Uranium: Valor boss George Bauk on why this time the shift will be different

Pic: Valor Resources executive chairman George Bauk

Amid a global shift in attitude towards decarbonisation, mitigating climate change, and reducing emissions, the world is waking up to the fact that uranium – and more importantly, nuclear energy – has a critical part to play.

In fact, Goldman Sachs global head of commodities research Jeff Currie advises the investment community to watch out for “one of these governments in Europe to classify nuclear power as being ESG-friendly or green” before this really begins to take off.

“I think we are getting very close to that happening,” he said.

His outlook for the commodity is “very bullish” on a medium to long-term basis from a fundamental perspective – “and then you throw Kazakhstan issues on top of it, and it just creates a much more bullish outlook.”

“#Uranium has a very bullish outlook on medium and longer term basis.”

Via @BloombergTV – Goldman’s Currie Says Commodities Are Best Place to Be Right Now: https://t.co/D4QtCvZaji$LOT pic.twitter.com/m7jIWCF6pm

— Lotus Resources (@Lotus_Resources) January 9, 2022

The ongoing unrest in Kazakhstan, where about 43% of the world’s uranium comes from, revolves around the doubling of gas prices for liquefied petroleum gas, or LPG, a low-carbon fuel that many Kazakhs use to power their cars.

With the country being home to the world’s largest uranium producer, Kazatomprom, analysts are now predicting the political unrest could send uranium prices flying, with some expecting the spot price to hit $140.

‘A totally different demand curve’ on the horizon

Echoing this sentiment is Valor Resources (ASX:VAL) executive chairman George Bauk, who, with more than 20 years’ experience within the resources industry, has overseen several uranium and rare earth exploration projects in Western Australia, Tanzania, and the US.

As managing director of Northern Minerals, he led the company from a greenfields rare earth explorer to one of a few global producers of high-value dysprosium outside of China.

In an interview with Stockhead, Bauk said for the first time since World War 2 people are beginning to acknowledge nuclear as being part of the new source of power and energy.

“During the last boom in 2007 we saw the rise of Kazakhstan, however the amount of uranium required in the long term is substantial and we are going to see a totally different demand curve,” he said.

“There will be a big shift in price – I don’t think we want to see what happened in 2010 where it went to ridiculous numbers, that is just an unsustainable price hike and people then move to alternatives and move away.

“But when you have a commodity that is getting market attention it encourages people to explore and discover, it gives people confidence that it’s a commodity that is worth looking at, and companies will prioritise what the market likes,” he said.

Bill Gates is IN

It’s been a tough gig for uranium, with most people associating the commodity with evil and the poor performances of a couple of facilities around the world.

The most recent of these being the Fukushima disaster in 2011, which is the most severe nuclear accident since the Chernobyl disaster in 1986.

At the time, Japan shut down reactors as they went into a massive review, which had a crippling effect on the uranium sector.

But Bauk says when you see people like Bill Gates starting to talk about uranium as being a fuel source, suddenly people start to stand back and ask, ‘why he is joining the pro group?’

“People are starting to stop and say ‘what are all our options with moving away from fossil fuels?’

“Those that were once very adamant about not using uranium are beginning to understand it – you’ve just got to put the framework around it and the safeguards to make sure it is used for the right reasons.”

Uranium’s resurgence

Now we are witnessing uranium’s resurgence and it is being delivered by a completely different factor.

“It sits under this whole banner of zero carbon emissions where everyone is looking for a cleaner environment and a cleaner world,” he said.

“There has been a big focus on portable energy sources with electric vehicles and the like, but everyone knows it has to be charged from somewhere.

“Everyone is looking at the mix and the science keeps pushing people back to uranium and whilst everyone has had issues in the past with it, people are slowly moving on the new smaller, mobile generator systems and realising their potential.”

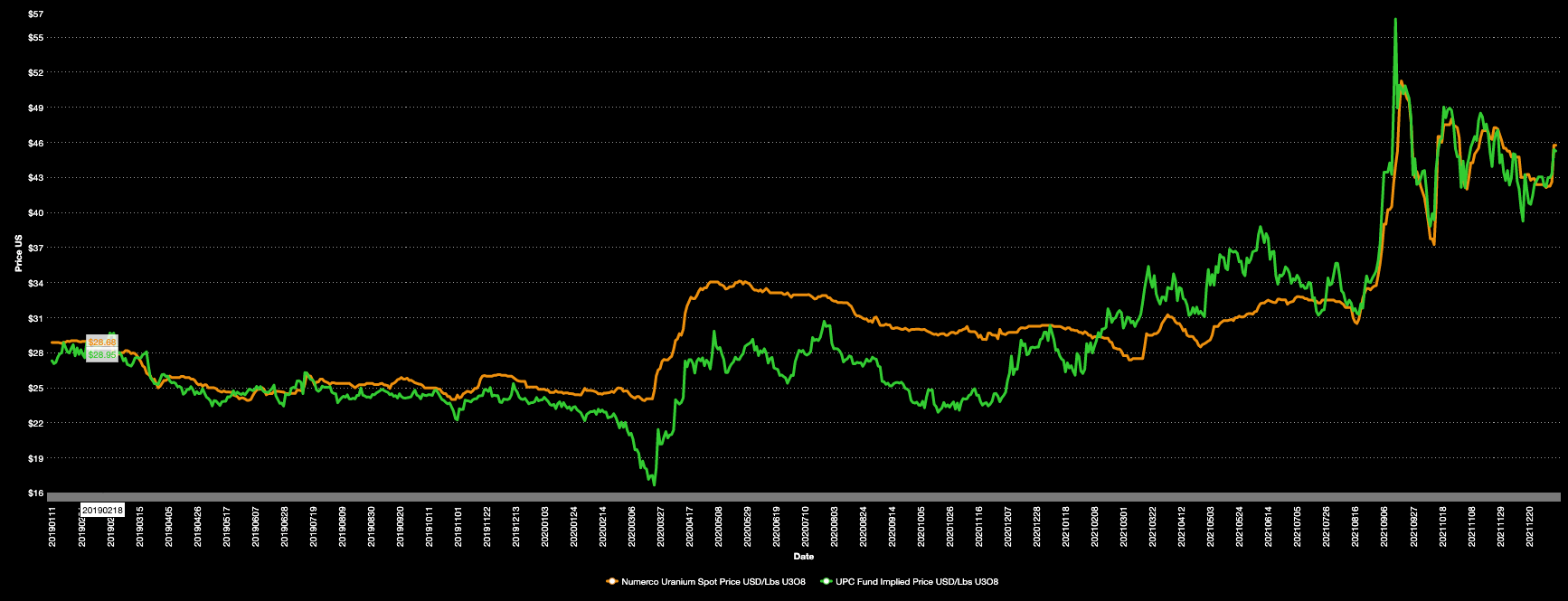

The uranium space started going bonkers back in August 2021 when the Sprott Physical Uranium Trust (SPUT) started buying up physical uranium, taking it out of market circulation.

This pushed the spot price at the time to more than 6-year highs.

Now it holds almost a third of the world’s annual supply and it’s only getting bigger.

According to Bloomberg, SPUT has scooped up roughly 41 million pounds of uranium since its launch in July 2021, which is roughly 30% of annual production.

The Canadian precious metals financial behemoth is set to undertake a dual listing of its stock on the New York Stock Exchange (SYE) which Bauk says will create a much more transparent viewer market of the commodity.

“This will provide another set of data for people to understand what the value of uranium is – like how lithium is going through a process now where it was initially done through cartels and secretive doors to now having open market price discovery through public options – people are now starting to get a better understand about what the product is,” he said.

ASX uranium stocks

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| DLC | Delecta Limited | 0.011 | 10% | -8% | 83% | 83% | $14,458,904 |

| DYL | Deep Yellow Limited | 0.95 | 10% | 4% | 32% | 62% | $375,426,972 |

| 92E | 92Energy | 0.665 | -2% | 14% | 122% | $36,374,971 | |

| VAL | Valor Resources Ltd | 0.014 | 0% | 0% | 27% | 180% | $50,120,223 |

| PEN | Peninsula Energy Ltd | 0.23 | 15% | 5% | 39% | 58% | $229,378,124 |

| EL8 | Elevate Uranium Ltd | 0.52 | 12% | 22% | 63% | 215% | $128,954,504 |

| AGE | Alligator Energy | 0.06 | 9% | 5% | 54% | 361% | $180,958,364 |

| VMY | Vimy Resources Ltd | 0.24 | 23% | 7% | 118% | 155% | $247,894,918 |

| BMN | Bannerman Energy Ltd | 0.315 | 17% | 11% | 91% | 152% | $363,369,673 |

| LOT | Lotus Resources Ltd | 0.305 | -2% | 0% | 69% | 103% | $307,306,628 |

| PDN | Paladin Energy Ltd | 0.94 | 7% | 18% | 88% | 204% | $2,451,138,574 |

| OKR | Okapi Resources | 0.385 | 12% | -7% | 75% | 60% | $43,363,223 |

| TOE | Toro Energy Limited | 0.024 | 9% | 4% | 26% | 33% | $89,638,870 |

| LAM | Laramide Res Ltd | 0.785 | -8% | -2% | 50% | 124% | $955,409 |

| GLA | Gladiator Resources | 0.037 | 9% | 19% | 106% | 146% | $16,315,947 |

| DEV | Devex Resources Ltd | 0.465 | -5% | -22% | 48% | 82% | $142,953,706 |

| BOE | Boss Energy Ltd | 2.36 | 5% | 0% | 90% | 168% | $645,186,651 |

| GTR | Gti Resources | 0.026 | 8% | 4% | 8% | -7% | $27,090,749 |

| CXU | Cauldron Energy Ltd | 0.028 | -3% | 4% | -28% | -36% | $13,756,222 |

| RDT | Red Dirt Metals Ltd | 0.76 | 14% | 21% | 375% | 176% | $188,054,681 |

| NXG | Nexgenenergycanada | 6.28 | 6% | 0% | 6% | $70,453,028 | |

| BKY | Berkeley Energia Ltd | 0.26 | 16% | 68% | -50% | -61% | $115,907,146 |

| ERA | Energy Resources | 0.41 | 21% | 28% | 49% | 30% | $1,365,811,783 |

| NVX | Novonix Limited | 10.36 | 13% | 21% | 347% | 667% | $4,524,051,852 |

Uranium players on Bauks’ watch-list include Paladin Energy (ASX:PDN) with their Langer Heinrich Mine in Namibia, Boss Energy (ASX:BOE) – owners of the Honeymoon Uranium Project in South Australia, and 92 Energy (ASX:92E), neighbours of Valor in the Athabasca Basin.

What’s in store for 2022?

Along with the resurgence of uranium will come the resurgence of exploration activity in the sector, Bauk says.

“That is the exciting part of it, a lot of money has been raised in the uranium sector and we’ve got people drilling and engaged and I think again, with every new rise in a commodity, you tend to find some great outcomes,” he said.

“Kazakhstan was probably the biggest winner out of the last boom, this time the focus is on small modular reactors, and I think that will underpin greater enthusiasm for uranium – there will be some exciting discoveries.”

A drill rig is making its way to Valor’s Hook Lake Uranium Project in the Athabasca Basin, the highest-grade uranium district in the world, where the company will kick off a 2,000m drill program targeting the main S Zone.

“We are also doing data compilation and interpretation on our five other properties on the basin so it’s going to be an exciting year,” he said.

“At the end of last year we raised $5m under a Canadian flow-through share regime and we are recruiting for a geologist to come with us on the journey.

“So much is happening in the Athabasca basin, there is going to be a lot of news flow and a lot of activity on the ground.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.