a deficit in 2019 and is expected to have a significant impact on uranium prices in the next year as the reduction in supply starts to take effect.

Uranium demand is also on the rise with Japan restarting more of its nuclear reactors and China’s plans to start building six to eight new reactors this year.

“In the short-term, demand has strengthened as financial buyers enter the market, the most notable of which was Yellow Cake plc listing on London’s Alternative Investment Market and using the proceeds to acquire 8.1 million pounds of U308 from KazAtomProm,” Mr Beevor said.

Bannerman is working to improve the economics of its Etango project in Namibia and says it has identified capital cost savings of $US73m on the previously estimated cost of $US793m and potential operating cost savings of about $US3 per pound on the average life-of-mine costs of $US38 per pound.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Deep Yellow (ASX:DYL) is also on the hunt for uranium in Namibia and is in the process of expanding its existing resource base.

The company says a uranium supply shortfall is set to emerge from 2023, which has clear implications for the price to overshoot the forecast $US65 to $US70-per-pound price levels required to incentivise new production.

Peninsula Energy (ASX:PEN) is already in production in Wyoming in the US.

Boss Resources (ASX:BOE) is working towards restarting its Honeymoon project in South Australia.

The project is already fully permitted with a 3.3 million pound per annum export licence. It was placed on care and maintenance back in 2013-14 due to the declining uranium price.

Boss could have Honeymoon back in production within nine months for a restart cost of about $US10 million, leveraging off $170 million in existing infrastructure.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.